2025 Year-End FCPA Update

Client Alert | January 8, 2026

2025 was by many measures a tumultuous year. The Foreign Corrupt Practices Act (FCPA) was no exception to a seismic reset of enforcement priorities across the U.S. government at the outset of the Trump II Administration. We saw an unprecedented, Oval Office-directed four-month “pause” in criminal FCPA enforcement, indicted cases discontinued on the eve of trial, and the apparent disbanding of a specialized unit at the Securities and Exchange Commission (SEC). But we also saw the timely release of new guidance governing continued FCPA prosecutions by the Department of Justice (DOJ), the first indictment of a corporation in 15 years, multiple trial convictions, and other indicia that show that while FCPA enforcement is shifting, it has not dissipated. On top of that, international anti-corruption enforcement continues to grow in strength with no signs of abatement, maintaining a trend seeded by U.S. enforcers years ago. Bottom line, vigorous cross-border anti-corruption enforcement remains.

Reflecting upon a whirlwind ride, this update provides an overview of key FCPA and other international anti-corruption enforcement, litigation, and policy developments from 2025, as well as our observations and analysis regarding the trends we are seeing from this activity. Especially in times of great change across the legal enforcement landscape, Gibson Dunn is privileged to service a wide range of sophisticated clients in all manner of industries and geographies in navigating the most complex, cutting-edge, and increasingly multi-jurisdictional anti-corruption challenges. The rigorous approach has allowed Gibson Dunn to consistently maintain its industry-leading expertise in this space, as exemplified by the honor of once again in 2025 being ranked Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices for the eighth consecutive year and the 10th time in the last 11 years.

For additional analysis on anti-corruption enforcement and related developments from 2025, we invite you to register here and join us for our upcoming complementary webcast presentation on February 3, 2026: “U.S. Criminal Law and Corporate Enforcement Developments in 2025.” As usual, CLE credit will be offered.

OVERVIEW OF FCPA AND OTHER U.S. FOREIGN ANTI-CORRUPTION LAWS

The FCPA’s anti-bribery provisions make it illegal to offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with corrupt intent, for the purpose of obtaining or retaining business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d) (typically referring to companies whose shares are listed on a national exchange). In this context, foreign issuers whose American Depositary Receipts (ADRs) or American Depositary Shares (ADSs) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and in some cases those acting on their behalf, and that are comprised of two core components. First, the books-and-records provision requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal accounting controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in resolution negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a transaction that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal accounting controls deficiency.

Further, following passage of the Foreign Extortion Prevention Act (FEPA) in December 2023, the receipt of corrupt payments by foreign government officials is directly criminalized. Still, two-plus years after the statute’s enactment, the impact of FEPA remains to be seen as there has yet to be a FEPA prosecution and DOJ has long been prosecuting foreign officials for their receipt of bribes under the U.S. money laundering statute, as noted immediately below.

Finally, prosecutors from the FCPA Unit of DOJ have the ability to, and frequently do, charge non-FCPA offenses such as money laundering, mail and wire fraud, Travel Act violations, securities fraud, tax violations, and even false statements, in addition to or instead of FCPA charges. The most prevalent among these “FCPA-related” charges is money laundering—a generic term used as shorthand for statutory provisions, including 18 U.S.C. § 1956, that generally criminalize conducting or attempting to conduct a transaction involving proceeds of “specified unlawful activity” or transferring funds to or from the United States, in either case to promote the carrying on of specified unlawful activity; to conceal or disguise the nature, location, source, ownership or control of the proceeds; or to avoid a transaction reporting requirement. “Specified unlawful activity” includes over 200 enumerated U.S. crimes and certain foreign crimes, including the FCPA, fraud, and corruption offenses under the laws of foreign nations. Although this has not always been the case, in recent history DOJ has frequently deployed the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA (but who may now be subject to FEPA, at least for post-2023 payments). It is not unusual for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering, particularly if the recipient is employed by a state-owned enterprise.

FCPA ENFORCEMENT PAUSED; RESTARTED IN 2025

To the extent our longtime readers have come to expect a recipe for these pages, you will notice that the order of operations has changed based on the unique experience of 2025. We will cover the year in FCPA enforcement actions and what they portend for the year ahead, but there is no way to start the story of 2025 anywhere other than the beginning, with President Trump’s February 10 Executive Order “pausing” FCPA enforcement shortly after retaking Office.

Executive Order “Pausing” FCPA Enforcement

A lifetime ago, in our 2016 Year-End FCPA Update, we noted just as President Trump was preparing to take Office for his first term a May 2012 CNBC SquawkBox interview given by the then-business mogul. During that interview, Mr. Trump called the FCPA a “horrible law [that] should be changed” because it puts U.S. businesses at a “huge disadvantage” vis-à-vis companies from nations that are not bound by aggressive international anti-corruption enforcement regimes. Proclaiming that foreign nations should prosecute corruption in their own country, Mr. Trump said that the FCPA makes the United States “the policeman for the world and it’s ridiculous.”

But as we reported in our 2020 and 2024 Year-End FCPA updates, enforcement of the statute surged during the Trump I Administration. There were 164 total DOJ/SEC FCPA enforcement actions during President Trump’s first term (2017–20), 30% higher than the predecessor second term of President Obama (126 actions between 2013–16), and more than 90% higher than the successor term of President Biden (96 actions between 2021–24). One could even make the case that FCPA enforcement was at its zenith during President Trump’s first Administration. Certainly, there is a lag in all complicated white-collar cases, such that any Administration’s enforcement is in large part the fruits of the investigations initiated by the prior Administration, but the numbers are stark. Still, as in many areas, results from the first Trump term have turned out to be a poor predictor of performance during the first year of his second term.

With no warning other than the flurry of presidential actions that preceded it, on February 10, 2025 President Trump signed Executive Order 14209, entitled “Pausing Foreign Corrupt Practices Act Enforcement to Further American Economic & National Security.” The Order directed DOJ to pause ongoing and new FCPA investigations and enforcement actions pending a review by then-newly appointed Attorney General Pamela Bondi, culminating in new enforcement guidance. In its opening lines, the Order asserts that the FCPA has been “systematically, and to a steadily increasing degree, stretched beyond proper bounds and abused,” such that its “overexpansive and unpredictable” enforcement impedes U.S. foreign policy objectives. An accompanying “Fact Sheet,” “President Donald J. Trump Restores American Competitiveness and Security in FCPA Enforcement,” proclaimed that “U.S. companies are harmed by FCPA overenforcement because they are prohibited from engaging in practices common among international competitors, creating an uneven playing field.”

With this Executive Order, FCPA enforcement was effectively “paused” pending a comprehensive, case-by-case review by Attorney General Bondi and her leadership staff, prominently including Deputy Attorney General Todd Blanche. (Although the Executive Order did not directly apply to the SEC, then-Acting SEC Deputy Director of Enforcement Antonia Apps said at the ABA White Collar Crime Conference in March 2025 that the SEC would “follow the lead of the DOJ” on this subject.) Priority attention was directed to already indicted cases pending trial, and as discussed below some of these were permitted to proceed while others were dismissed, but no new cases were filed during the review period, explaining, in part, the reduced enforcement figures in 2025. The review process also encompassed corporate enforcement actions resolved during the Biden Administration, resulting in many (but not all) companies receiving an early termination of their post-resolution reporting obligations as discussed separately below.

For a more comprehensive and real-time analysis of the FCPA Executive Order, we direct our readers to our client alert, “President Trump Pauses New FCPA Enforcement, Initiates Enforcement Review, and Directs Preparation of New Guidance.” With nearly a year of hindsight, you can even grade our predictions.

DOJ FCPA Guidelines

On June 9, 2025, nearly two months ahead of the 180-day target set forth in the Executive Order, Deputy Attorney General Blanche issued “Guidelines for Investigations and Enforcement of the Foreign Corrupt Practices Act.” The FCPA Guidelines provide four non-exhaustive factors to guide current FCPA enforcement, asking in each instance whether the suspected corruption at issue:

- Relates to the criminal operations of a cartel or transnational crime organization (TCO), including utilizing money launderers that also launder money for, or bribes paid to foreign officials that also receive bribes from, cartels and TCOs;

- Causes economic injury to specific, identifiable U.S. persons that sought to compete in the relevant foreign market on non-corrupt terms;

- Threatens U.S. national security by implicating the defense, intelligence, or critical infrastructure sectors; or

- Involves strong indicia of corrupt intent by specific individuals.

