January 8, 2020

In 2019, the drumbeat favoring corporate non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”)[1] kept time, and we are continuing to see these agreements used frequently by prosecutors to resolve complex corporate enforcement actions. Despite perennial scrutiny, NPAs and DPAs have withstood political vicissitudes and the comings and goings of administrations and agency heads; they have weathered the test of time and we have seen them become more sophisticated year over year as regulators and practitioners alike learn from past agreements and hone key language to achieve desired results. This has led not only to template language used repeatedly by certain units of the U.S. Department of Justice (“DOJ” or the “Department”), but also an expansion of NPAs and DPAs to other agencies.

In this client alert, the twenty-first in our series on NPAs and DPAs, we: (1) report statistics regarding NPAs and DPAs from 2000 through 2019; (2) discuss the recent return of DPAs to the political spotlight; (3) overview the Commodity Futures Trading Commission’s (“CFTC’s”) new Enforcement Manual and its implications for NPAs and DPAs; (4) discuss developments in DOJ corporate enforcement policy; (5) summarize 2019’s publicly available federal corporate NPAs and DPAs; and (6) survey recent developments in DPA regimes abroad.

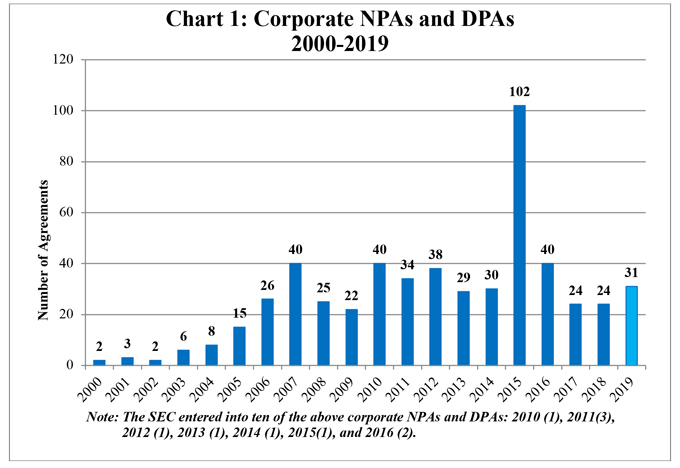

Chart 1 below shows all known corporate NPAs and DPAs from 2000 through 2019.

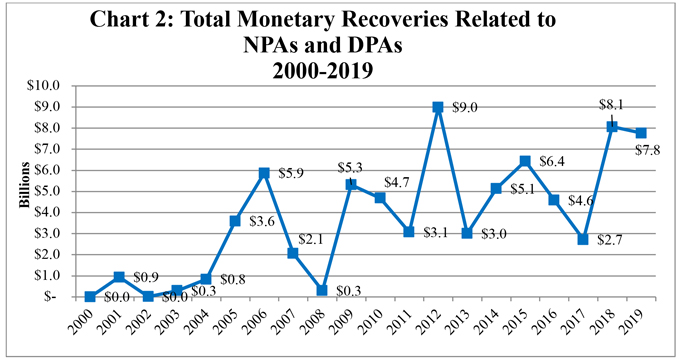

Chart 2 reflects total monetary recoveries related to NPAs and DPAs from 2000 through 2019. At nearly $7.8 billion, recoveries associated with NPAs and DPAs in 2019 came close to the approximately $8 billion in total recoveries in 2018, and far outstrip total recoveries in 2017. Total 2019 recoveries also exceeded the average annual recovery from 2005-2018, of approximately $4.56 billion.

DOJ entered into seven NPAs and DPAs this year addressing allegations of violations of the Foreign Corrupt Practices Act (“FCPA”). These agreements included the third-largest resolution overall in 2019, a DPA with Swedish telecommunications company Ericsson that imposed a total of nearly $1.1 billion in monetary obligations. Together, the seven FCPA-focused resolutions imposed a total of approximately $2.8 billion, or about 36% of total monetary recoveries this year. Only one of the FCPA resolutions involved a voluntary self-disclosure by the settling company, and four of the seven agreements imposed independent compliance monitors. For a more detailed analysis of this year’s FCPA resolutions, see our 2019 FCPA Year-End Update.

