March 2, 2023

2022 marked another year of robust enforcement of the Foreign Corrupt Practices Act (“FCPA”) and other anti-corruption laws by enforcers in the United States and globally. In particular, the U.S. Department of Justice (“DOJ” or the “Department”) continues to indict, try, and convict individual defendants in FCPA and money laundering cases at a vigorous pace, even as it reworks corporate enforcement policies to rebuild the robust pipeline of corporate cases seen in prior years. Additionally, the network of anti-corruption enforcers at home and abroad continues to expand, leading to a complex decision tree for any general counsel and chief compliance officer facing a serious anti-corruption matter.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from 2022 and select developments from early 2023, as well as the trends we see from this activity. Gibson Dunn has the privilege of helping our clients navigate anti-corruption-related challenges every day, and we are honored to have once again been ranked Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices—Gibson Dunn’s fifth consecutive year and seventh in the last eight years to have been so honored in this top spot.

For more analysis on anti-corruption enforcement and related developments over the past year, we invite you to join us for our upcoming complimentary webcast presentation on March 28, 2023: FCPA 2022 Year-End Update.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depositary Receipts (“ADRs”) or American Depositary Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal accounting controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal accounting controls deficiency.

International corruption also may implicate other U.S. criminal laws. Prosecutors from DOJ’s FCPA Unit also charge non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and false statements, in addition to or instead of FCPA charges. Without question, the most prevalent amongst these “FCPA-related” charges is money laundering—a generic term used as shorthand for statutory provisions that generally criminalize conducting or attempting to conduct a transaction involving proceeds of “specified unlawful activity” or transferring funds to or from the United States, in either case to promote the carrying on of specified unlawful activity, to conceal or disguise the nature, location, source, ownership or control of the proceeds, or to avoid a transaction reporting requirement. “Specified unlawful activity” includes over 200 enumerated U.S. crimes and certain foreign crimes, including the FCPA, fraud, and corruption offenses under the laws of foreign nations. Although this has not always been the case, in recent history, DOJ has frequently deployed the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is not unusual for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

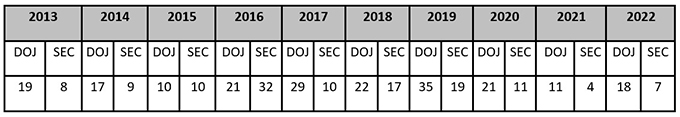

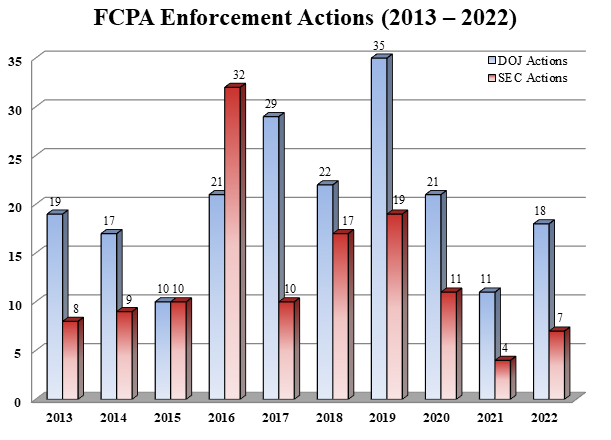

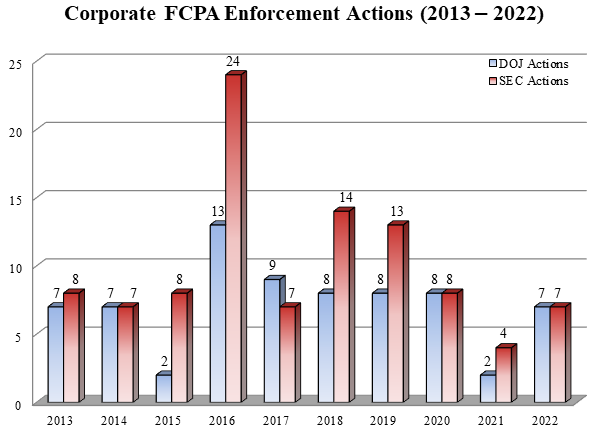

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the Securities and Exchange Commission (“SEC”), the statute’s dual enforcers, during the past 10 years.

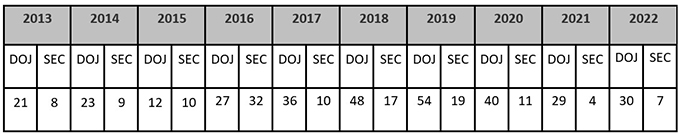

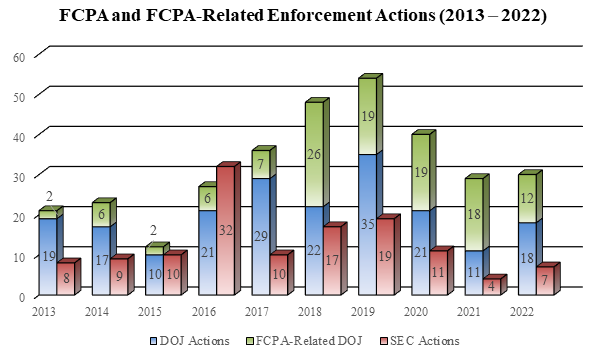

But as our readers know, the number of FCPA enforcement actions represents only a piece of the robust pipeline of international anti-corruption enforcement efforts by DOJ. Indeed, the increasing proportion of “FCPA-related” charges in the overall enforcement docket of FCPA prosecutors is a trend we have been remarking upon for years. In total, DOJ brought 12 such FCPA-related actions in 2022, bringing the overall count to 30 cases that DOJ’s FCPA unit filed, unsealed, or otherwise joined since the beginning of the year. The past 10 years of FCPA plus FCPA-related enforcement activity is illustrated in the following table and graph.

2022 FCPA-RELATED ENFORCEMENT TRENDS

In each of our year-end FCPA updates, we seek not merely to report on the year’s FCPA enforcement actions, but also to distill the thematic trends we see stemming from these individual events. For 2022, we have identified three key enforcement developments that we believe stand out from the rest, although the first two will likely require more time to see if they develop into longer-term trends:

- A rebound in corporate FCPA enforcement actions;

- Revitalized interest in corporate monitorships; and

- Individual FCPA and FCPA-related enforcement continues apace.

Rebound in Corporate FCPA Enforcement Actions

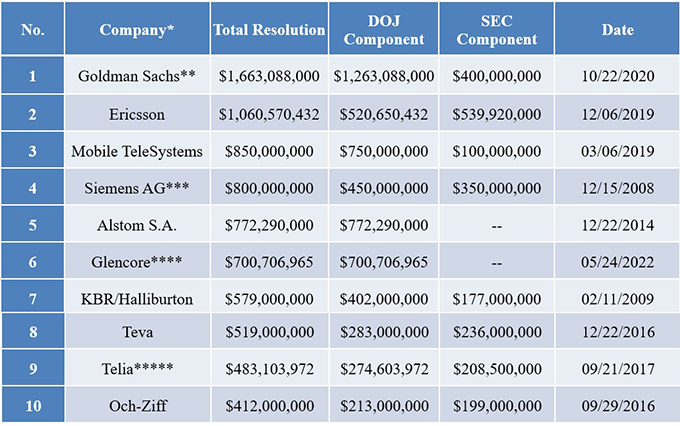

As we reported in our 2021 Year-End FCPA Update, corporate FCPA enforcement fell off of the proverbial cliff in 2021 with the lowest total of corporate enforcement actions (6) in modern FCPA enforcement history. 2022 saw a rebound back toward normalcy, with a total of 14 corporate enforcement actions—more than a 100% increase over 2021. In addition, the financial significance of these cases increased over those brought in 2021, with three 2022 cases topping the $100 million mark in combined disgorgement and penalties, one of which joined the all-time Corporate FCPA Top Ten list. That was Glencore, with over $700 million in FCPA-related penalties, as discussed in our 2022 Mid-Year FCPA Update. A chart of corporate FCPA enforcement actions for the past decade is set forth below, followed by our updated Corporate FCPA Top 10 List and then a discussion of corporate enforcement cases from the last four months of the year.

* Our figures do not include the 2018 FCPA case against Petróleo Brasileiro S.A. – Petrobras (“Petrobras”), even though some sources have reported the resolution as high as $1.78 billion, because the first-of-its kind resolution negotiated by Gibson Dunn offset the vast majority of payments against a shareholders’ class action lawsuit and foreign regulatory proceeding, leaving only $170.6 million fairly attributable to the DOJ / SEC FCPA resolution.