As summarized by then-Acting Head of the Criminal Division Matthew Galeotti in a June 10, 2025 speech announcing and interpreting the FCPA Guidelines, “the through-line [of these four factors is] the vindication of U.S. interests.” In other words, FCPA prosecutors should focus their resources on “conduct that genuinely impacts the United States,” whereas corruption “that does not implicate U.S. interests should be left to our foreign counterparts” to prosecute. DOJ has been clear these factors are not exhaustive and no single factor is necessary or dispositive.

During the roughly four-month “FCPA pause”—between the FCPA Executive Order and the FCPA Guidelines—interactions with prosecutors on pre-indictment investigations fell eerily silent as prosecutors awaited Front Office direction. But soon after issuance of the FCPA Guidelines, defense counsel began receiving calls from DOJ FCPA Unit attorneys letting them know whether their clients’ investigation would be continued or terminated following DOJ’s internal review pursuant to the memorandum. In our experience, no detailed reasoning was communicated, only the “up or down” decision. We are aware of many investigations that were terminated and numerous others that were (and are) continued. For a more detailed analysis of the FCPA Guidelines, we direct our readers to our client alert, “DOJ Leadership Highlights Criminal Enforcement Priorities in New FCPA Memorandum and Public Remarks.”

Only time will tell how DOJ applies the new FCPA Guidelines factors in practice. We cover below our analysis of how the FCPA and FCPA-related cases brought and continued during the second half of 2025 stack up.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

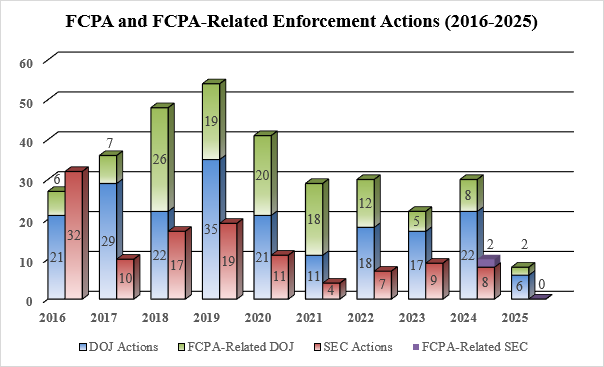

The below table and graph detail the number of FCPA and FCPA-related enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, in each of the past 10 years. The precipitous drop in 2025 DOJ FCPA enforcement is notable, but not surprising given the “FCPA pause” and associated ramp-up activities that impacted more than half the year. More striking is the complete absence of observable FCPA enforcement activity by the SEC, which we discuss further below.

|

KEY 2025 FCPA-RELATED ENFORCEMENT DEVELOPMENTS

New 2025 FCPA and FCPA-Related Enforcement Actions

There are only a handful of cases, spread over little more than a season’s time, against which to benchmark DOJ’s new FCPA and FCPA-related enforcement actions brought in 2025 and the FCPA Guidelines discussed above. Recognizing that public charging documents are an imperfect barometer for DOJ’s internal case deliberations, we set forth below our assessment of how the public allegations in the eight FCPA and FCPA-related enforcement actions announced this year stack up against the FCPA Guidelines, followed by individualized discussions of the cases.

| Defendant | Cartel / TCO | U.S. Victim | National Security | Individual Corruption |

| Avila Lizarraga |

X |

X |

||

| Rovirosa Martinez |

X |

X |

||

| TIGO Guatemala |

X |

X |

||

| Liberty Mutual | ||||

| Alvelais Alarcón |

* |

* | * |

* |

| A. Mohamed |

X |

|||

| N. Mohamed |

X |

|||

| Smartmatic |

X |

.

* The Alvelais Alarcón charging documents are under seal as of publication, thus the applicable factors are unknown.

Mario Alberto Avila Lizarraga & Ramón Alexandro Rovirosa Martinez

The first FCPA enforcement action filed following the “pause” came on August 6, 2025, with an indictment charging two U.S. resident / Mexican citizen businessmen—Mario Alberto Avila Lizarraga and Ramón Alexandro Rovirosa Martinez—with an alleged bribery scheme to retain and obtain business from Mexico’s state-owned oil conglomerate Petróleos Mexicanos (PEMEX). The indictment alleges that, between 2019 and 2021, the two provided more than $150,000 in cash and luxury gifts to PEMEX officials in exchange for contracts and related benefits valued at more than $2.5 million. Announcement of the case on August 11 was timed to coincide with Rovirosa’s arraignment, while Avila was (and remains) a fugitive believed to be outside the United States.

In addition to strong indicia of individualized corruption—in theory a prerequisite to all criminal charges against individual defendants—DOJ alleged (at least initially) a cartel element to the case. Specifically, in the original press release announcing the charges and a motion seeking to impose certain conditions of pretrial release, DOJ alleged that Rovirosa had “ties to Mexican cartel members and that he was previously involved in violent conduct in Mexico.” These allegations do not feature in the indictment and appear to have nothing to do with the corruption case, and Rovirosa made much of what he contended was an improper effort to poison the jury pool.

By FCPA case standards, the Rovirosa case proceeded to trial on a lightning track. Less than four months after the indictment, and following a three-day trial, on December 5, 2025, the Southern District of Texas jury returned a verdict convicting Rovirosa of three of the four counts of FCPA bribery and conspiracy. Rovirosa has since moved to set aside the guilty verdict, principally contesting the propriety of allowing a recorded law enforcement interview of Rovirosa to be played for the jury and the admission in evidence of text messages unsupported by first-hand testimony. Co-defendant Avila remains a fugitive not before the Court.

Comunicaciones Celulares S.A. (dba TIGO Guatemala)

The final FCPA enforcement action of 2025 brings the “Cartel / TCO” factor of the FCPA Guidelines into sharper relief. On November 10, 2025, Comunicaciones Celulares, which provides telecommunications services in Guatemala under the trade name TIGO Guatemala, agreed to resolve a decade-long corruption investigation. According to the charging documents, between 2012 and 2018 TIGO Guatemala paid bribes to legislators in Guatemala to support the passage of laws and other policies favorable to the telecommunications provider. To resolve the single charge of FCPA conspiracy, TIGO Guatemala entered into a deferred prosecution agreement and agreed to pay a total of $118.2 million in fines and forfeiture.

The “Cartel / TCO” link comes from DOJ’s allegation that “narcotrafficking proceeds [] were used to generate cash for some of the bribe payments.” Specifically, the criminal information asserts that TIGO Guatemala Head of Legal and Corporate Affairs Asisclo Valladares Urruela used the services of Guatemalan banker Alvaro Estuardo Cobar Bustamante to turn fictitious invoices from shell companies into cash for the bribe payments to the politicians. Cobar also allegedly laundered money for narcotraffickers, using cash from the illegal drug sales to fund the bribe payments. In this way, DOJ asserts that a telecommunications operator’s corruption facilitated narcotrafficking such as to warrant prosecution under the FCPA Guidelines.

Of more traditional FCPA interest, the TIGO Guatemala case presents yet another example of a “near miss” self-disclosure pursuant to the Criminal Division’s Corporate Enforcement Policy. (Please see our 2023 and 2024 Year-End FCPA updates for variations on this recurring issue from the Albermarle and AAR cases, respectively.) According to DOJ, TIGO Guatemala’s current parent company Millicom International Cellular, S.A. voluntarily disclosed the TIGO Guatemala bribery scheme to DOJ a decade ago, in 2015. But at that time, Millicom held only 55% ownership in what was then a joint venture, and lacked the operational control necessary to access critical information, provide full cooperation, or implement remediation on behalf of TIGO Guatemala. DOJ closed its investigation without action in 2018, but in 2020 DOJ developed additional evidence independent of the company and reopened its investigation. Although not specified in the corporate charging documents, the timing of the charges and cooperation agreements of individual defendants Cobar and Valladares suggests that a narcotics investigation led to the development of corruption-related evidence by virtue of the common money launderer. In all events, according “significant weight” to the initial voluntary disclosure, DOJ granted TIGO Guatemala the first maximum 50% discount from the bottom of the U.S. Sentencing Guidelines range available for non-disclosure cases under the Corporate Enforcement Policy, limited the term of the deferred prosecution agreement to two years (rather than the more standard three-year term), and did not impose a compliance monitor.