DPAs Back in Political Crosshairs

In April 2019, Senator Elizabeth Warren (D-Mass.) introduced proposed legislation expanding criminal liability to negligent executives of large corporations that enter into DPAs or NPAs.[2] Under the Corporate Executive Accountability Act, executives may be criminally liable if they are negligent with regard to the conduct of companies with more than $1 billion in annual revenue that: (1) are found guilty of or plead guilty to a crime; (2) enter into a DPA or NPA regarding any criminal allegations; (3) enter into a settlement with any state or federal regulator for any civil law violation that affects the health, safety, finances, or personal data of at least 1% of the population of any state or of the United States; or (4) commit a second civil or criminal violation while operating under a civil or criminal judgment, DPA, NPA, or other state or federal settlement.[3] Punishments under the Corporate Executive Accountability Act would include up to a year in jail, or up to three years for a repeat violation. Senator Warren is known for being a frequent and outspoken critic of the use of NPAs or DPAs, arguing they are used to soften the blow for corporations implicated in corporate wrongdoing and act as “get-out-of-jail cards.”[4] Senator Warren views the existence of DPAs, and the difficulty of proving that any individual executive had “knowledge” of corporate wrongdoing by their employer, as reasons why no CEO of a major bank has gone to jail for conduct related to the 2008 financial crisis.[5] Thus, the Corporate Executive Accountability Act requires only a finding of “negligence” to impose liability.[6] Along with the Corporate Executive Accountability Act, Senator Warren also re-introduced the Ending Too Big to Jail Act—covered in our 2018 Mid-Year Update—which requires judicial oversight of DPAs between DOJ and financial institutions; requires DOJ to post on its website both DPAs and the terms and conditions of any agreements between the subject companies and independent compliance monitors; and limits courts’ discretion to approve DPAs absent a finding that the agreement is in the “public interest.”[7] As Senator Warren seeks to advance her bid for the 2020 Democratic presidential nomination, we will continue to monitor public discourse about the use and oversight of NPAs and DPAs.

Normalization of Corporate NPAs and DPAs Across Agencies

On May 8, 2019, the U.S. Commodity Futures Trading Commission (“CFTC”) Division of Enforcement issued its first public Enforcement Manual. The Enforcement Manual provides a broad overview of the CFTC and its Division of Enforcement, the CFTC’s investigative process, and the tools available to the CFTC in pursuing or settling enforcement actions, including DPAs and NPAs.[8] The Enforcement Manual, which tracks language in the SEC Enforcement Manual, states that DPAs typically will require that the company cooperate “truthfully and fully in the CFTC’s investigation and related enforcement actions,” enter into a long-term tolling agreement, comply with express prohibitions or undertakings during the period of deferred prosecution, and agree to “either admit or not to contest” the underlying facts that the CFTC could assert to establish a violation of the Commodity Exchange Act.[9] Unlike the SEC, however, the CFTC does not include a lengthy list of terms that “a [DPA] should generally include.”[10]

The Enforcement Manual states that NPAs will be utilized in “generally very limited” circumstances and will require—again, tracking the SEC Enforcement Manual—truthful and full cooperation with the CFTC’s investigation and related enforcement actions, as well as compliance “under certain circumstances” with “express undertakings”.[11] Of course, we know from experience that, despite the SEC’s pronouncements in its own Enforcement Manual—from which the relevant portions of the CFTC Enforcement Manual are drawn—the SEC heavily favors administrative action over NPAs and DPAs. To date, the CFTC has not issued any corporate NPAs or DPAs, and time will tell whether the CFTC follows the SEC’s lead and continues to favor administrative proceedings over NPAs and DPAs.