** Goldman agreed to pay several billion to authorities in the United States, United Kingdom, Singapore, Hong Kong, and Malaysia.

*** Siemens’s U.S. FCPA resolutions were coordinated with a €395 million ($569 million) anti-corruption settlement with the Munich Public Prosecutor.

**** Glencore negotiated a coordinated resolution of market manipulation charges with the U.S. Commodity Futures Trading Commission and anti-corruption authorities in the UK, Netherlands, and Switzerland, with a total anticipated price tag of approximately $1.5 billion to resolve all matters.

***** Telia agreed to pay a total of $965,603,972 in criminal penalties and disgorgement to authorities in the United States, the Netherlands, and Sweden.

ABB Ltd.

The second-largest corporate FCPA action of 2022 was announced on December 2, 2022, against Swiss-based global technology company and U.S. issuer ABB. According to the charging documents, between 2014 and 2017 ABB paid bribes to a high-ranking official of a state-owned energy company in South Africa to maintain and secure engineering contracts at a power plant in Witbank. It did so by hiring subcontractors associated with the government official, one of which was owned by a member of the official’s family, even though these subcontractors were allegedly unqualified to do the work and more expensive than other options, with the expectation that portions of the subcontractor payments would benefit the government official. In exchange, ABB allegedly received various types of preferential treatment by the government official in the contracting process, including confidential bid information about competitors and inflated purchase orders paid to ABB.

To resolve the matter, ABB entered into coordinated resolutions with DOJ and the SEC in the United States and criminal authorities in South Africa and Switzerland. The DOJ resolution took the form of a deferred prosecution agreement (“DPA”) with parent ABB, as well as guilty pleas by two subsidiaries, involving FCPA bribery and books-and-records charges and a criminal penalty of $315 million, although portions are offset against other resolutions. The SEC brought FCPA bribery and accounting charges and imposed a $75 million civil penalty, plus just over $72.5 million in disgorgement and prejudgment interest that was deemed satisfied by a 2020 civil restitution agreement with the South African government. In addition, ABB reached coordinated criminal resolutions with South African and Swiss authorities, and is reportedly in talks with German authorities. The total 2022 resolutions amounted to over $315 million; including the prior civil settlement with South Africa brings the total price tag to approximately $460 million.

There are several notable aspects of the ABB resolution. First, this is the first coordinated anti-corruption resolution between DOJ, the SEC and South African authorities, which DOJ in particular heralded as it seeks continuously to expand its network of law enforcement partners across the globe.

Second, the settlement papers outline an intriguing (and for others, informative) chain of events leading to the initiation of the investigation. According to the DPA, shortly after becoming aware of the South Africa allegations, ABB contacted DOJ to schedule a meeting at which it planned to disclose the conduct to DOJ, but without describing the content of that disclosure in its initial contact. Between the initial call and the scheduled meeting with DOJ, the media reported on the subject-matter of the investigation, making DOJ aware of it prior to ABB’s disclosure. Accordingly, DOJ did not grant ABB voluntary disclosure credit under the FCPA Corporate Enforcement Policy, although it asserts that it considered ABB’s “demonstrated intent to disclose the misconduct” in fashioning other aspects of the resolution, including by allowing the company to resolve via DPA rather than requiring a guilty plea.

Finally, ABB is now a three-time FCPA offender, having previously resolved separate criminal and civil FCPA enforcement matters with DOJ and the SEC in 2004 and 2010, as reported in our 2010 FCPA Year-End Update. The principal consequence of this recidivism is that the 25% discount DOJ granted to ABB based on its substantial cooperation and remediation was taken not from the bottom of the U.S. Sentencing Guidelines (“Guidelines”) range as is customary, but rather from the mid-point between the middle- and high-ends of the Guidelines. In announcing DOJ’s subsequent Criminal Division Corporate Enforcement Policy on January 17, 2023, covered in more detail below, Criminal Division Assistant Attorney General Kenneth A. Polite cited ABB as the example of DOJ not applying discounts from the bottom of the Guidelines range—but rather higher points in the range—for so-called “recidivists.”

Honeywell International, Inc.

The third-largest FCPA resolution of 2022 came on December 19, 2022, when North Carolina-based manufacturing and technology company Honeywell International, Inc. agreed to pay $202.7 million to resolve parallel anti-corruption investigations by DOJ, the SEC, and Brazilian prosecutors. The DOJ matter was resolved by way of an FCPA bribery conspiracy DPA with Honeywell subsidiary Honeywell UOP—with certain guarantees by the parent company—which alleged that between 2010 and 2014 the subsidiary paid $4 million to an official of Brazilian state oil company Petrobras in exchange for a contract to design and build an oil refinery. The resolution with Brazil’s Office of the Attorney General, Comptroller General, and Federal Prosecution Service concerned the same conduct. The SEC cease-and-desist proceeding also included the Petrobras conduct, but further added allegations that in 2011 and 2012 Honeywell’s Belgian subsidiary paid $75,000 to obtain a contract with Algerian state oil company Sonatrach.

The three-year DPA with DOJ included a $79.2 million criminal penalty, reflecting what was then the maximum 25% discount from the bottom of the Guidelines range for Honeywell’s substantial cooperation and remediation, as well as $105.7 million in forfeiture. But the full forfeiture amount and half the criminal penalty were credited against other resolutions. The SEC resolution included $81.2 million in disgorgement and prejudgment interest, but credited nearly half to payments made in the Brazilian resolutions and did not impose a penalty in light of the DOJ resolution. Finally, the Brazilian resolutions, resolved by way of leniency agreements, added an incremental $42.3 million in additional payments bringing the total to $202.7 million.

Gibson Dunn served as co-counsel to Honeywell in connection with aspects of the investigations.

GOL Linhas Aéreas Inteligentes S.A.

On September 15, 2022, Brazilian airline and U.S. issuer GOL resolved corruption-related charges with DOJ, the SEC, and Brazilian authorities. According to the charging documents, in 2012 and 2013, a member of GOL’s Board of Directors agreed to pay Brazilian officials approximately $3.8 million to secure favorable legislation that reduced payroll and aviation fuel taxes specific to the airline industry. The alleged bribes were paid through consulting companies, using sham contracts, and then recorded in GOL’s books as legitimate advertising or other expenses.

In its DPA with DOJ, GOL received maximum cooperation and remediation credit that reduced its fine to $87 million—25% below the bottom of the Guidelines range—but then DOJ further reduced the fine to $17 million after GOL demonstrated an inability to pay the full amount. A further $1.7 million of this amount was then credited against the $3.4 million paid to Brazilian authorities. The SEC cease-and-desist order, which charged FCPA bribery and accounting violations, imposed $70 million in disgorgement plus prejudgment interest, then waived all but $24.5 million, which will be paid over the next two years, based on the financial condition of GOL.

Oracle Corp.

Two weeks later, on September 27, 2022, Texas-headquartered information technology company Oracle resolved FCPA books-and-records and internal controls charges with the SEC. According to the cease-and-desist order, between 2014 and 2019, Oracle subsidiaries in India, Turkey, and the UAE entered into a variety of schemes with indirect channel resellers to pass along improper benefits to government officials. The schemes generally involved Oracle employees authorizing excess discounts to value-added distributors and resellers, which then pooled portions of these extra discounts and used them to fund customer travel and entertainment that did not meet Oracle policies and even, in certain instances, may have been used to make improper payments.

Without admitting or denying the allegations, Oracle agreed to pay a total of close to $23 million, including a $15 million penalty and $7.9 million in disgorgement plus prejudgment interest. As discussed in our 2012 Year-End FCPA Update, the SEC previously sanctioned Oracle for similar “slush fund”-based FCPA allegations in India in 2012. In this case, the SEC acknowledged Oracle’s full cooperation with the investigation and substantial remedial actions.

Safran S.A.

The final corporate FCPA enforcement event of 2022 was a “declination with disgorgement” issued by DOJ to French defense company Safran on December 21, 2022. According to DOJ’s declination letter, two current subsidiaries of Safran, one based in the U.S. and one in Germany, paid millions of dollars to a consultant in China between 1999 and 2015 while knowing that the consultant was a close relative of a high-ranking Chinese government official who favorably influenced the award of train lavatory contracts to these businesses. Safran did not own these businesses at the time of the misconduct, but subsequently acquired them, identified the conduct during post-acquisition due diligence, and took appropriate remedial action, including voluntarily disclosing the matter to DOJ. As a condition of the declination, Safran agreed to disgorge nearly $17.2 million in allegedly ill-gotten gains from the pre-acquisition misconduct, and also committed to resolving a parallel investigation in Germany.