Liberty Mutual Insurance Company

The only FCPA “declination with disgorgement” resolution of 2025 was reached with Liberty Mutual on August 7, 2025. As we reported in our client alert “DOJ Announces White Collar Enforcement Priorities,” on May 12, 2025, DOJ’s Criminal Division announced revisions to its Corporate Enforcement Policy designed to “simplify the policy and clarify the outcomes that companies can expect.” Liberty Mutual was the first test of the new Corporate Enforcement Policy, resolving allegations of corruption associated with its Indian subsidiary.

According to DOJ’s declination letter, between 2017 and 2022 the Indian branch of Liberty Mutual paid approximately $1.47 million in bribes to officials at six state-owned banks in India to induce these officials to refer customers to Liberty Mutual insurance products. As is standard for these declination letters, the facts are sparse and insufficient to identify which (if any) of the four FCPA Guideline factors apply (and indeed, there is a question whether the factors apply, at least in the same way, to Corporate Enforcement Policy declinations). As is required, Liberty Mutual disgorged $4.7 million in profits from its affected business with the state-owned banks. DOJ praised the company for its voluntary disclosure, cooperation, “thorough and systematic root-cause analysis,” and “separation from personnel involved in the misconduct.”

Carlos Leopoldo Alvelais Alarcón

The 2025 FCPA case about which the least is known—at least as of our publication deadline—is that against customs broker Carlos Leopoldo Alvelais Alarcón. It is public that Alvelais, who operates freight forwarding and customs clearances services between the United States and Mexico, pleaded guilty on October 23, 2025 to one count of conspiracy to violate the FCPA. But the criminal information and plea agreement both remain under seal, and no detail is available publicly concerning the circumstances of the corruption scheme. Alvelais is currently scheduled to be sentenced in the Western District of Texas in March 2026, but that date already has been postponed once under circumstances that suggest ongoing cooperation.

Azruddin & Nazar Mohamed

Acknowledging as we always do the difficulty in tracking non-FCPA cases associated with FCPA investigations, the only FCPA-related cases of 2025 of which we are aware are those against father and son Nazar and Azruddin Mohamed. On October 2, 2025, a grand jury sitting in the Southern District of Florida returned an indictment charging them collectively with conspiracy, mail fraud, wire fraud, and money laundering arising out of a corruption-facilitated import-export scheme.

According to DOJ, the two owned a gold wholesale and export business in Guyana that sold gold to buyers in Miami and Dubai (transshipped through Miami). The two allegedly reused official government seals from one shipment where appropriate taxes were paid to avoid the payment of required taxes on subsequent shipments, and allegedly paid bribes to Guyanese customs officials to facilitate the untaxed shipments. DOJ alleges that the scheme caused an estimated tax loss of $50 million to the Government of Guyana. Additionally, Azruddin Mohamed is charged with a separate scheme to evade over $1 million in Guyanese import taxes associated with the shipment of a Lamborghini from Miami to Guyana.

The two Mohameds and their company were the subject of comprehensive economic sanctions imposed by the U.S. Department of Treasury Office of Foreign Assets Control in 2024 pursuant to the Global Magnitsky Human Rights Accountability Act. The younger Mohamed, Azruddin, is the leader of Guyana’s “We Invest in Nationhood” party and a presidential candidate in Guyana’s 2025 election. Both Mohameds were reportedly arrested in Guyana pursuant to a request from the United States, but have been released on bond pending extradition proceedings.

Smartmatic

We save for last in our rundown of 2025 FCPA enforcement actions the case which is likely to have the most significant carryover effect in the new year. On October 16, 2025, DOJ announced a superseding indictment in the Philippines voting corruption case we first covered in our 2024 Year‑End FCPA Update, now charging UK voting machine company SGO Corporation (better known as Smartmatic) with FCPA bribery and money laundering offenses. Although the case itself is not new, this is the first time since 2010 (Lindsey Manufacturing Company, discussed in our 2010 Year-End FCPA Update) that DOJ has indicted a corporate defendant.

As we reported previously, DOJ already charged three Smartmatic executives—Roger Alejandro Piñate Martinez, Jorge Miguel Vasquez, and Elie Moreno—with FCPA bribery for allegedly paying more than $1 million in bribes to then-Chairman of the Commission on Elections of Philippines Juan Andres Donato Bautista to secure voting machine contracts in the 2016 Philippine elections. Donato is separately charged with money laundering for his alleged receipt of the bribes. Piñate Martinez and Vasquez were awaiting an April 2026 trial date, but trial has now been rescheduled to January 2027 with the addition of the corporate defendant. Moreno reportedly remains at large and Bautista is contesting extradition from Canada.

Beyond entering its appearance and pleading not guilty, Smartmatic has yet to file substantive pretrial motions. But outside the courtroom, the company has been vocal in denouncing what it contends is a “targeted, political, and unjust” prosecution that followed “extensive cooperation with the government.” The political intrigue surrounds criticism that the indictment is allegedly a retributive response to Smartmatic’s defamation lawsuit associated with voter fraud claims arising from the 2020 U.S. election in which President Trump was defeated. We anticipate fireworks in the Smartmatic criminal case in 2026.

DOJ Reviews of Previously Indicted FCPA Cases

As noted above, a requirement of President Trump’s February 2025 FCPA Executive Order was that DOJ undertake a review of all “existing FCPA [] enforcement actions,” which included those cases indicted prior to February 2025. Indeed, DOJ sensibly prioritized for expedited review those cases with upcoming trial dates. Although the internal DOJ review process was predictably shrouded in secrecy, the following cases before the courts provide a narrow window of insight.

Charges Against Gordon Coburn & Steven Schwartz Dismissed Per FCPA Executive Order Review

The most notable FCPA review process concerns the decision to proceed with, then delay, then dismiss the criminal case against former Cognizant Technology Solutions President Gordon Coburn and Chief Legal Officer Steven Schwartz. By way of background, as discussed initially in our 2019 Year-End FCPA Update (and many times since), on February 15, 2019, DOJ secured a 12-count indictment against Coburn and Schwartz in the District of New Jersey based on allegations that they authorized a $2 million payment for the benefit of an Indian government official to expedite permits for the construction of a new corporate campus in Tamil Nadu. Long before the Executive Order, this was one of the most heavily litigated cases in the history of the FCPA, finally set for its ninth scheduled trial date in March 2025.

The day after the FCPA Executive Order, on February 11, 2025, the Honorable Michael Farbiarz of the District of New Jersey sua sponte ordered DOJ to “state its position as to the upcoming trial,” then set for early March. DOJ initially responded that it had “prioritized review of [the] matter,” and subsequently confirmed that “[f]ollowing its review of this case pursuant to the Executive Order, the Government can report that the Government intends to proceed to trial.” Notably, these filings were all under the signature block of leadership from both DOJ’s Criminal Division, Fraud Section, and the New Jersey U.S. Attorney’s Office, but digitally signed by the line attorneys as is the ordinary course.

Later, on March 4, 2025, newly installed Acting U.S. Attorney John Giordano submitted his own letter requesting a 180-day continuance to conduct a personal review “of the application of the President’s February 10, 2025 Executive Order to this matter.” Although the Executive Order explicitly vested the FCPA review process in the Office of the Attorney General, a higher level within the Justice Department than any U.S. Attorney, and DOJ had previously represented that this review process had been completed with a decision to proceed to trial, the Court nonetheless granted, in part, Acting U.S. Attorney Giordano’s request, allowing 30 days for the Acting U.S. Attorney’s secondary review. Then, on April 1, 2025, after Acting U.S. Attorney Giordano was reassigned to serve as the U.S. Ambassador to Namibia, his replacement Acting U.S. Attorney Alina Habba, in her own letter, moved to dismiss the case “based on the recent assessment of the Executive Order’s application to this matter.” Two days later, on April 3, 2025, the Court granted the motion, bringing this long-running case and much-anticipated trial to an end.