The CFTC’s Enforcement Manual devotes significant attention to self-reporting, cooperation, and remediation, including a policy that the Division of Enforcement will consider a “substantial reduction from the otherwise applicable civil monetary penalty” if a company or individual self-reports, fully cooperates, and remediates.[12] With respect to FCPA matters, the CFTC Enforcement Manual distinguishes between companies that are required to register with the CFTC, and those that are not. For the former, the Division of Enforcement will recommend, absent aggravating circumstances, a resolution with no civil monetary penalty in a case where a company makes a voluntary disclosure, fully cooperates, and appropriately remediates.[13] Companies and individuals who are required to register with the CFTC are not eligible to take advantage of the presumption of no civil monetary policy, but the Division of Enforcement will recommend a “substantial reduction” in the penalty.

Developments in DOJ Corporate Enforcement Policies Regarding FCPA and National Security Matters

2019 witnessed additional developments in DOJ’s corporate enforcement policy.

DOJ updated its FCPA Corporate Enforcement Policy (the “FCPA Policy”) in four key areas. First, DOJ changed its policy—originally put forth in December 2017—of requiring companies that self-disclose misconduct to prohibit their employees from “using software that generates but does not appropriately retain business records or communications” to receive full remediation credit.[14] That policy was widely interpreted as covering the use of ephemeral messaging platforms such as WhatsApp. With the changes announced in March 2019, the policy no longer strictly prohibits the use of ephemeral messaging platforms and instead now requires companies seeking remediation credit to “implement[] appropriate guidance and controls on the use of personal communications and ephemeral messaging platforms . . . to appropriately retain business records or communications or otherwise comply with the company’s document retention policies or legal obligations.”[15]

Second, DOJ codified its position that there will be a presumption of a declination where “a company undertakes a merger or acquisition, uncovers misconduct by the merged or acquired entity through thorough and timely due diligence or, in appropriate instances, through post-acquisition audits or compliance integration efforts, and voluntarily self-discloses the misconduct.”[16]

Third, DOJ revised the requirement for receiving full cooperation credit after making a self-disclosure. Now, the FCPA Policy states that to receive cooperation credit, a company must disclose “all relevant facts known to it at the time of the disclosure, including as to any individuals substantially involved in or responsible for the misconduct at issue.”[17] These changes reflect then Deputy Attorney General Rod J. Rosenstein’s statement in 2018 that “investigations should not be delayed merely to collect information about individuals whose involvement was not substantial, and who are not likely to be prosecuted.”[18] The revisions to the FCPA Policy also included a footnote acknowledging that “a company may not be in a position to know all relevant facts at the time of a voluntary self-disclosure, especially where only preliminary investigative efforts have been possible. In such circumstances, a company should make clear that it is making its disclosure based upon a preliminary investigation or assessment of information, but it should nonetheless provide a fulsome disclosure of the relevant facts known to it at that time.”[19] Notably, the revisions also involved modifying language in the previous policy that required a self-disclosing company to identify to the Department opportunities “to obtain relevant evidence not in the company’s possession and not otherwise known to the Department” that the company is or should be aware of.[20] The revised FCPA Policy now states that a self-reporting company must simply identify relevant evidence of which it is actually aware.[21]

Finally, DOJ also relaxed its policy on de-confliction—that is, the deferral, at the request of DOJ, of investigative steps a company otherwise wishes to take in its internal investigation. The previous policy required that a self-disclosing company seeking full cooperation credit agree to de-confliction “where requested.”[22] The FCPA Policy now states that DOJ will only request de-confliction where “requested and appropriate.”[23] Additionally, in a new footnote, the FCPA Policy states that DOJ will not “take any steps to affirmatively direct a company’s internal investigation.”[24]

DOJ’s National Security Division also revised its policy (the “NSD Policy”) regarding voluntary disclosures of export control and sanctions violations to more closely resemble the FCPA Policy.[25] The changes are detailed in our client alert titled “DOJ National Security Division Released Updated Guidance on Voluntary Self-Disclosures,” and several significant changes warrant mention here.