Rounding Out the 2022 Corporate Enforcement Docket

Other corporate FCPA enforcement events discussed in our 2022 Mid-Year FCPA Update include those involving Jardine Lloyd Thompson Group Holdings Ltd. (DOJ declination with disgorgement), KT Corp. (SEC only), Stericycle, Inc. (DOJ and SEC), and Tenaris, S.A. (SEC only).

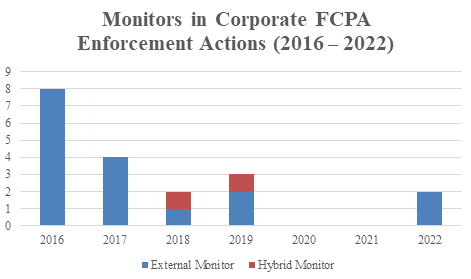

Revitalized Interest in Corporate Monitorships

The practice of imposing a compliance monitor as a condition of resolution has ebbed and flowed over the years of corporate FCPA enforcement. Following a two-year hiatus in any FCPA cases involving monitors—likely influenced by the 2018 “Benczkowski Memo,” wherein then-Assistant Attorney General Brian A. Benczkowski stated that monitors should only be used “where there is a demonstrated need for, and clear benefit to be derived from, a monitorship relative to the projected costs and burden”—2022 saw the return of this practice in two FCPA resolutions. Those two cases are Glencore and Stericycle, both discussed in our 2022 Mid-Year FCPA Update. It is no coincidence that current Deputy Attorney General Lisa O. Monaco retracted any presumption against corporate monitorships that could be read from the Benczkowski Memo in guidance she issued in interim form in October 2021, and then final form in September 2022 (the “Monaco Memorandum”), as discussed below and in our separate client alerts: Deputy Attorney General Announces Important Changes to DOJ’s Corporate Criminal Enforcement Policies and From the Broader Perspective: Deputy Attorney General Announces Additional Revisions to DOJ’s Corporate Criminal Enforcement Policies.

The current guidance according to the latest Monaco Memorandum is that there is no presumption in favor or against corporate monitorships, and that each case is to be weighed on its own merits. However, DOJ prosecutors are not to seek to impose a monitor if a company has implemented and tested an effective compliance program. Consistent with this guidance, the January 2023 Criminal Division Corporate Enforcement Policy discussed below reiterates that generally, monitors will not be necessary in voluntary disclosure cases where, by the time of the resolution, the company “has implemented and tested an effective compliance program and remediated the root cause of the misconduct.”

Against this background, it is too soon to tell whether the two corporate monitorships imposed in 2022 FCPA cases represent a blip or a trend upward. We will continue to monitor these developments and report in future updates. For now, the below chart illustrates the frequency with which monitors (including hybrids, where a monitor is imposed for a shorter period with a self-reporting period thereafter) have been imposed in corporate FCPA enforcement actions over the past seven years:

Individual FCPA and FCPA-related Enforcement Continues Apace

DOJ has for years been stating that “individual accountability” is its top priority. The statistics bear this out, and the current question is whether we have passed beyond “trend” and into the realm of the “new normal.” In the September 2022 Monaco Memorandum, DOJ implemented additional guidance requiring prosecutors to analyze warranted criminal charges against individuals as part of every corporate charging memorandum, with a preference for bringing individual cases first or simultaneously, and later only if supported by a detailed plan.

There were at least 23 FCPA and FCPA-related charges filed or unsealed, or in which DOJ FCPA prosecutors first entered an appearance, in 2022. We note that many charges against individuals are initially filed under seal, and only become publicly known months or even years later after being unsealed, often in connection with an arrest or other enforcement development. We covered 19 of those defendants in our 2022 Mid-Year FCPA Update, and discuss the remaining four from the last four months of the year below.

Cary Yan & Gina Zhou

On September 2, 2022, DOJ unsealed a 2020 indictment charging Yan and Zhou with FCPA and money laundering offenses arising out of alleged bribe payments to officials of the Republic of the Marshall Islands. The indictment alleges that between 2016 and 2020, Yan and Zhou paid tens of thousands of dollars to these officials in exchange for legislation that would create a semi-autonomous region within the Republic of the Marshall Islands to the benefit of Yan and Zhou’s business interests. Illustrating the long tail of these cases, Yan and Zhou were originally charged in August 2020, and the case was unsealed upon their extradition to the United States from Thailand more than two years later.

On December 1, 2022, each of Yan and Zhou pleaded guilty to a single count of conspiracy to violate the FCPA’s anti-bribery provision. Sentencing before the Honorable Naomi Reice Buchwald of the U.S. District Court for the Southern District of New York is currently set for March 2023.

Asante Kwaku Berko

On November 3, 2022, Berko, a dual U.S. and Ghanaian citizen and former executive director of a UK subsidiary of Goldman Sachs, was arrested as he landed at Heathrow Airport and United States authorities unsealed a six-count indictment from 2020. The indictment alleges that between 2014 and 2017 Berko paid more than $700,000 to Ghanaian government officials to assist a Turkish energy company client in securing required approvals to build an electric power plant in Ghana.

What is most interesting about Berko’s case is that, as discussed in our 2020 Mid-Year FCPA Update, the SEC filed a civil complaint against Berko for FCPA violations relating to the same conduct in 2020. Then, in June 2021, without admitting or denying the charges and without appearing physically in court, Berko agreed to resolve the SEC enforcement action via an injunction and the payment of approximately $330,000. Berko is still undergoing extradition proceedings in the United Kingdom.

Nilsen Arias Sandoval

On January 19, 2022, Arias pleaded guilty to a single count of money laundering, though the connection to DOJ’s FCPA Unit was not solidified until the entry of an appearance by a FCPA Unit attorney in October 2022. The information charges that between 2010 and 2021 Arias, a former senior manager of Ecuadorian state oil company Empresa Publica de Hidrocarburos del Ecuador (“Petroecuador”), received millions of dollars in bribe payments from a series of energy, asphalt, and transportation companies in exchange for influencing the award of Petroecuador contracts. This is part of the Petroecuador investigation we have been covering for years, which led to a sprawling array of charges against individuals and companies, as most recently covered in our 2022 Mid-Year FCPA Update.

On December 2, 2022, prosecutors also filed a superseding indictment against Javier Aguilar, a former Vitol Group oil trader whom the government alleges caused approximately $920,000 in bribes to be paid to Arias. We covered the original charges against Aguilar in our 2020 Year-End FCPA Update. Aguilar has pleaded not guilty.

2022 FCPA-RELATED ENFORCEMENT LITIGATION (with an Early 2023 Bonus)

As our readership knows, following the filing of FCPA or FCPA-related charges, criminal and civil enforcement proceedings can take years to wind their way through the courts. The substantial number of enforcement cases from prior years, especially involving contested criminal indictments of individual defendants, has led to an active year in enforcement litigation. In addition to the matters discussed in our 2022 Mid-Year FCPA Update, a selection of 2022 matters that saw material enforcement litigation developments follows (in addition to one matter from early 2023).

Former Venezuelan National Treasurer and Husband Convicted of Money Laundering

On December 13, 2022, a federal jury sitting in the Southern District of Florida found ex-Venezuelan National Treasurer Claudia Patricia Diaz Guillen and her husband Adrian Jose Velasquez Figueroa guilty of conspiracy to commit money laundering, as well as two counts of substantive money laundering for Velasquez Figueroa, and one count for Diaz Guillen (who was acquitted of the other count). We first covered this case in our 2020 Year-End FCPA Update. According to the evidence presented to the jury, the defendants received more than $100 million in bribes from Venezuelan billionaire and media mogul Raul Gorrín Belisario in exchange for Diaz Guillen allowing him access to favorable exchange rates on Venezuelan treasury bonds. Gorrín Belisario remains a fugitive, reportedly living in Venezuela.

Diaz Guillen and Velasquez Figueroa have filed a motion to set aside the verdict, or in the alternative for a new trial, which remains pending before the Honorable William P. Dimitrouleas. Sentencing has been scheduled for March 28, 2023.

Saab Moran’s Motion to Dismiss Indictment Based on Diplomatic Immunity Denied

As we first covered in our 2019 Year-End FCPA Update, joint Colombian and Venezuelan citizen Alex Nain Saab Moran was indicted on money laundering offenses in connection with an alleged $350 million construction-related bribery scheme in Venezuela. After he was detained in the Republic of Cape Verde on an INTERPOL “red notice” request by U.S. authorities, Saab Moran filed a motion to enter a special appearance and challenge the indictment from abroad. The motion was denied by the Honorable Robert N. Scola, Jr. of the U.S. District Court for the Southern District of Florida, as reported in our 2021 Year-End FCPA Update. Saab Moran’s appeal was dismissed as moot by the Eleventh Circuit after he was successfully extradited to the United States, as reported in our 2022 Mid-Year FCPA Update. On December 23, 2022, with both Saab Moran and his motion to dismiss squarely before the Court, Judge Scola denied the motion to dismiss the indictment in a 15-page order.