It appeared for a time that the parallel SEC civil action against Coburn and Schwartz, also filed in 2019 based on the same core facts but stayed pending the criminal case, might nonetheless proceed. On April 10, 2025, the parties jointly moved to restore the SEC case to the active docket “while they consider a potential resolution.” But on July 15, 2025, the SEC followed DOJ’s suit by filing a joint stipulation dismissing its civil action “as a policy matter.”

Carl A. Zaglin’s Case Proceeds to Trial & Conviction Following FCPA Executive Order Review

Another previously indicted case pending trial at the time of the FCPA Executive Order concerned a procurement bribery scheme involving the sale of law enforcement uniforms and equipment to the Honduran National Police. As we most recently reported in our 2024 Year-End FCPA Update, Atlantco CEO Carl A. Zaglin, his alleged middleman Aldo N. Marchena, and former Honduran official Francisco Roberto Cosenza Centeno were all scheduled for an FCPA and money laundering trial in the Southern District of Florida in April 2025. The trial was initially delayed, in part, due to DOJ’s “priority review” of the case pursuant to the FCPA Executive Order. But then, on April 11, 2025, DOJ filed a “Notice of Authorization to Proceed,” advising “that the Government has completed its detailed review of the instant case as contemplated by [the FCPA Executive Order] and intends to proceed to trial.”

Shortly thereafter, in June and July 2025 respectively, Marchena and Cosenza each announced their intention to plead guilty. Zaglin elected to proceed to trial in September 2025.

On September 15, 2025, after a two-week trial, the jury returned a verdict of guilty on each of the three counts of conspiracy to violate the FCPA, FCPA bribery, and conspiracy to commit money laundering. On December 2, 2025, the Honorable Jacqueline Becerra denied Zaglin’s motion for a new trial and sentenced Zaglin to eight years in prison and granted a preliminary order of forfeiture. Zaglin already has noted an appeal to the U.S. Court of Appeals for the Eleventh Circuit.

Case Against Charles H. Hobson Survives FCPA Review; Trial Rescheduled for February 2026

A third case to undergo a post-indictment, pre-trial FCPA Executive Order review in 2025 was that against former Corsa Coal executive Charles Hunter Hobson. As we discussed in our 2022 Mid-Year FCPA Update, in March 2022 a grand jury sitting in the Western District of Pennsylvania returned a seven-count indictment charging Hobson with FCPA bribery, money laundering, and wire fraud conspiracy for allegedly bribing Egyptian officials from 2016 to 2020 to procure over $143 million in government contracts for Corsa Coal.

Prior to the FCPA Executive Order, Hobson’s trial was scheduled to begin on April 21, 2025. But following the pause on FCPA enforcement, Hobson moved for a six-month continuance to facilitate DOJ’s review of his submissions as to why his case ought to be dismissed pursuant to the Executive Order. DOJ opposed the continuance as excessive given its “priority review” of the case, but on March 6, 2025 the Honorable Robert Colville granted Hobson’s motion and removed the trial date from the Court’s calendar. On April 11, 2025, notably the same day as the Zaglin “Notice of Authorization to Proceed,” DOJ advised the Court “that the Government has completed its detailed review of the instant case as contemplated by [the FCPA Executive Order] and intends to proceed to trial.”

Trial in the Hobson matter is currently set for February 2026. On December 18, 2025, Hobson filed another motion to delay trial to facilitate further deliberation of his case by DOJ pursuant to the FCPA Executive Order. He contended that his “case is most similar to the Coburn case in New Jersey,” which notably was dismissed by the Acting U.S. Attorney after Main Justice initially decided to proceed with the case, and further noted that the Western District of Pennsylvania is one of the few districts without an appointed U.S. Attorney. The next day, DOJ “strenuously oppose[d]” the continuance, stating in no uncertain terms that the review of Hobson’s case required by the Executive Order had been completed and no further review would be conducted. The Court denied the motion on December 23, leaving the February 2026 trial date in place.

Case Against Asante K. Berko Survives FCPA Review; Motion to Dismiss Denied

Another pre-FCPA Executive Order indictment we have been following in these pages is the case against banker Asante K. Berko. As we most recently reported in our 2024 Year-End FCPA Update, the dual American and Ghanian citizen was arrested in London in 2022 at the request of U.S. authorities and subsequently extradited in 2024 to the Eastern District of New York where he faces a five-count FCPA and money laundering indictment based on allegations that he paid hundreds of thousands of dollars to assist a Turkish energy company client secure approvals to build an electric power plant in Ghana.

Most of the public docket filings in 2025 have concerned Berko’s motion to dismiss the indictment as untimely and in violation of his Speedy Trial Act rights. But an April 30, 2025 letter from Berko’s counsel to DOJ attached to his motion papers shows that he also advocated to have his case dismissed pursuant to the FCPA Executive Order. In that letter, Berko contended that the charges against Berko are “emblematic of the type of overexpansive and unpredictable enforcement of the FCPA that the Executive Order condemns,” because the alleged scheme occurred almost entirely abroad and its connection to the United States consists only of Berko’s citizenship, payments transmitted through correspondent banking accounts, one transfer to Berko’s U.S. bank account, and an email Berko sent in furtherance of the scheme from the United States. DOJ’s response to Berko’s FCPA Executive Order letter is not public, but in context it is clear that DOJ has decided to proceed with the prosecution post-Executive Order review.

Regarding the Court-filed motion to dismiss, Berko contended that DOJ improperly sealed and maintained the 2020 indictment under seal for years leading up to arrest, even after Berko was well aware of DOJ’s investigation and indeed had resolved a parallel SEC case, thereby circumventing the statute of limitations and Berko’s right to a speedy trial. After an evidentiary hearing that saw testimony from DOJ’s investigator and Berko’s original defense counsel, the Honorable Diane Gujarati denied the motion from the Bench in an unwritten order. A status hearing in the case is currently scheduled for January 2026, and no trial date has yet been set.

Case Against the “Adani Group Eight” Remains Pending; Status Unclear

The outstanding FCPA-related case with perhaps the most political intrigue has seen the least movement in response to the FCPA Executive Order, at least publicly. As reported in our 2024 Year-End FCPA Update, in November 2024 DOJ and the SEC jointly announced an FCPA-related case that includes securities and wire fraud charges against Indian billionaire Gautam Adani, his nephew Sagar Adani, and Vneet Jaain, all executives of Indian renewable energy company Adani Green Energy, and FCPA charges against Ranjit Gupta and Rupesh Agarwal, former executives of U.S. issuer Azure Power, and Cyril Cabanes, Saurabh Agarwal, and Deepak Malhotra, former employees of Canadian pension fund CDPQ (as well as in Cabanes’s case, a former board member of Azure Power). The criminal indictment and civil complaint together allege that the defendants promised more than $250 million to Indian officials to secure large solar‑power supply contracts, and that the defendants made false or misleading statements related to the scheme while raising over $1 billion in Rule 144A Bond offerings and another $2 billion in U.S. dollar syndicated loans.

There has been no public movement on the criminal case docket, or other reports that suggest extradition of the criminal defendants from India is moving forward. The only updates in the civil case are periodic, non-specific status reports by the SEC of its ongoing efforts to serve the civil complaints on the SEC defendants via India’s Ministry of Law & Justice pursuant to The Hague Service Convention. Multiple news articles source reports that defendants, led by Gautam Adani, a close confidant of Indian Prime Minister Narendra Modi, are seeking to persuade DOJ to dismiss the criminal case pursuant to the FCPA Executive Order, though these same reports suggest that tense bilateral trade negotiations and other geopolitical tensions between the United States and India have frustrated these efforts.

DOJ Reviews of Prior Corporate FCPA Resolutions with Post-Resolution Obligations

A curious provision in the February 10, 2025 FCPA Executive Order directed the Attorney General to “determine whether . . . remedial measures with respect to inappropriate past FCPA investigations and enforcement actions [] are warranted.” Although what these “remedial measures” might be was and still is unclear, one potential explanation can be tied to a separate Criminal Division policy announcement on May 12, 2025. On that day, then-Criminal Division Head Galeotti announced a White Collar Enforcement Plan that, among other things, announced an ongoing review of all active Criminal Division corporate resolutions with post-resolution reporting obligations “to determine if they should be terminated early.” Enumerated factors that could justify early termination of post-resolution reporting include: (1) duration of the reporting period; (2) a reduction in the company’s risk profile; (3) remedial progress and maturity in the corporate compliance program; (4) and if the company self-reported the original misconduct. The same day, then-Criminal Division Head Galeotti amended DOJ’s Monitorship Guidance to include similar considerations in the decision to impose future compliance monitorships.