First, the NSD Policy now applies to financial institutions.[26] Additionally, the NSD Policy now includes a presumption that companies that voluntarily self-disclose export control or sanctions violations to the Counterintelligence and Export Control Section, fully cooperate, and timely and appropriately remediate will receive an NPA and will not be fined if there are no aggravating factors. If aggravating factors do exist warranting a different criminal resolution (such as a DPA or guilty plea) but the company otherwise satisfies the above criteria, DOJ will recommend at least a 50% reduction in the fine otherwise available under the alternative fine statute,[27] and will not impose a monitor if the company has implemented an effective compliance program by the time of resolution.[28] However, even a company that receives an NPA will still be required to pay applicable disgorgement, forfeiture, and/or restitution.[29]

Second, in another parallel to the FCPA Policy revisions, the NSD Policy now grants a presumption of an NPA where “a company undertakes a merger or acquisition, uncovers misconduct by the merged or acquired entity through thorough and timely due diligence or, in appropriate instances, through post-acquisition audits or compliance integration efforts, and voluntarily self-discloses the misconduct.”[30]

Third, the revisions to the NSD Policy follow the changes to the FCPA Policy on voluntary self-disclosure credit: to qualify for a credit, a company must disclose “all relevant facts known to it at the time of the disclosure, including as to any individuals substantially involved in or responsible for the misconduct at issue.”[31] Additionally, the revised NSD Policy includes a footnote mirroring footnote 1 in the FCPA Policy, stating that “a company may not be in a position to know all relevant facts at the time of a voluntary self-disclosure, especially where only preliminary investigative efforts have been possible. In such circumstances, a company should make clear that it is making its disclosure based upon a preliminary investigation or assessment of information, but it should nonetheless provide a fulsome disclosure of the relevant facts known to it at that time.”[32]

Fourth, the NSD—like the Fraud Section—also modified its policy on de-confliction. The NSD Policy now states that the Department will only request de-confliction where “appropriate.”[33] Additionally, in a footnote, the NSD Policy says the Department will not “take any steps to affirmatively direct a company’s internal investigation.”[34]

Finally, as it relates to remediation, the NSD Policy now requires companies to conduct root cause analyses to address and remediate the underlying causes of the conduct at issue.[35] Moreover, the NSD Policy now includes guidance addressing ephemeral messaging mirroring the FCPA Policy: a company must “implement[] appropriate guidance and controls on the use of personal communications and ephemeral messaging platforms that undermine the company’s ability to appropriately retain business records or communications or otherwise comply with the company’s document retention policies or legal obligations.”[36]

2019 Corporate NPAs and DPAs

Avanir Pharmaceuticals (DPA)

On September 26, 2019, Avanir Pharmaceuticals (“Avanir”), a pharmaceutical manufacturer, entered into a DPA with the U.S. Attorney’s Office for the Northern District of Georgia to resolve allegations that it had paid kickbacks to a physician to induce prescriptions of its drug Nuedexta.[37] As part of the DPA, which has a term of three years, Avanir consented to the filing of a one-count Information alleging that Avanir violated the Anti-Kickback Statute by: (1) paying a doctor to become a high prescriber of Nuedexta to beneficiaries of federal health care programs, (2) offering that doctor financial incentives to write additional Nuedexta prescriptions for beneficiaries of federal health care programs, and (3) inducing the doctor to recommend that other physicians prescribe Nuedexta to beneficiaries of federal health care programs.[38] The DPA required Avanir to pay a monetary penalty in the amount of $7,800,000, and forfeiture in the amount of $5,074,895.[39] In light of a parallel civil settlement (described below), the DPA did not require additional restitution to be paid by the company.[40]