Saab Moran argued that at the time of his arrest in Cape Verde he was a Venezuelan diplomat with immunity under the Vienna Convention on Diplomatic Relations, incorporated into U.S. law by the Diplomatic Relations Act, such that his arrest and subsequent extradition were improper. Judge Scola rejected the argument that Saab Moran was a “special envoy” sent on a trade mission by Nicholas Maduro, as well as the significance of Saab Moran’s post-arrest appointment as an “Alternative Permanent Representative [] to the African Union,” the timing of which the Court found “only added more cause for suspicion.” In addition to finding that Saab Moran doctored evidence submitted to the Court in a “post hoc [effort] to imprint upon Saab Moran a diplomatic status that he did not factually possess” at the time of his arrest, the Court further held that because the U.S. Government does not recognize the regime of President Maduro, Saab Moran could not be a recognized diplomat. Saab Moran already has filed a notice of appeal with the Eleventh Circuit.

Second Circuit Affirms Money Laundering Convictions of Donville Inniss

As discussed in our 2020 Mid-Year FCPA Update, in January 2020 a federal jury in the Eastern District of New York found Donville Inniss, the one-time Minister of Industry and member of the Parliament of Barbados, guilty of one count of conspiracy to commit money laundering and two counts of substantive money laundering. The charges stemmed from a scheme in which Inniss conspired with Insurance Corporation of Barbados Ltd. (“ICBL”) executives to increase ICBL’s portion of a governmental agency’s business in exchange for $36,000 in bribes. ICBL received a “declination with disgorgement” letter from DOJ, as discussed in our 2018 Year-End FCPA Update. Inniss, for his part, appealed.

On October 5, 2022, the U.S. Court of Appeals for the Second Circuit issued a summary order affirming the convictions. The Court rejected Inniss’s arguments that the evidence was insufficient to support a money laundering conviction because he only received the illicit proceeds, without further laundering them after receipt, as foreclosed by Circuit precedent. The Circuit also held that the District Court properly instructed the jury on various witness issues, as well as on the law on intent and what constitutes a “specified unlawful activity” for purposes of money laundering.

Fifth Circuit Reinstates Venezuelan FCPA / Money Laundering Indictment (2023)

We covered in our 2021 Year-End and 2022 Mid-Year FCPA Updates the dismissal of FCPA and money laundering indictments against Swiss wealth management advisors Daisy Teresa Rafoi Bleuler and Paulo Jorge Da Costa Casqueiro Murta by the Honorable Kenneth M. Hoyt of the U.S. District Court for the Southern District of Texas. Rafoi Bleuler and Casqueiro Murta were charged with setting up accounts used to launder bribes associated with alleged corrupt business dealings with the Venezuela state-owned oil company Petróleos de Venezuela, S.A. (“PDVSA”). Judge Hoyt dismissed both indictments on jurisdictional grounds, finding that the U.S. contact allegations set forth in the indictment were insufficient as a matter of law as to each defendant, and further that for Casqueiro Murta the indictment was untimely. DOJ appealed and the cases were consolidated for argument. Although the opinion came down in 2023, its significance warrants coverage here.

On February 8, 2023, the Fifth Circuit rejected all aspects of Judge Hoyt’s decisions below, reinstated the indictment, and remanded the case back to the Southern District of Texas for further proceedings. (The panel withdrew and reissued its opinion with inconsequential changes on February 28, 2023.) Writing for the unanimous panel, the Honorable Kurt D. Engelhardt first found that it was error to dismiss the indictment for lack of subject-matter jurisdiction because in federal criminal cases the only subject matter needed is for the indictment to state an offense against the United States—the question of extraterritoriality goes to the merits of the case at trial. As to the FCPA counts, the Court held that the indictment sufficiently alleged that both defendants were agents of a domestic concern and that Casqueiro Murta additionally engaged in a corrupt act while within the territory of the United States. The Fifth Circuit panel further held that the “agency” allegations were not unconstitutionally vague on their face because, although the term is not defined in the FCPA, a person of common intelligence can understand its meaning. With respect to the money laundering counts, the Court held that there is “no physical-presence requirement” under the applicable money laundering statutes, and therefore, it is sufficient for the government to allege that the unlawful transactions occurred, in part, in the United States. The Court was clear that its holding was limited to the facial sufficiency of the indictment, and that the defendants may be able to argue as a matter of fact at trial that the evidence is insufficient to establish jurisdiction or agency.

The panel also rejected the District Court’s holding regarding the untimeliness of the indictment as to Casqueiro Murta. The statute of limitations for Casqueiro Murta’s alleged offenses is five years, and Casqueiro Murta argued that his indictment was not handed down until more than five years after his involvement in the conspiracy ended. The government sought to remedy this issue by arguing that the statute was tolled for a sufficient period under 18 U.S.C. § 3292 while DOJ sought evidence located abroad pursuant to Mutual Legal Assistance Treaty (“MLAT”) requests to the Swiss and Portuguese governments. The District Court agreed with Casqueiro Murta, holding that because Casqueiro Murta was not the subject of DOJ’s initial MLAT request or the initial indictment, and because § 3292 refers an application for tolling “filed before return of an indictment,” the return of the first indictment after the first MLAT request ended the tolling period. The Fifth Circuit reversed, holding in a case of first impression that “before return of the indictment” means the indictment in which a defendant is charged, and thus the earlier indictment that did not name Casqueiro Murta did not stop tolling as to him.

2022 FCPA-RELATED POLICY DEVELOPMENTS (with a 2023 Bonus)

In addition to enforcement developments, 2022 and early 2023 saw important developments in FCPA-related policy areas.

Monaco Memorandum Update

As discussed in our 2021 Year-End FCPA Update, in October 2021 Deputy Attorney General Lisa O. Monaco made an important announcement modifying certain corporate criminal enforcement policies generally applicable to white collar crime. Those updates were coupled with the creation of a Corporate Crime Advisory Group with the mandate to study and make recommendations for further updates regarding Department policy in this area.

On September 15, 2022, Deputy Attorney General Monaco issued a further memorandum (“Monaco Memorandum”) updating the prior guidance concerning DOJ’s corporate criminal enforcement policies with the benefit of the Corporate Crime Advisory Group’s work. We cover this important update more thoroughly in our separate client alert From the Broader Perspective: Deputy Attorney General Announces Additional Revisions to DOJ’s Corporate Criminal Enforcement Policies, but in brief, the announcement covers six key areas generally relevant to white collar corporate crime: (1) expressing a clear priority for individual prosecutions;

(2) evaluating companies’ history of misconduct; (3) requiring all corporate criminal enforcement components of DOJ to develop voluntary self-disclosure policies; (4) evaluating corporate cooperation; (5) evaluating corporate compliance programs; and (6) evaluating the imposition of corporate compliance monitors.

In some respects, the core thrust of the Monaco Memorandum is to take the best practices developed in FCPA enforcement and expand them Department-wide. For example, Deputy Attorney General Monaco cited the voluntary disclosure and cooperation credit guidance from the FCPA Corporate Enforcement Policy as a model for replication across DOJ’s corporate prosecution components. Further, designating individual accountability as the “number one priority” is nothing new to FCPA enforcers, although FCPA practitioners would do well to note the Monaco Memorandum’s admonitions regarding the focus on timeliness regarding reporting on evidence relating to individual misconduct. What is new across the board, with implementation still an outstanding question, is the novel statement that companies should shift the burden of financial penalties from shareholders to executives via compensation clawbacks, in effect expanding the concept of SOX 404 clawbacks well beyond that provision. We direct our readers to our separate client alert on this important subject for more detailed discussion and analysis.

Criminal Division Corporate Enforcement & Voluntary Self-Disclosure Policy (2023)

In another significant early 2023 development, on January 17, Criminal Division Assistant Attorney General Kenneth A. Polite, Jr. issued a new Criminal Division Corporate Enforcement & Voluntary Self-Disclosure Policy (“Corporate Enforcement Policy”). This is an update that replaces the FCPA Corporate Enforcement Policy discussed in our 2019 Year-End, 2017 Year-End, and (in its pilot form) 2016 Mid-Year FCPA Updates. But importantly, it also expressly applies the guidance throughout the Criminal Division for the first time.