The White Collar Enforcement Plan and updated Monitorship Guidance cover more than the FCPA, but resolutions under this statute have for many years constituted a significant portion of the Criminal Division’s corporate enforcement docket. Although then-Criminal Division Head Galeotti commented at the 2025 ACI FCPA Conference that DOJ has “turned down requests for [early] termination way more than we’ve granted,” FCPA resolutions with publicly announced early terminations of post-resolution reporting obligations in 2025 include:

- Glencore International – On March 20, 2025, DOJ moved the U.S. District Court for the Southern District of New York to terminate 15 months early a compliance monitorship imposed as a probationary condition associated with Glencore’s 2022 FCPA guilty plea covered in our 2022 Mid-Year FCPA Update (and moved that same day to terminate a parallel market manipulation compliance monitorship);

- Stericycle – On April 21, 2025, DOJ moved the U.S. District Court for the Southern District of Florida to dismiss seven months early the criminal information filed against Stericycle as part of an FCPA deferred prosecution agreement covered in our 2022 Mid-Year FCPA Update (the two-year compliance monitorship imposed pursuant to the resolution already had concluded);

- Albemarle – On May 1, 2025, Albemarle disclosed in a securities filing that the prior month DOJ had agreed to conclude 17 months early an FCPA non-prosecution agreement covered in our 2023 Year-End FCPA Update;

- ABB – On June 18, 2025, DOJ moved the U.S. District Court for the Eastern District of Virginia to dismiss six months early the criminal information filed as part of ABB’s 2022 deferred prosecution agreement covered in our 2022 Year-End FCPA Update; and

- Honeywell UOP – On July 8, 2025, DOJ moved the U.S. District Court for the Southern District of Texas to dismiss five months early the criminal information filed as part of Honeywell’s 2022 deferred prosecution agreement covered in our 2022 Year-End FCPA Update.

All the above motions were granted by the respective courts without controversy. For a more detailed analysis of DOJ’s May 12, 2025 announcement of its White Collar Enforcement Plan, updated Monitorship Guidance, and updated Criminal Division Corporate Enforcement Policy, please see our separate client alert, “DOJ Announces White Collar Enforcement Priorities.” In a notable further development, in December 4, 2025 remarks from the 2025 ACI FCPA Conference, Deputy Attorney General Blanche announced DOJ is in the process of refashioning the current Criminal Division Corporate Enforcement Policy into a Department-wide Corporate Enforcement Policy to ensure even application in criminal matters across DOJ.

FCPA Unit Staffing Developments

Anyone paying attention to the federal government over the course of 2025 will be familiar with the Trump Administration’s efforts to reshape its size and focus to better align with current Executive priorities. The FCPA Units of each of DOJ and the SEC have been no exception to this reallocation of federal government resources.

On the DOJ side, the FCPA Unit within the Criminal Division has maintained its integrity as a standalone section with institutional expertise for coordinating and conducting criminal FCPA and FEPA investigations and prosecutions. That is a significant win for FCPA Unit Chief David M. Fuhr and his team, at a time when we have seen the effective dissolution of storied prosecutorial units within DOJ, ranging from the Public Integrity Section, to the Money Laundering and Asset Recovery Section, to the entire Tax Division. The current FCPA Unit stands at roughly a dozen prosecutors, less than half its strength at the end of 2024, but it continues to partner with U.S. Attorney’s Offices around the country in pursuit of its anti-corruption enforcement mission.

On the SEC side, the integrity of a standalone FCPA Unit is less certain. Although there has been no official announcement of its dissolution, the Unit no longer shows up on SEC directories of specialized units. Moreover, Charles Cain, the legendary and highly respected Chief who has been a leader in the SEC’s FCPA Unit since its creation, retired in April 2025 to take a senior position with Ernst & Young, and he has not been replaced. Our understanding is that remaining SEC FCPA Unit alumni have been reassigned within the Enforcement Division, where they may still handle FCPA cases, among others, as was the setup within the SEC prior to formation of the SEC’s specialized FCPA Unit in January 2010. Much was in flux within the SEC in 2025 as Chairman Paul Atkins and Director of Enforcement Margaret “Meg” Ryan establish their priorities, and there was not a single FCPA action filed during the course of the year.

Rounding Out the Year in FCPA Enforcement

Even in a year with reduced enforcement, there was no shortage of developments left on the cutting room floor as we sought to make this update digestible to our busy audience. For other FCPA-related developments of import in 2025, yet not covered in this update, please see our separate client alerts linked below:

- “New Memoranda from Attorney General Bondi: Topics to Watch in Corporate Enforcement” (Feb. 7, 2025);

- “New Executive Order on Regulatory and Enforcement Review: Topics to Watch in Corporate Enforcement” (Feb. 25, 2025);

- “California Reminds Companies That Foreign Bribery Violates State Law” (Apr. 7, 2025);

- “New Executive Order Seeks to Combat ‘Overcriminalization in Federal Regulations’” (May 17, 2025); and

- “June 5, 2025 Internal Guidance from DOJ’s Criminal Division Prioritizes Victim Compensation in Coordinated Corporate Resolutions” (Jun. 17, 2025).

Finally, although more common than it once was, it is still noteworthy whenever we see a published opinion from a U.S. Court of Appeals add to the growing body of FCPA-related case law. On December 5, 2025, the Second Circuit affirmed the 2022 jury trial conviction of Ng Chong Hwa (also known as Roger Ng) in a unanimous, 50-page panel opinion authored by the Honorable Amalya L. Kearse. As we covered in our 2022 Mid-Year FCPA Update, Ng was convicted of conspiracy to violate the FCPA’s anti-bribery and internal controls provisions, as well as money laundering conspiracy, in connection with the massive corruption scheme involving 1Malaysia Development Berhad (1MDB). The Second Circuit seemed to have little trouble dismissing Ng’s claim that excluding a purportedly exculpatory recorded conversation with one of his co-conspirators was an abuse of discretion by the trial judge. It also rejected Ng’s venue challenge as unpreserved because Ng did not refile his venue-related motion to dismiss after DOJ superseded the indictment (even though the text of the superseding indictment was materially identical).

2025 YEAR-END INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

In part early response to the United States retracting the reach of its international anti-corruption enforcement, in part continuation of a trend we have observed for years, other global leaders are increasing enforcement of their own international anti-corruption laws. Whether other nations, alone and in collaboration, will be able to fill the void left by a less activist U.S. presence will be a fascinating question to answer in the coming years. We cover the early returns from 2025 below.

International Anti-Corruption Prosecutorial Taskforce

Perhaps the highest-profile international “response” to the “pause” in U.S. FCPA enforcement came on March 20, 2025, when the UK Serious Fraud Office (SFO), Swiss Office of the Attorney General (OAG), and French Parquet National Financier (PNF) announced a joint task force to combat international corruption. Though SFO Director Nick Ephgrave was quick to state that this announcement was “in no way a reaction” to the FCPA enforcement pause, the context of these three agencies—each strong international anti-corruption enforcers in their own right—taking a coordinated step forward six weeks after the United States took a big step back is notable.

The stated goal of the International Anti-Corruption Prosecutorial Task Force is to exchange insights, share best practices, and identify opportunities for operational collaboration in cross-border corruption matters. A group of leaders from each of the three agencies will convene annually to set strategic priorities, while a working-level group will meet bi-monthly to coordinate day-to-day operational matters. The taskforce has yet to show any public results from this new collaboration, and in October 2025 leaders of the three agencies cautioned the public not to expect any near-term results, but rather “medium-term or even long-term results.”

World Bank

Multilateral development banks (MDBs), particularly the World Bank, continued their enforcement efforts in 2025. These cases can involve proven corruption, but also a much broader array of practices deemed to be “coercive,” “collusive,” or “obstructive” to the contracting processes for Bank-funded projects. The ramifications of Bank-led investigations and sanctions can go far beyond those projects, including cross-debarments with other MDBs and, in some cases, referrals to state law enforcement authorities.