Although Avanir did not receive voluntary self-disclosure credit in the DPA, the company did otherwise receive full credit for its cooperation with the government’s investigation.[41] The DPA noted its extensive remedial measures (including terminating, or permitting to resign in lieu of termination, multiple employees, at various levels of the organization, including senior executives), and enhancements to its compliance program.[42] In determining that an independent compliance monitor was unnecessary, DOJ cited these considerations, as well as the fact that Avanir had entered into a Corporate Integrity Agreement with the Department of Health and Human Services, Office of the Inspector General (“HHS OIG”), which required the engagement of an independent review organization (“IRO”).[43]

In a parallel civil settlement, Avanir also resolved allegations that it violated the civil False Claims Act (“FCA”) by paying kickbacks to long-term care providers and engaging in false and misleading marketing of Nuedexta, all in an effort to induce the physicians to prescribe the drug for off-label uses.[44] The FCA settlement required Avanir to pay $95,972,017 to the U.S. government, and $7,027,983 to resolve state Medicaid claims.[45]

The civil settlement resolved allegations, among others, that between October 29, 2010, and December 31, 2016, Avanir provided remuneration in the form of money, honoraria, travel, and food to certain physicians and other health care professionals to induce them to write prescriptions for Nuedexta.[46] Contemporaneous with the civil settlement, Avanir entered into a five-year Corporate Integrity Agreement with HHS OIG. The agreement requires, among other things, that Avanir implement additional controls around its interactions with physicians and conduct internal and external (through an IRO) monitoring of promotional and other activities.[47]

Baton Holdings LLC / Bankrate, Inc. (NPA)

On March 5, 2019, DOJ reached an NPA with Baton Holdings, LLC, the successor in interest of Bankrate, Inc., to resolve allegations of accounting fraud. The misconduct occurred prior to Bankrate’s acquisition by Red Ventures Holdco, LP, the ultimate parent company of Baton Holdings LLC.[48]

Although the company did not receive self-disclosure credit, DOJ credited Bankrate’s Audit Committee for, two years into the investigation, hiring new outside counsel, ordering an independent internal investigation, and cooperating fully.[49] Under the leadership of the Audit Committee, the company engaged in extensive remedial measures, including termination of employees who engaged in or were aware of misconduct, and issuance of restated financial statements.[50] Further, the company committed to continued improvements in its compliance and reporting programs.[51]

The NPA has a three year term, with a possible one-year extension, and no provision for early termination.[52] In addition to a monetary penalty of $15.54 million, Baton Holdings agreed to pay $15 million in disgorgement of profits and prejudgment interest to the SEC, and $13 million in restitution to shareholders via a third-party claims administrator.[53] The NPA did not impose a monitor, but Baton Holdings agreed to designate knowledgeable employees to provide information to DOJ upon request, including disclosure of “credible evidence or allegations and internal or external investigations.”[54]

Celadon Group, Inc. (DPA)

On April 25, 2019, Celadon Group, Inc. (“Celadon”), a transportation company headquartered in Indianapolis, Indiana, entered into a DPA with DOJ’s Criminal Division Fraud Section and the U.S. Attorney’s Office for the Southern District of Indiana to resolve allegations that it had misled investors and falsified books and records.[55] As part of the DPA, which has a term of five years, Celadon consented to the filing of a one-count Information charging the company with conspiracy to commit securities fraud and to “knowingly and willfully falsify the books, records and accounts of the Company.”[56] The DPA resolves allegations that between June 2016 and October 2016, Celadon conspired with a wholly owned subsidiary, Quality Companies LLC (“Quality”), in a scheme that “resulted in Celadon falsely reporting inflated profits and inflated assets to the SEC and the investing public through Celadon’s financial statements.”[57] Ultimately, the DPA alleges, Celadon used falsified invoices reflecting inflated truck values to “hide millions of dollars of losses from investors when reporting its financial condition.”[58]