The most significant update to the Corporate Enforcement Policy is to substantially increase the discounts available to companies for voluntary disclosure, cooperation, and remediation. Under the old FCPA Corporate Enforcement Policy, the maximum credit a company could get if prosecution was appropriate in a voluntary disclosure case—where the company disclosed misconduct before DOJ was aware of it, then fully cooperated and remediated—was a 50% discount below the Guidelines range, and in non-voluntary disclosure cases the maximum was 25%. Under the Corporate Enforcement Policy, the presumption in voluntary disclosure cases is still a “declination with disgorgement” if the relevant requirements are met, but now if a case is brought companies are eligible for up to a 75% discount below the Guidelines range. In non-voluntary disclosure cases, companies may now receive up to a 50% discount.

Whereas the overall policy standards are much the same as before, the new watchword for cooperation and remediation is “extraordinary.” In announcing the new policy at his alma mater Georgetown University Law Center, also the alma mater of numerous senior DOJ officials and a number of the authors of this update, Assistant Attorney General Polite made clear that 50% is not “the new norm” that companies can expect for cooperation and remediation. Rather, raising the ceiling to 50% credit in non-voluntary disclosures is meant to provide room to distinguish between cooperation that is merely “full” and that which is “truly extraordinary.” The latter and tougher standard requires companies to go “above and beyond” and deliver evidence that DOJ simply could not have gotten on its own. This may include producing overseas evidence, consensual recordings, or immediate images of electronic devices as the case warrants, with the ultimate standard for prosecutors likely being “I know it when I see it.”

The other key development in the revised Corporate Enforcement Policy is enhanced guidance on the point in the applicable Sentencing Guidelines range from which the cooperation and remediation discount is taken. As FCPA practitioners know, these discounts (like the Guidelines themselves) present a math problem: in addition to knowing the discount, it is important to know the figure to which the discount applies. The Corporate Enforcement Policy makes clear that in most cases involving cooperating companies, it will be appropriate to apply the discount from the bottom of the Guidelines range. But for non-cooperating companies, not only is there no presumption of a discount, but there is also no presumption that DOJ’s sentencing recommendation will be at the bottom of the range. And for cooperating companies that are “recidivists,” the Corporate Enforcement Policy directs prosecutors to consider taking the appropriate discount from a different and higher point within the Guidelines range. As discussed above, this is what happened to three-time FCPA offender ABB—it received a 25% discount (at the time, the maximum in a non-disclosure case), but because of its criminal history the discount was taken from a midpoint between the middle- and high-end of the Guidelines range rather than the bottom. Notably, the term “recidivist” is not defined, and although the application to those with recent prior FCPA convictions may be straightforward, it is less clear how this has and will be applied to companies with prior enforcement actions for non-FCPA conduct.

2022 FCPA SPEAKER’S CORNER

U.S. anti-corruption enforcement personnel stayed active on the speaking circuit in the last months of 2022, offering a glimpse into DOJ and SEC priorities and expectations for the companies that appear before them. In addition to the notable speeches from the first eight months of 2022, covered in our 2022 Mid-Year FCPA Update, we offer the below for our readers’ attention, all of which come from the 39th American Conference Institute International Conference on the FCPA.

Acting Principal Deputy Assistant Attorney General Nicole M. Argentieri

Delivering the Conference’s keynote address, Argentieri emphasized DOJ’s coordination efforts with international anti-corruption partners. She noted that in recent years DOJ has worked closely in FCPA matters with the governments of the United Kingdom, Brazil, Malaysia, Switzerland, Ecuador, France, the Netherlands, Singapore, and others, which, as noted above in our discussion of the ABB matter, now also includes South Africa. Argentieri also highlighted DOJ’s efforts to repatriate the proceeds of international corruption to the people of the country harmed by the bribery, whether by transferring monies forfeited in criminal resolutions or allowing companies to offset penalties owed to DOJ against those paid to the foreign governments in coordinated settlements pursuant to the “Anti-Piling On” Policy.

DOJ Fraud Section Chief Glenn S. Leon

In response to critiques regarding a drop in corporate enforcement, Leon trumpeted the Fraud Section’s record of over 160 individuals prosecuted, as well as 65 trials, in 2022—well above prior-year numbers. As for corporate cases, Leon emphasized that it is important to look not only at the numbers, “but are we doing the right cases, are we bringing the right results, are we having the right impact?” And by that measure, Leon stated that he felt quite confident DOJ’s Fraud Section is doing its job.

SEC FCPA Unit Chief Charles E. Cain

Discussing the knotty challenge of ephemeral messaging, Cain emphasized that if companies implement third-party application messaging policies, they are expected to consistently follow them. “You either prohibit it and actually prohibit it or you don’t. . . . [If you have a policy and do not enforce it] it’s going to have unintended consequences.” According to DOJ officials speaking at the conference, the Criminal Division is preparing additional guidance on ephemeral messaging, which is expected to be released in 2023.

2022 FCPA-RELATED PRIVATE CIVIL LITIGATION

We continue to note that although the FCPA does not provide for a private right of action, civil litigants pursue a variety of causes of action in connection with FCPA-related conduct, with varying degrees of success. In addition to the matters discussed in our 2022 Mid-Year FCPA Update, a selection of noteworthy developments in the last several months of the year follows.

Select Shareholder Lawsuits / Class Actions

- Goldman Sachs Group Inc. – On September 16, 2022, the Honorable Vernon S. Broderick of the U.S. District Court for the Southern District of New York issued an order of preliminary approval for a May 2022 settlement agreement between Goldman Sachs and derivative plaintiffs who alleged that bank officers and directors breached their fiduciary duties in connection with the 1Malaysia Development Bhd (“1MDB”) matter leading to a DOJ / SEC FCPA settlement as previously reported in our 2020 Year-End FCPA Update. Pursuant to the agreement, which was finally approved on January 20, 2023, Goldman Sachs agreed to use $79.5 million (minus a 25% attorneys’ fee award) to improve its compliance and governance measures, establish an anonymous hotline for employee tips, and expand the powers of its Chief Compliance Officer.

- Cognizant Technology Solutions Corp. – On September 27, 2022, the Honorable Kevin McNulty of the U.S. District Court for the District of New Jersey dismissed derivative claims filed on behalf of shareholders of Cognizant arising from the company’s resolution of an FCPA matter with the SEC (as well as a “declination with disgorgement” from DOJ) as reported in our 2019 Year-End FCPA Update. Judge McNulty granted the motion based on “an unexcused failure to make a demand on the Board,” and also commented that the lawsuit lacked plausible allegations that current or former board members ignored red flags about Cognizant’s overseas business practices. Shareholders have appealed to the U.S. Court of Appeals for the Third Circuit, which appeal remains pending as of publication.

2022 INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

World Bank

In his foreword to the World Bank Group’s FY 2022 Sanctions System Annual Report, World Bank Group President David Malpass wrote that the World Bank “must be continually vigilant against corruption” in Bank-supported projects, and must work to “send a clear message: corruption has no place in development.” The World Bank’s actions in 2022 did indeed send a clear message, as the Bank sanctioned 35 companies and individuals for corrupt practices and other sanctionable conduct, debarring the vast majority with conditional release—a requirement that the firm or individual sanctioned must satisfy certain conditions in order to be released from debarment and regain eligibility to participate in Bank-funded projects. One notable recent enforcement action from the last months of 2022 is:

- On November 16, 2022, the World Bank announced a three-year debarment with conditional release of Spanish national Carlos Barberán Diez and two companies he controls, AC Oil & Gas SL and AC Oil & Gas Emirates LLC, for corrupt practices related to a Bank-funded project to aid in the development of Guyana’s legal framework and institutional capacity to manage its oil and gas sector. The debarment is based on allegations that Barberán Diez solicited four consulting companies for payments in return for offers to give them preferential treatment in the project procurement process. Notably, the Bank reduced the duration of its debarment in recognition of Barberán Diez’s cooperation with the Bank investigation and his agreement to take remedial steps, including “corporate ethics training.”