A selection of notable World Bank enforcement actions in 2025 follows:

- On January 16, 2025, the World Bank announced the 30-month debarment of Nigerian-based Viva Atlantic Limited and Technology House Limited, plus their Managing Director and CEO Norman Bwuruk Didam, for a range of conduct that included the alleged receipt of confidential tender information from public officials in return for providing items of value to public officials;

- On March 19, 2025, the World Bank announced a two-year debarment of Italy-based filtration system company Panaque, S.R.L. and its sole director, Oscar Di Santo, for allegedly making improper payments to a public official during contract execution discussions and failing to disclose the resulting conflict of interest;

- On March 26, 2025, the World Bank sanctioned Christian Magni of Gabon for eight months in connection with allegedly improperly receiving an All-Terrain Vehicle while acting as Deputy CEO of the Gabonese railway operator, though the terms are conditional, meaning he is still eligible to participate in Bank Group-financed projects if he complies with the terms of the agreement;

- On May 8, 2025, the World Bank announced the 4.5-year debarment of Philippines-based S.D. Construction & Supplies due to alleged collusive, fraudulent, and corrupt practices in connection with the Philippine Rural Development Project, including alleged improper payments made to secure a contract and expedited processing of invoices;

- On July 8, 2025, the World Bank announced the 18-month debarment with conditional release of GenKey Solutions B.V., a Netherlands-based biometrics firm, for allegedly lax internal controls that led the company to fail to disclose commission payments to an agent in connection with a project providing income support to poor Liberian households; and

- On December 11, 2025, the World Bank announced the 24-month sanction (12 months of debarment with conditional release followed by 12 months of conditional non-debarment) of Turkey-based engineering company Kontrolmatik Teknoloji Enerji Ve Mühendislik A.Ş. for allegedly submitting fabricated past performance documents, impersonating a third party to verify these documents, and making false statements to investigators.

United Kingdom

UK Enforcement Updates

On April 17, 2025, the SFO charged UK insurance broker United Insurance Brokers Limited with failure to prevent bribery under the UK Bribery Act associated with insurance products it sold to insurers covering parts of the Ecuadorian public sector, including the state water and electricity companies. Specifically, the SFO alleges that UIBL paid ~ $3 million to intermediaries who then subsequently paid bribes to an Ecuadorian official in exchange for the insurance contracts. This is yet another in a string of anti-corruption prosecutions, brought by prosecutors on both sides of the Atlantic, for corruption in the Ecuadorian reinsurance industry. Notably, if this case proceeds to trial, it could provide useful guidance on compliance expectations associated with the UK “failure to prevent bribery” offense. UIBL is next scheduled to appear in court in May 2026.

On May 29, 2025, the Crown Prosecution Service (CPS) charged UK businessman Zuneth Sattar for alleged corruption in Malawi. Sattar, who is from Malawi, is charged with 18 counts of violating the UK Bribery Act associated with up to $50,000 in alleged corrupt payments in 2020 and 2021 to at least seven different Malawi officials, ranging from the country’s late Vice President to the former heads of the country’s Police, Anti-Corruption Bureau, and Public Procurement Agency. Public records show that Sattar’s company, Xaviar Limited, which is not separately charged, has received more than $50 million dollars in military support contracts from Malawi in recent years. Sattar’s trial is currently scheduled for September 2027.

On August 28, 2025, the CPS charged 11 former executives of gambling company Entain plc in connection with an alleged bribery scheme in Turkey that led to the company’s deferred prosecution agreement in 2023 covered in our 2023 Year-End FCPA Update. In this latest action, former CEO Kenneth Alexander and former Chairman Lee Feldman are charged with conspiring to defraud and to pay bribes, a group of seven others headlined by former CFO Richard Cooper and including Robert Dowling, James Humberstone, Scott Masterton, Caroline Roe, Raymond Smart, and Richard Raubitschek-Smith face similar conspiracy charges, and Jersey-based Alexander MacAngus and former director Robert Hoskin are charged with fraud and perverting the course of justice, respectively. The individuals all made their initial appearances in court on October 6, 2025, and have been released on bail. Given the complexity of the allegations and numerosity of defendants, the case has preliminarily been split into three trial phases, with start dates stretching from February 2028 to March 2029.

On November 21, 2025, former leader of the Reform UK Party in Wales and former Member of European Parliament (MEP) Nathan Gill was sentenced to more than 10 years in prison for his receipt of approximately £40,000 in bribes from pro-Russia advocates to give interviews and speeches favorable to Russia-leaning politicians in Ukraine. Gill, who pleaded guilty to eight counts of violating the UK Bribery Act in September 2025, is the first UK politician to be jailed for a Bribery Act offense.

UK Policy Updates

On April 3, 2025, the SFO published its Annual Business Plan highlighting priorities including enforcement of the “failure to prevent fraud” offense and whistleblower incentivization. As reported in our 2023 and 2024 Year-End FCPA updates, the new failure to prevent fraud offense, which took effect on September 1, 2025, means that large organizations can be held criminally liable where a specified fraud offense is committed by a person associated with the organization (such as an employee or agent) with the intention to benefit the organization directly or indirectly, similar in kind to Section 7 (failure to prevent bribery) of the UK Bribery Act.

On April 24, 2025, the SFO issued new External Guidance on Corporate Cooperation and Enforcement, replacing its 2019 framework and reinforcing the SFO’s commitment to using deferred prosecution agreements where appropriate, with self-reporting and cooperation being the key drivers for eligibility. The Guidance clarifies, however, that self-reporting alone is not sufficient to be considered cooperative, and it provides examples of how companies might supplement self-reporting, such as by proactively preserving, identifying, and producing evidence, affirmatively presenting facts and involved persons to prosecutors, avoiding strategic forum shopping, engaging with the SFO early, providing regular updates, and voluntary privilege waivers. Moreover, full engagement that constitutes “exemplary cooperation” may result in the SFO considering a deferred prosecution agreement even in the absence of a self-report. For a more detailed treatment of this subject, we direct readers to our separate client alert, “UK Serious Fraud Office Issues New Guidance on Corporate Self-Reporting and DPAs.”

Europe

European Union

From an enforcement perspective, the most notable EU anti-corruption update of 2025 broke on April 4, when Belgian prosecutors charged eight individuals associated with an alleged scheme by Chinese telecommunications provider Huawei to make illegal payments to secure legislative support from several different MEPs. These charges followed 21 searches coordinated across Belgium and Portugal, including raids on European Parliament offices and Huawei’s Brussels headquarters. The corruption, money laundering, and criminal organization participation charges against eight defendants—reportedly including Huawei executives, Huawei lobbyists, and MEP assistants, have been followed by a request to lift parliamentary immunity to investigate as many as five MEPs. The European Parliament has barred Huawei lobbyists from its premises, and the European Commission has suspended engagement with the company.

In policy developments, on December 2, 2025, the European Parliament and the Council reached an agreement on the first EU Anti-Corruption Directive. The directive establishes a common framework for corruption sanctions ranging from maximum prison sentences of up to five years and corporate fines of up to 5% of global turnover, to removal and disqualification from holding public office, to exclusions from public benefits and contracting opportunities. The directive further provides for closer coordination among national enforcement authorities and EU bodies.

The directive will enter into force following formal approval by both the European Parliament and the Council. Member States will thereafter be required to amend their national legislative frameworks within two years to reflect the directive’s harmonized definitions of corruption-related offenses and penalty structures. It is expected that the EU Anti-Corruption Directive will enhance and harmonize anti-corruption laws across the European Union, thus resulting in stronger cooperation between the Member States when it comes to enforcing corruption-related offenses.

France

On February 11, 2025, the PNF announced the resolution of two corporate corruption cases, one involving domestic bribery and the other international corruption in Algeria. According to the PNF, Paris-based Paprec Group agreed to pay €18.5 million (~ $19.1 million) pursuant to a judicial public interest agreement (CJIP) that found that Paprec paid kickbacks to receive domestic contracts and non-public bidding information between 2013 and 2022. Paprec did not admit the allegations, but company founder and former CEO Jean-Luc Petithuguenin is reportedly among six individuals charged in the scheme. Separately, PNF announced that French vehicle manufacturing and maintenance business Klubb agreed to pay a €558,000 (~ $575,000) penalty for allegedly bribing a public official in Algeria to secure ambulance supply contracts in a separate CJIP resolution.