Although Celadon did not voluntarily disclose the conduct, a “relevant consideration” for entering into the DPA was that, “after learning of the allegations of misconduct by Company officials, the Company retained an external law firm to conduct an independent investigation, and ultimately notified [DOJ] of its investigation and intent to fully cooperate.”[59] The DPA also credits Celadon with engaging in “significant remedial measures,” including that “(i) the Company no longer employs or is affiliated with any of the individuals known to the Company to be implicated in the conduct at issue . . .; (ii) the Company created the new position of Chief Accounting Officer reporting directly to the Chief Financial Officer; (iii) the Company hired an experienced Internal Audit staff member reporting directly to the Company’s Internal Audit Manager; and (iv) the Company enhanced its compliance program . . . .”[60] On the same day DOJ announced the Celadon DPA, it also announced it had reached a guilty plea with the former president of the Celadon subsidiary that included counts of conspiracy to commit securities fraud, to make false statements to auditors, and to falsify the company’s books, records, and accounts.[61]

Pursuant to the DPA, Celadon agreed to pay approximately $42.2 million in restitution to victims of the offense, in addition to the “cost of the administration of all restitution claims by a third party claims administrator.”[62] Unusually for a resolution lacking in voluntary disclosure credit, the company did not have to pay a fine or further financial penalty beyond the approximately $42.2 million in victim restitution.

On December 5, 2019, the SEC charged two of Celadon’s former top executives for their participation in the alleged conduct.[63] Less than a week after the executives were charged, Celadon filed for Chapter 11 bankruptcy protection, citing “legacy and market headwinds” as well as the “significant costs associated with a multi-year investigation into the actions of former management, including the restatement of financial statements.”[64]

ContextMedia Health LLC (NPA)

On October 17, 2019, ContextMedia Health LLC (“ContextMedia”), a digital provider of medical information and advertising in doctors’ offices, entered into an NPA with DOJ and the U.S. Attorney’s Office for the Northern District of Illinois.[65] The agreement was secured by Gibson Dunn and resolved allegations that from 2012 to 2017, former executives and employees of ContextMedia defrauded clients—most of which were pharmaceutical companies—by falsely inflating the numbers of physicians it told those clients they would reach by placing advertisements on ContextMedia’s network.[66]

ContextMedia admitted that former executives invoiced clients as if advertising campaigns had been delivered in full, when in reality the company under-delivered the campaigns because its advertising network did not reach all of the physicians that ContextMedia represented it did.[67] To conceal the under-deliveries, former employees allegedly falsified records to make it appear the company was delivering advertising content to the number of in-office devices its clients were promised their advertisements would reach.[68] Former executives and employees also allegedly inflated metrics measuring the frequency with which patients engaged with devices receiving the clients’ advertising content.[69]

The NPA noted that ContextMedia no longer employs the former executives and employees who were involved in the alleged wrongdoing, and the company has made significant improvements to address and improve the reliability of reporting on advertising campaign delivery, including by hiring third parties to audit all of its advertising campaigns.[70] Based on these improvements and the strength of the company’s enhanced compliance program, DOJ determined that a compliance monitor was not necessary and did not impose a fine.[71]

ContextMedia’s obligations under the agreement have a term of three years.[72] Under the terms of the NPA, the company committed to compensating its pharmaceutical clients up to a cumulative amount of $70 million, approximately $65.5 million of which the company had already returned through a combination of cash payments and in-kind services and the remaining $4.5 million of which will be set aside to cover any future claims for restitution made by ContextMedia’s clients.[73]

Dannenbaum Engineering Corporation (DPA)

On November 22, 2019, Dannenbaum Engineering Company (“DEC”) and its parent company, Engineering Holding Corporation (“EHC”), entered into a three-year DPA with DOJ’s Public Integrity Section and the U.S. Attorney’s Office for the Southern District of Texas. The government alleged that DEC violated the Federal Election Campaign Act (“FECA”).[74] As part of the resolution, DEC agreed to pay a monetary penalty of $1.6 million.