An important characteristic of interactions between multilateral development banks (“MDBs”) is the cross-debarment agreements between them, whereby sanctions by one MDB are recognized by other MDBs such that sanctioned parties are barred from doing business with multiple MDBs. In Fiscal Year 2022, the World Bank recognized 72 cross-debarments by other MDBs, and 30 World Bank debarments were eligible for recognition by other MDBs. In one particularly interesting example from the second half of 2022:

- On August 11, 2022, the Inter-American Development Bank (“IDB”) debarred Brazilian construction company Sociedad Anónima de Obras y Servicios Copasa do Brasil (“Copasa”) for 18 months for corrupt and fraudulent practices related to a Brazilian road construction project. Copasa was sanctioned not for engaging in corrupt conduct itself, but for failing to report suspected bribery it became aware of by a consortium partner when it had a chance to prevent it. Copasa cooperated with the IDB investigation and did not contest its responsibility for failing to act to prevent bribery from occurring. This debarment—as with the July 2022 debarment of the consortium partner directly responsible for the alleged bribes (Construcap)—qualified for cross-debarment by the World Bank, the Asian Development Bank, the European Bank for Reconstruction and Development, and the African Development Bank.

Europe

United Kingdom

Glencore Energy UK Limited

On November 3, 2022, Glencore UK was ordered to pay nearly £281 million in fines and costs to resolve the UK portion of the global anti-corruption settlement (also including U.S., Brazilian, and Swiss authorities) reported in our 2022 Mid-Year FCPA Update. The UK resolution involved corrupt payments in Cameroon, Equatorial Guinea, Ivory Coast, Nigeria, and South Sudan, and represents the largest-ever penalty handed out for a corporate criminal conviction in the UK, consisting of a fine of £182.9 million, a confiscation order of £93.5 million for the profits obtained from bribes, and payment of £4.5 million in investigation costs.

This is the first-ever conviction of a company on substantive charges of authorizing bribery, rather than purely a failure to prevent it, obtained by the UK Serious Fraud Office (“SFO”) since the introduction of the UK Bribery Act 2010. In total, Glencore UK admitted to seven bribery counts. According to press reports, as many of 17 individuals, including 11 former Glencore employees, are being investigated by the SFO for their role in this conduct, but as of this writing no charging decisions have been announced.

New Economic Crime Bill Introduced That Could Expand SFO Powers

On September 22, 2022, the UK government introduced a new Economic Crime and Corporate Transparency Bill, which includes provisions that would expand the SFO’s Section 2A pre-investigative powers under the Criminal Justice Act 1987. These powers allow the SFO to compel suspected criminals and financial institutions to share information in relation to a suspected crime. Under the existing legislation, the SFO can only employ Section 2A powers to cases of suspected international bribery and corruption. The new bill would expand the SFO’s Section 2A authority to encompass cases involving allegations of domestic bribery and corruption, as well as fraud. These expanded powers would help expedite the information gathering process, enabling the SFO to reduce its reliance on voluntary cooperation by third parties, open investigations more quickly, and prevent the destruction of relevant evidence of criminal activity. As of this writing, the bill has advanced through the House of Commons and is under consideration by the House of Lords.

Belgium

As 2022 came to a close, the EU was shaken by a scandal involving corruption charges against European Parliament Vice President Eva Kaili, among others. On December 9 and 10, 2022, Belgian authorities raided more than 20 homes and offices across Europe and seized considerable amounts of cash as well as assets such as computers and mobile devices. According to a statement from the Belgian federal prosecutor’s office, a Gulf country has allegedly sought to influence decisions at the European Parliament through paying large sums of money or offering substantial gifts to people with a significant political and/or strategic position. Several media reported that Qatar may be the country said to be involved in providing money and gifts, leading the investigation to be dubbed “Qatargate.”

Kaili recently made positive comments about Qatar’s labor rights record, in tension with reports of harsh labor conditions for construction workers involved in building facilities for the World Cup. On December 1, 2022, Kaili also voted in favor of an EU visa liberalization process for Qatari nationals during a parliamentary committee meeting. On December 15, 2022, the European Public Prosecutor’s Office requested the lifting of parliamentary immunity for Kaili.

France

Idemia

On July 7, 2022, the French National Financial Prosecutor’s Office (“PNF”) announced that it had entered into a deferred prosecution agreement (“CJIP”) with digital security company Idemia, which was ordered to pay just under €8 million ($9.4 million) to resolve charges arising from its alleged improper payment to an official in Bangladesh in order to secure a contract to create identity cards for the Bangladesh Election Commission. Under the CJIP, Idemia is required to undergo audits and verifications conducted by the French Anti-Corruption Agency (“AFA”) and implement certain compliance program enhancements over a three-year period.

Doris Group SA

On the same day, the PNF announced a second, unrelated CJIP with oil and gas engineering company Doris Group. Based on allegations that a subsidiary in Angola had made improper payments to officials of state-oil provider Sonangol, Doris Group was required to pay nearly €3.5 million ($4.1 million) and undergo audits and verifications by the AFA and implement compliance program enhancements over a three-year period.

The Idemia and Doris CJIPs are examples of the increasing cooperation between international enforcement agencies, as the French investigations were commenced after authorities received information from their counterparts in the UK (Idemia) and the United States (Doris).

Airbus SE

On November 30, 2022, the PNF announced a “limited extension” of the wide-ranging 2020 global corruption settlement discussed in our 2020 Mid-Year FCPA Update. The instant charges were resolved by CJIP and involved the use of intermediaries in connection with the sale of jets to the Gaddafi regime in Libya in 2007 and the sale of helicopters and satellites to the Kazakh government in 2009. These matters were reportedly known at the time of the prior resolution, but because of a procedural matter could not be charged at that time. To resolve the 2022 case, Airbus paid an additional €15.9 million ($16.5 million).

Italy

In October 2022, the OECD Working Group on Bribery published its Phase 4 Report on Italy’s implementation and enforcement of the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions and related instruments. The report concluded that Italy has strengthened its legislative framework to fight foreign bribery since the Phase 3 report in 2011, including by lengthening the statute of limitations for foreign bribery offenses by natural persons, increasing prison terms and disqualification sanctions, and introducing whistleblower protections. Further, the report acknowledged that Italy has shown an increase in enforcement actions since 2011 and complimented Italy for process improvements to its judiciary system to improve the efficiency of case processing, improvements to its mutual legal assistance and extradition framework, and improved cooperation between law enforcement and tax authorities.

Despite these improvements, the report expressed concern about the high number of dismissals of litigated foreign bribery cases with almost all foreign bribery convictions being secured through non-trial resolution. Recommendations by the Working Group instruct Italy to (1) develop a comprehensive national strategy to fight foreign bribery, (2) strengthen its monitoring of Italian and foreign media to identify potential instances of corruption, (3) raise awareness of foreign bribery and the Convention among Italian officials, accountants and auditors, and small- and medium-sized enterprises, (4) encourage companies to adopt anti-corruption compliance programs, and (5) strengthen the sanctions imposed for foreign bribery offenses. Italy has until October 2024 to make a written submission addressing all of the Working Group’s recommendations and providing an update regarding its enforcement efforts.

Russia & Former CIS

Kazakhstan

In September 2022, Kairat Satybaldy, a former high-ranking public official and nephew of Kazakhstan’s former president Nursultan Nazarbayev, was sentenced to six years in prison and banned from holding public office for 10 years for embezzling funds from and causing property damage to state-owned companies Kazakhtelekom and Transport Service Center. Satybaldy admitted to embezzling over $58 million and causing property damage worth over $25 million. The Kazakh Anti-Corruption Agency reports that it has recovered over $700 million in assets as part of its investigation into Satybaldy and four other suspects.

Russia

The state crackdown on all forms of dissent, which has intensified since Russia’s invasion of Ukraine, continues to impact the anti-corruption domain. In August, Russian federal agents arrested a number of Telegram channel administrators engaged in anti-corruption reporting work, on charges that have been widely decried as pretextual. For example, journalist Alexandra Bayazitova has been charged with extortion of an executive at the state-owned Promsvyazbank, but maintains her innocence and attributes her wrongful detention to her publication of evidence that, in fact, Promsvyazbank executives themselves had engaged in embezzlement of state funds.

In early December 2022, Russian Prosecutor General Igor Krasnov estimated that corruption had caused around 37.6 billion rubles (~ $520 million) of damage to the Russian state through the first nine months of 2022. Krasnov asserted, however, that law enforcement authorities had recovered over 62 billion rubles (~ $900 million) worth of property to compensate for the damage. This report followed an earlier announcement by Krasnov, in October, that efforts to investigate and weed out corruption had resulted in the dismissal of 800 malfeasant state officials over the preceding 18 months.

Ukraine

As Russia’s war of aggression shows no signs of abating, Ukraine has sought to shore up support from the West. In June 2022, the European Commission granted Ukraine candidate status for membership in the European Union. To move down the path to full EU membership, Ukraine must implement a list of anti-corruption initiatives. Ukraine has wasted no time in getting its house in order, as reflected by its National Anti-Corruption Bureau’s June 2022 decision to go to trial on charges initially filed in 2020 against the Chairman of the Kyiv District Administrative Court, Pavlo Vovk, two of his deputies, and four judges for soliciting bribes in exchange for favors related to judicial processes. Then, in December, just days after the United States announced sanctions against Vovk, Ukraine’s parliament voted to disband the Kyiv District Administrative Court altogether, noting that it had become a “criminal organization.”