On April 29, 2025, the Paris Criminal Court found two subsidiaries and two senior employees of the SPIE Group guilty of bribing an Indonesian police officer. The case stems from an incident in 2015, when, in response to a former employee’s demand for millions in compensation following his dismissal, SPIE Indonesia hired a local lawyer to file a criminal complaint against the former employee and part of the payment to the lawyer was allegedly a bribe to a police officer to falsely imprison the former employee. A third defendant, a former SPIE Group employee, is set to stand trial for the same conduct in early 2026.

On June 19, 2025, the PNF announced a third CJIP resolution with France-based cybersecurity company Exclusive Networks Corporate SAS. Exclusive Networks agreed to pay €16.1 million (~ $18.5 million) to resolve allegations that that it paid bribes through third parties in India, Indonesia, Malaysia, Thailand, and Vietnam. According to the CJIP, the company’s former risk and compliance manager reported concerns about use of third parties to the PNF after he raised concerns internally but the company allegedly took no action.

On September 3, 2025, the PNF announced a fourth corruption-related CJIP resolution with security technology company Surys (formerly Hologram Industries), pursuant to which the company will pay €22.8 million (~ $26.6 million) without an admission of guilt. According to the PNF, between 2013 and 2021, Surys conspired with the director of Polygraph Combinat Ukraina to overcharge the Ukrainian state-owned entity for passport-related contracts, kicking back portions of the overcharge. Although not identified in the CJIP documents, Ukrainian politician Maksym Stepanov held the position during a portion of the relevant period and, in 2023, the High Anti-Corruption Court of Ukraine issued a warrant for his arrest on charges of embezzlement and money laundering.

Germany

On December 16, 2025, Germany’s Federal Ministry of Justice formally responded to the observations made in connection with the review of Germany’s implementation of the United Nations Convention against Corruption (UNCAC) in the first two review cycles. Although acknowledging Germany’s strong existing anti-corruption framework, the UNCAC review identified certain areas for improvement, including enhancing transparency in political party financing, facilitating the reporting of corruption to appropriate authorities, and harmonizing provisions on the sentencing for bribery.

Germany has since undertaken measures to further enhance its anti-corruption framework in these areas including: (i) amending the Political Parties Act to increase transparency requirements for political donations in 2024, (ii) implementing a Whistleblowing Law in 2023, and (iii) upgrading the offense of bribing parliamentarians to a felony in 2024. UNCAC’s observation that Germany should seek ways to coordinate and generate relevant corruption statistics remains under consideration, but will need to be addressed also with a view to the EU Anti-Corruption Directive that requires the submission of corruption statistics to the EU from all EU Member States. In its 2025 coalition agreement, Germany’s current government announced only light measures in terms of combatting corruption in procurement processes, with the main focus being on measures in the area of anti-money laundering and sanctions.

The Netherlands

On April 25, 2025, the Dutch Public Prosecution Service (OM) announced bribery and sanctions charges against shipbuilding business Damen Shipyards and six associated persons. The corruption allegations are that, between 2006 and 2017, Damen Shipyards paid inflated commissions, used to make corrupt payments to government officials, to agents facilitating sales of ships across Africa, Asia, and South America, and then falsified insurance documents to hide the commissions. Damen Shipyards is also alleged to have violated Russian sanctions imposed following the invasion of Ukraine in February 2022. On November 25, 2025, two of the individual defendants—former Damen Shipyards Marketing Director Sander Van Oord and former director of the Port Authority of Curaçao Richard Lopez-Ramirez—pleaded guilty. The company, its former CEO, the current owner, the owner’s son, and a sales agent are all currently on trial, which is expected to continue into 2026.

Switzerland

On the enforcement front, the Swiss Office of the Attorney General (OAG) initiated several actions in 2025, including among others:

- On February 27, 2025, the OAG issued a summary penalty order against Morgan Stanley (Switzerland) GmbH for CHF 1 million (~ $1.2 million) associated with alleged compliance deficiencies relating to the purported proceeds of payments made for the benefit of a former Greek government official;

- On June 17, 2025, the OAG issued a summary penalty order against Banque Pictet et Cie SA and a former relationship manager for CHF 2 million (~ $2.5 million) and a suspended six-month sentence, respectively, associated with an alleged failure to implement adequate measures to prevent the laundering of over $4 million linked to the “Operation Car Wash” scandal; and

- On August 22, 2025, the OAG issued a summary penalty order against JPMorgan Suisse for CHF 3 million (~ $3.8 million) associated with alleged failures to scrutinize banking relationships and transactions that purportedly facilitated the misappropriation of assets from Malaysia’s sovereign wealth fund in 2014 and 2015 as part of the 1MDB scandal.

In addition to these new cases, in January 2025 the Swiss OAG obtained a conviction of Trafigura AG, its former Chief Operating Officer Mike Wainwright, former Angolan official Paulo Gouveia Junior, and intermediary Thierry Plojoux. As we covered in our 2024 Year-End FCPA Update, the Federal Criminal Court in Bellinzona convicted the defendants of charges that, between 2009 and 2011, Trafigura caused and failed to prevent the payment of $5 million in bribes to Angolan officials in exchange for ship chartering and oil bunkering contracts. In December 2025, Trafigura announced that it has filed an appeal challenging the conviction and sentence.

And on June 25, 2025, the former CFO of Swiss-based Koenig & Bauer Banknote Solutions was acquitted of corruption charges arising out of Morocco. Prosecutors alleged that the former CFO was involved in a scheme between 2009 and 2014 to pay bribes to win contracts from the Moroccan central bank, but the Federal Criminal Court in Bellinzona found that he only provided “administrative support” to corruption at the company. In 2017, Koenig & Bauer (then KBA-NotaSys) was convicted of foreign bribery, and since then four other former employees have been prosecuted for corruption associated with contracts in Morocco as well as Brazil, Egypt, Nigeria, and Ukraine. On November 3, 2025, the OAG appealed the acquittal.

Switzerland complemented the above enforcement actions with legislative reforms in 2025. Specifically, on September 26, 2025, the Swiss Parliament adopted the Federal Act on the Transparency of Legal Entities (LETA) and a revised Anti-Money Laundering Act (AMLA) to strengthen the country’s anti-money laundering and counter-terrorism financing measures, with their entry into force anticipated in 2026. The reforms impose new transparency obligations on legal entities, including the duty to report information to a newly created central beneficial ownership register, and extend the applicability of the AMLA to certain consultancy services linked to high-risk transactions.

Eastern Europe, Caucus, and Central Asia

Armenia

According to the Organisation for Economic Co-operation and Development (OECD)’s Fifth Round Anti-Corruption Monitoring Follow-Up Report and other international observers, Armenia has maintained an overall positive trajectory in anti-corruption performance since 2022, advancing in policy development, asset disclosure, business integrity, public procurement, and enforcement of corruption offenses. This has included aligning its anti-corruption enforcement framework more closely to international standards and strengthening mechanisms for civil forfeiture of illicit assets. On the enforcement front in 2025, Armenia’s Anti-Corruption Committee reported significant enforcement activity, with over 1 billion Armenian drams (~ $2.6 million) recovered in completed cases and 1,653 criminal cases investigated in the first half of the year alone.

Azerbaijan

The OECD had more mixed reports on Azerbaijan’s 2025 anti-corruption outlook, finding uneven progress across nine performance areas without stronger institutional safeguards and regression in overall anti-corruption policy, judicial independence, and specialized institutions. That said, in September 2025, an Azeri court sentenced Ramin Isayev, the General Director of a joint venture involving state-owned oil company SOCAR, to 14 years in prison for embezzling approximately 54 million manats (~ $31.76 million), along with money laundering, abuse of office, and fraud.