Ukraine has also been working toward implementing the specific reforms required by the European Commission, enacting all of the anti-corruption legislation that the EU had required Ukraine to pass continuing EU membership talks. Among those reforms, the legislature passed a law that met with some controversy related to changes to the selection process for Constitutional Court judges. Additional reforms implemented in recent months have included laws strengthening Ukraine’s anti-corruption measures, harmonizing media regulation with EU standards, and protecting national minorities.

The Americas

Argentina

On December 6, 2022, sitting Vice President of Argentina Cristina Fernández de Kirchner was found guilty of “fraudulent administration” over the awarding of some 51 fraudulent public works contracts to a friend while she served as President (2007 – 2015), and a three-judge panel sentenced her to six years in prison. Prosecutors alleged the kickback scheme had caused the Argentine state a loss of at least $1 billion. Many legal observers note she is unlikely to serve time, in part due to legal immunity she enjoys as head of the Senate in Argentina. Even though Kirchner has been banned for life from holding public office as part of her sentence, she continues to serve as Vice President during the pendency of her appeal, which could take years to resolve.

Brazil

On July 12, 2022, the Brazilian government issued Decree No. 11,129/2022, a new regulation on the Brazilian Clean Company Act that, among other things, establishes procedures regarding the entry of leniency agreements and updates the methods of calculating penalties and consequences for their breach. In addition, the Decree enhances the regulations around corporate integrity programs, including providing further guidance on requirements regarding: (1) tone from the top and the proper allocation of resources to compliance functions; (2) ongoing compliance communications; (3) the need for periodic risk assessments to ensure continuous monitoring and improvement; (4) due diligence of third parties; (5) due diligence for sponsorships and donations; and (6) complaint hotline procedures, among other topics.

On December 19, 2022, Brazil’s Comptroller General and its Attorney General’s Office announced a leniency agreement with Keppel Offshore & Marine, five years after the company reached a resolution on the same facts with U.S. and Singaporean authorities, as well as a different Brazilian authority (the Federal Prosecution Service) as reported in our 2017 Year-End FCPA Update. The 2022 settlement required the payment of an additional $64.9 million payment, but is reported to resolve the matter completely for Keppel.

Canada

On September 21, 2022, the Royal Canadian Mounted Police (“RCMP”) announced that Ultra Electronics Forensic Technology Inc., along with four former executives, are facing charges of bribery and fraud under the Corruption of Foreign Public Officials Act and the Criminal Code. The company and each of the four individuals were charged with two counts of bribery of a foreign public official and one of defrauding the public arising from allegations that the defendants directed local agents in the Philippines to bribe foreign public officials in an effort to influence and expedite the award of a multi-million-dollar contract.

Eight days later, on September 29, Ultra Electronics announced that it had agreed to a remediation agreement—akin to U.S. and UK deferred prosecution agreements—with the Public Prosecution Service of Canada to resolve the claims. Details of the settlement still have not been made public as the agreement is subject to approval by the Quebec Superior Court. The settlement does not resolve the matter for the four former Ultra Electronics executives, whom the company said would be tried separately.

Panama

In June 2022, a Panamanian court provisionally dismissed money laundering charges against more than 40 defendants charged in the long-running Lava Jato (“Operation Car Wash”) cases, including the founders of Mossack Fonseca, the Panamanian law firm at the epicenter of the “Panama Papers” leak in 2016. The court found that prosecutors had not sufficiently established the precise amount of funds the defendants allegedly received from offshore sources. But then in mid-October 2022, Panama’s Superior Court of Settlement of Criminal Cases overturned the provisional dismissal of charges against 32 of those individuals, resetting their cases for trial.

Peru

In October 2022, prosecutors in Peru filed a constitutional complaint against then-President Pedro Castillo, alleging that he was operating a de facto “criminal organization” within the Peruvian government in order to corruptly benefit himself and his allies, also detaining five of his associates. As Peru’s Congress prepared to pursue its third impeachment against Castillo since he assumed office in July 2021, on December 7, 2022, Castillo declared that he was replacing Congress with an “exceptional emergency government.” Hours later, lawmakers called an emergency impeachment session, voting to remove Castillo immediately from the presidency, setting off a wave of protests by his supporters that left more than 20 dead. The same day, Castillo was also arrested and charged with rebellion, and he is being held in pretrial detention while his investigation proceeds. Following Castillo’s ouster, Vice President Dina Boluarte was elevated to the presidency to complete the term through 2026. Given recent corruption scandals, President Boluarte is Peru’s fifth president since 2020. On February 17, 2023, Peru’s Congress passed a constitutional complaint alleging corruption charges against Castillo, allowing the Attorney General’s office to open a formal criminal investigation.

Asia

China

In October 2022, the Twentieth Congress of the Chinese Communist Party (“CCP”) concluded in Beijing with a strong reiteration of the Party’s commitment to combating corruption within its ranks. Subsequently, on December 9, 2022, the Supreme People’s Procuratorate issued its Guiding Opinions on Strengthening the Handling of Bribery Criminal Cases, which emphasize its enforcement focus on both bribe givers and receivers. The Guiding Opinions provide further guidance to the lower-level procuratorates and reiterate some of the key points mentioned in the synopses of five bribery prosecutions reported in our 2022 Mid-Year FCPA Update.

The last year brought an increase in anti-corruption enforcement actions in China’s technology manufacturing and financial sectors. For example, the Central Commission for Discipline Inspection (“CCDI”) investigated a number of high-profile figures of Sino IC Capital, which manages the state-backed China Integrated Circuit Industry Investment Fund, and brought corruption-related charges against senior officials of the Bank of East Asia, China Merchants Bank, and People’s Bank of China.

Hong Kong

On August 19, 2022, the Independent Commission Against Corruption (“ICAC”) indicted Ricky Lee, the principal manager of the Hong Kong Airport Authority, and Ng Kai-on of Carol Engineering for allegedly accepting and offering bribes totaling approximately HKD 3.8 million (~ USD 490,000) in connection with the Hong Kong International Airport third-runway project. According to the ICAC, Carol Engineering was a subcontractor on the project and made payments to Lee in exchange for being awarded works and materials supply contracts, and for assistance in securing the release of payments due to Carol Engineering by the general contractors on the project. On February 15, 2023, the ICAC announced charges against eight additional defendants for their roles in offering, accepting, or handling bribes related to the third-runway project scheme. The new defendants include the former General Manager of the Hong Kong Airport Authority, Ricky Lee’s wife, four individuals related to subcontractors Carol Engineering and Goldwave Steel Structure Engineering, and two operators of a supplier for the third-runway project.

India

In June 2022, India’s Central Bureau of Investigation (“CBI”) arrested an officer of India’s drug regulator (the Central Drugs Standard Control Organization), and an employee of Biocon Biologics (a subsidiary of the well-known Indian biotechnology company Biocon Limited), on allegations of corruption. The CBI alleged that the arrested official accepted a bribe from a middle-man representing Biocon Biologics in exchange for a clinical trial waiver for a new drug being manufactured by the company. The CBI also arrested another public official from the drug regulator and employees of two private firms that were liaising with the drug regulator on behalf of Biocon Biologics.

Also in June 2022, India’s anti-corruption ombudsman (the “Lokpal”) announced that it had received 5,680 corruption-related complaints through its publicly available reporting channels between April 2021 and March 2022. In response to a Right to Information petition, the Lokpal also disclosed that it has yet to commence formal investigations into more than 5,100 of these complaints. Directors of inquiry and prosecution have not yet been appointed and we are not aware of any significant anti-corruption actions undertaken by the Lokpal. Further, two judicial member positions in the eight person Lokpal have remained vacant and unfilled for more than two years.

In a significant court decision issued in August 2022, the High Court of Karnataka quashed a 2016 executive order issued by the state government creating the state’s Anti-Corruption Bureau (“ACB”). The executive order had created the ACB under the supervision of the state’s Chief Minister and had empowered it to probe corruption allegations involving state public officials. In invalidating the executive order, the High Court found that the state government had sought to usurp the powers of the state’s Lokayukta—an anti-corruption watchdog that is empowered to investigate and prosecute corruption cases involving public officials. The court also found that the executive order did not explicitly stipulate the authority that is empowered to investigate corruption cases involving the Chief Minister, other ministers, or members of the state legislature. Historically, the Lokayukta has been responsible for the most significant anti-corruption enforcements in Karnataka and is viewed as less prone to political influence.