Georgia

Many have expressed concern about the trajectory of anti-corruption enforcement in Georgia, with NGOs accusing the government of concentrating on investigations of watchdog groups rather than high-level institutional graft. Parallel pressure on the civic space—in particular government demands for detailed NGO reporting—is feared to chill oversight from civil society anticorruption watchdogs. Against this backdrop, observers warned that the overall rule-of-law trajectory has been negatively affected by a package of repressive legislative changes that weaken independent scrutiny and increase the risk of selective enforcement. In November 2025, this culminated in an announcement that the Georgian government to abolish the Anti-Corruption Bureau and merge its functions into the State Audit Office by March 2026.

Kazakhstan

On April 1, 2025, the President of Kazakhstan signed into law the Commonwealth of Independent States Agreement on Cooperation in Combating Corruption, expanding the country’s commitments to regional anti-corruption enforcement, extradition of offenders, and other regional assistance with investigating and enforcing corruption offenses. Additionally, in July 2025, the government issued a decree transferring functions related to corruption-prevention and investigation to a newly established Anti-Corruption Service within Kazakhstan’s National Security Committee. On the enforcement front, a January 2025 report showed that in 2024, 1,493 people were convicted on corruption charges and more than 486 billion tenge (~ $937 million) in assets were returned to the state.

Moldova

Moldova’s anti-corruption agenda in 2025 advanced amid an EU-accession track that kept rule-of-law benchmarks front-and-center, with authorities emphasizing justice-sector reform, asset recovery, and preventive integrity controls as core elements of the government’s program. The most notable legislative development is a draft law that would merge the Anti‑Corruption Prosecutor’s Office and the Prosecutor’s Office for Combating Organized Crime and Special Causes into a single new body called the Anti‑Corruption and Organized Crime Prosecutor’s Office. The reform is being pitched as a response to the convergence of corruption, political influence, and organized-crime activities—particularly in electoral contexts—and the view that having two separate specialized offices has reduced overall effectiveness.

Russia

Russia’s 2025 anti-corruption landscape saw a steady drumbeat of prosecutions against regional officials, as the government continued to present corruption control as a pillar of national governance, even as critics claim that enforcement remains highly centralized and selective. At the policy level, President Putin signed legislation increasing penalties and reporting obligations for “foreign agents,” steps framed by authorities as integrity and transparency initiatives but viewed by many external observers as further encroachment on the information environment. This trend escalated in October when the Prosecutor General petitioned to designate the Anti-Corruption Foundation a “terrorist organization,” a classification carrying severe criminal liabilities for associates and supporters. On the enforcement front, asset recovery and criminal prosecutions have remained key themes in Russia, with Russian media estimating that the state has returned about 6 trillion rubles (~ $76 billion) in assets through various mechanisms since 2022.

Specific prosecutions have included the detention of Yalta’s deputy city head on corruption charges and the conviction of a former head of the Interior Ministry’s anti-corruption unit in Sverdlovsk region for taking exceptionally large bribes. And in July 2025, the country’s former Deputy Defense Minister Timur Ivanov was convicted and received a 13-year sentence on charges of embezzlement and money laundering.

Ukraine

Ukraine’s anti-corruption efforts in 2025 continued to unfold under the dual pressures of wartime governance and the drive toward European Union integration, producing both notable institutional progress and renewed public debate over the independence of key enforcement bodies. A significant milestone came late in the year, when Ukraine was invited to accede to the OECD Anti-Bribery Convention, a move predicated on the adoption of critical legislative reforms, including strengthened corporate liability for corruption offenses. Despite these achievements, the reform path has been volatile, characterized by a tension between strengthening institutions and recurring political attempts to curtail their independence.

The most significant legislative development of the year occurred in July, when the Verkhovna Rada passed a bill that would have effectively subordinated the National Anti-Corruption Bureau of Ukraine (NABU) and the Specialized Anti-Corruption Prosecutor’s Office (SAPO) to the Prosecutor General. The bill sparked nationwide outrage known as the “Cardboard Protests,” international concern, and criticism from the EU, prompting President Zelenskyy to propose revisions to restore the agencies’ institutional independence and safeguards. On the enforcement front, in early 2025, Ukrainian authorities launched multiple high-profile investigations into defense-sector procurement and energy-industry contracts, including an alleged $100 million kickback scheme tied to procurement contracts at the state nuclear energy company. Most recently, Andriy Yermak, chief of staff to President Zelenskyy, has resigned after anti-corruption investigators raided his home and office amid a sweeping energy-sector graft probe—a development that raises serious political tensions in Ukraine as the country enters critical peace talks, given that Yermak was the lead negotiator in talks with the United States.

The Americas

Brazil

On March 28, 2025, in a follow-on to its 2024 FCPA resolution with DOJ reported in our 2024 Year-End FCPA Update, Swiss commodities trader Trafigura Beheer B.V. entered into a leniency agreement with the Brazilian Comptroller-General’s Office (CGU) and Attorney General of the Union (AGU), agreeing to pay approximately $80 million to resolve the allegations of corruption with Brazilian state-owned oil company Petrobras stemming from the “Operation Car Wash” investigation. This action was anticipated by DOJ’s 2024 FCPA resolution, which allowed for a partial offset of the Brazilian penalty against the U.S. penalty.

Another “Car Wash”-related enforcement actions announced by the CGU in 2025 include those against Japanese petrochemical group Toyo Engineering and its Brazilian subsidiary, which were administratively fined 566.6 million reais (~ $95.9 million) on April 7, 2025. Toyo Engineering has pronounced its innocence and intent to challenge the fine.

Rounding out the enforcement docket for Brazil in 2025, on April 22, 2025, the CGU announced a leniency agreement with MicroStrategy Brasil Ltda., which agreed to pay 2.4 million reais ($420,000). And on July 3, 2025, the CGU announced two separate summary judgment resolutions with chemicals producer Rhodia Brasil and trading company Sojitz do Brasil which agreed to pay just under 4 million reais ($720,000) collectively. These resolutions resolved separate, non-“Car Wash” investigations.

On the policy front, on July 29, 2025, the CGU opened a public consultation process to “establish the criteria and procedures for the negotiation, execution and monitoring of compliance with the leniency agreements” for Brazil’s Anti-Corruption Law, expected to be published in 2026. Among the proposed changes is the introduction of a “marker,” allowing a company to secure timeliness credit and negotiation priority by formally declaring its intent to cooperate even before completing an internal investigation. This “marker” approach is widely used in cartel enforcement around the world, but its proposed application to corruption measures is unique. Then, on September 10, 2025, the CGU published eight “administrative statements” to provide guidance regarding respect to Brazil’s Anti-Corruption Law and its regulatory decrees. Among other things, the CGU elaborated on the definition of an “undue advantage” as set forth in the Clean Company Act, clarified that the scope of gifts and entertainment restrictions, and elaborated upon the law’s strict liability principle.

Finally, on November 4, 2025, Judge Antonio Claudio Macedo da Silva annulled the 10.3 billion reais (~ $3.2 billion at the time) penalty imposed as part of the 2017 leniency agreement between Brazilian authorities and J&F Investimentos S.A., the controlling shareholder of Brazilian meatpacker JBS S.A. As covered in our 2017 Mid-Year FCPA Update, J&F’s owners admitted to paying 600 million reais (~ $182 million at the time) to nearly 1,900 politicians to secure financing from pension funds and state-run banks. But Judge Claudio ruled that the “environment of systemic legal uncertainty” in which the leniency agreement was negotiated meant that J&F accepted the terms under duress because its choices were to accept an agreement with a fine that prosecutors knew to be illegal or face a “threat of corporate annihilation and multiple prosecutions in the chaotic Brazilian scenario.” The Court ordered the Federal Prosecution Service (MPF) to recalculate the penalty according to specified parameters.

Guatemala

In a highly charged international action, on June 2, 2025, Guatemala’s Attorney General’s Office issued arrest warrants for sitting Colombian Attorney General Luz Adriana Camargo and former Colombian prosecutor and current Ambassador to the Holy See Ivan Velásquez. The charges concern alleged involvement of Velásquez and Camargo in the sprawling Odebrecht corruption scheme we have been covering for nearly a decade, but notably date back to the period when the two worked in the International Commission against Impunity in Guatemala (CICIG), a U.N. body created to investigate corruption networks in the high spheres of the Guatemalan government and that resulted in prosecution of former Guatemalan presidents, ministers, businessmen and senior military commanders. The Colombian Ministry of Foreign Affairs condemned the warrants, calling them unfounded and against international law.

Peru