Finally, a court of appeal in Delhi recently upheld the right of enforcement agencies to intercept telephone conversations of a person suspected to have violated provisions of India’s Prevention of Corruption Act. The court recognized the right of the Indian Government to approve such “phone tapping” on public security grounds, though the Indian Government did not provide elaborate reasons as to why the interception was required for public security.

Indonesia

On August 15, 2022, Indonesia’s Attorney General’s Office announced that businessman Surya Darmadi voluntarily surrendered after eight years on the run from corruption charges. Indonesia’s Corruption Eradication Commission (known locally as the “KPK”) alleged that Darmadi paid 3 billion rupiah (~ $200,000) in bribes to the then-governor of Riau province, Annas Maamum, to amend a forestry regulation that allowed Darmadi’s Duta Palma Group to convert 91,000 acres of forest into palm oil estates. The corruption allegedly cost the country IDR 78 trillion rupiah (~$5 billion), making it the largest corruption case in the country’s history. On February 23, 2023, a court sentenced Darmadi to fifteen years in prison, in addition to a 39 billion rupiah (~$2.6 million) fine.

On September 25, 2022, the KPK announced that it had detained Supreme Court judge Sudrajad Dimyati, and six other individuals, for involvement in an alleged scheme to pay IDR 2.2 billion

(~ $141,430) in bribes to secure a favorable rulings in an appeal by a lending cooperative facing insolvency.

Japan

In November 2022, the Tokyo District Public Prosecutors Office filed indictments against former 2020 Tokyo Olympic and Paralympic Organizing Committee Executive Board Member Haruyuki Takahashi, Aoki Holdings founder Hironori Aoki, former Aoki executive Katsuhisa Ueda, and twelve other individuals. The indictments alleged that Takahashi accepted a total of ¥196 million (~ $11.2 million) in bribes from five companies, including Aoki Holdings and the Kadowaka publishing firm, in exchange for awarding them sponsorship rights at the Olympics. On December 22, 2022, Takahashi, Aoki, and Ueda all pleaded guilty to the allegations at the same trial. Prosecutors are continuing to investigate the executives of the five companies, as well as former Prime Minister Yoshiro Mori, in relation to the alleged bribery.

Korea

Recent amendments to the Improper Solicitation and Graft Act, also widely known as the Kim Young-Ran Act, went into effect on June 8, 2022. Among other things, the amendments now prohibit providing improper payments and other benefits to persons reviewing scholarship, thesis, and internship applications, such as professors and company employees. Moreover, the amendment enhances protections for those who report violations. For example, individuals may now report anonymously through attorneys to further protect their identities. Furthermore, if the individual making the report has violated the Act, the amendments allow for reduced liability, including potential non-prosecution or exemption from fines, in exchange for information regarding potential violations committed by the reporter or others. Lastly, the amendment allows for compensation of reporters who incur medical expenses in connection with submitting reports, such as mental distress.

On August 12, 2022, South Korea’s President Suk-Yeol Yoon administered National Liberation Day special pardons to nearly 1,700 people, including Samsung Electronics Co.’s Chairman Jae-Yong Lee and Lotte Group’s Chairman Dong-Bin Shin. As previously reported in our 2019 Year-End and 2018 Mid-Year FCPA Updates, respectively, Lee was convicted of bribing former president Geun-Hye Park in exchange for securing government support during a merger between two Samsung affiliates in 2015, and Shin was convicted of bribing the former president in exchange for assistance in securing a license for his duty-free business. Importantly, through the special pardons, Lee and Shin are no longer subject to Korean laws that prohibit employers from re-hiring individuals who committed certain crimes (such as bribery) for five years following a term of imprisonment, making it possible for Lee and Shin to resume leadership positions within their former companies.

2022 also saw the first trial and judgment arising from case brought by Korea’s Corruption Investigation Office for High-Ranking Officials (“CIO”), which we reported on in our 2021 Year-End FCPA Update. On November 9, 2022, the Seoul Central District Court’s 1st Criminal Division acquitted a former chief prosecutor, Hyung-Jun Kim, who was charged with receiving a bribe from a lawyer in exchange for leniency during investigations in 2015 and 2016. In acquitting Kim, the Court found that part of the alleged bribe was a loan from the lawyer, and that there was insufficient evidence to conclude that the remainder of the funds were provided in exchange for favors during the investigations. The CIO has suggested that it may appeal the ruling.

Australia

In September 2022, Australian prosecutors charged Panjak Patel and Sornalingam Ragavan, two former senior managers of engineering firm SMEC International, with conspiring to bribe public officials in Sri Lanka in connection with a bid to win contracts for a pair of infrastructure projects in the country worth a combined AUD 14 million (~ $8.8 million). The pair are alleged to have paid roughly AUD 304,000 (~ $200,000) in bribes to the Sri Lankan officials between 2009 and 2016.

On November 30, 2022, Australia’s parliament passed legislation creating a new National Anti-Corruption Commission (“NACC”) to investigate public corruption and empowering it to act independently of political authorities, with broad jurisdiction to investigate and prosecute corrupt conduct across Australia’s public sector. The legislation also creates strong protections for whistleblowers who report corrupt conduct and exemptions allowing journalists to protect the identity of their sources.

Africa

Democratic Republic of the Congo

On December 5, 2022, Glencore plc announced that it will pay $180 million to the Democratic Republic of the Congo as part of an agreement to resolve alleged corruption between 2007 and 2018. This settlement relates to the same underlying conduct in the Democratic Republic of the Congo that formed part of the FCPA settlement with the company as reported in our 2022 Mid-Year FCPA Update, and illustrates the increasing risk of follow-on claims by local governments after companies resolve FCPA cases.

South Africa

In September 2022, South Africa’s National Prosecuting Agency charged the South African subsidiary of McKinsey & Company in connection with the consulting company’s work for state railway company Transnet. McKinsey’s prosecution is connected to an ongoing criminal case against five former Transnet executives charged with fraud, corruption, and money laundering over a bribery scheme allegedly designed to assist a Chinese state company in winning a contract to supply 1,300 trains for South Africa’s railways. A previous commission had found that Transnet awarded tenders to McKinsey due in part to its connections to the Gupta family, who have drawn scrutiny for using connections to former president Jacob Zuma to embezzle state funds. McKinsey previously agreed to pay back over 870 million rand (~ $63 million) in connection with the fees it received, but did not admit any wrongdoing.

In October 2022, South African President Cyril Ramaphosa announced that the government will establish a permanent and independent agency to combat corruption and fraud. The proposed Permanent Anti-Corruption Commission and Public Procurement Anti-Corruption Agency are consequences of the recommendations of the Commission of Inquiry into State Capture, also known as the Zondo Commission, created in 2018 to investigate widespread corruption allegations against former President Jacob Zuma’s government. Legislation connected to the Commission’s recommendations is set to be finalized in Parliament in March 2023.

The following Gibson Dunn lawyers participated in preparing this client update: F. Joseph Warin, John Chesley, Richard Grime, Patrick Stokes, Kelly Austin, Patrick Doris, Katharina Humphrey, Matthew Nunan, Oleh Vretsona, Oliver Welch, Brian Anderson, Hadhy Ayaz, Anthony Balzofiore, Joerg Biswas-Bartz, Ella Alves Capone, Peter Chau, Josiah Clarke, Rommy Lorena Conklin, Angela Coco, Bobby DeNault, Andreas Dürr, Kate Goldberg, Sarah Hafeez, Kathryn Harris, Michael Kutz, Nicole Lee, Allison Lewis, Ramona Lin, Lora MacDonald, Nikita Malevanny, Andrei Malikov, Jacob McGee, Megan Meagher, Katie Mills, Su Moon, Sandy Moss, Jaclyn Neely, Ning Ning, Bryan Parr, Mariam Pathan, Julian Reichert, Jasmine Robinson, Hayley Smith, Jason Smith, Pedro Soto, Laura Sturges, Karthik Ashwin Thiagarajan, Katie Tomsett, Alyse Ullery-Glod, Tim Velenchuk, Dillon Westfall, Edward Zhang, Yan Zhao, and Caroline Ziser Smith.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. We have more than 100 attorneys with FCPA experience, including a number of former federal prosecutors and SEC officials, spread throughout the firm’s domestic and international offices. Please contact the Gibson Dunn attorney with whom you work, or any of the following:

Washington, D.C.

F. Joseph Warin (+1 202-887-3609, [email protected])

Richard W. Grime (+1 202-955-8219, [email protected])