According to the DPA’s Statement of Facts, from at least March 2015 through April 2017, DEC and EHC made $323,300 in illegal conduit contributions through various employees and their family members to federal candidates and their committees.[75] The DPA alleges that DEC corporate funds were used to advance or reimburse employee monies for these contributions, and that the object of the alleged scheme was for DEC, its CEO, and a former employee to gain access to and potentially influence various candidates for federal office, including candidates for President, the Senate, and the House of Representatives.[76]

DOJ listed several factors on which it based the resolution, including DEC’s cooperation with the government investigation, the “thorough” internal investigation DEC conducted, and its remedial measures. The remedial measures included, among others: (1) resignation by the CEO and departure of the one other employee who allegedly engaged in misconduct; (2) the restructuring of the company’s board to ensure that the former CEO cannot control it; (3) ending all politically related payments to its employees; (4) the hiring/designation of a full-time Chief Governance and Compliance Officer, and the engagement of an independent company to design a new compliance program; and (5) the creation of a whistleblower email system and training program for employees.[77]

Ericsson (DPA)

On November 26, 2019 DOJ and the U.S. Attorney’s Office for the Southern District of New York entered into a three-year DPA with Telefonaktiebolaget LM Ericsson (“Ericsson”), a multinational telecommunications company headquartered in Sweden, for conspiring to violate the FCPA. Ericsson’s subsidiary Ericsson Egypt Ltd. (“Ericsson Egypt”) also pled guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA.[78] The DPA alleged that Ericsson paid bribes to high-level government officials in Djibouti and committed violations of the FCPA’s books and records and internal controls provisions to disguise payments in Djibouti, China, Vietnam, Indonesia, and Kuwait over the course of 17 years.[79]

The DPA imposed a total criminal penalty of $520,650,432, which includes a $9,520,000 criminal fine Ericsson agreed to pay on behalf of Ericsson Egypt. The total penalty reflects an aggregate discount of 15% off the bottom of the U.S. Sentencing Guidelines fine range.[80] Ericsson also settled a related investigation by the SEC by agreeing to pay $458,380,000 in disgorgement and $81,540,000 in prejudgment interest.[81] The approximately $1.1 billion in total monetary obligations imposed on Ericsson make this matter the third-largest FCPA settlement reached to date. The Ericsson DPA is the largest agreement of 2019 (measured by total dollar value) to require an independent compliance monitor. The DPA imposed a three-year independent compliance monitor, citing the fact that Ericsson “has not yet fully implemented or tested its compliance program.”[82] Ericsson also agreed to “implement rigorous internal controls” and “cooperate fully with the [g]overnment in any ongoing investigations.”[83] Among the factors DOJ considered in entering into the DPA was the fact that although Ericsson had “inadequate anti-corruption controls and an inadequate anti-corruption compliance program” during the relevant period, Ericsson enhanced its compliance program and controls in the course of DOJ’s investigation.[84] DOJ did not give Ericsson full cooperation credit because the company “did not disclose allegations of corruption with respect to two relevant matters, produced certain relevant materials in an untimely manner, and did not timely and fully remediate, including by failing to take adequate disciplinary measures with respect to certain executives and other employees involved in the misconduct.”[85]

Fresenius Medical Care AG & Co. KGaA (NPA)

On March 28, 2019, Fresenius Medical Care AG & Co. KGaA (“Fresenius”), “a German-based provider of medical products and services,” entered into an NPA with DOJ’s Criminal Division, Fraud Section, and the U.S. Attorney’s Office for the District of Massachusetts to resolve criminal and civil claims relating to Fresenius’s alleged violations of the FCPA through “participation in various corrupt schemes to obtain business in multiple foreign countries.”[86] Specifically, Fresenius admitted to making improper payments to “publicly employed health and/or government officials to obtain or retain business in Angola and Saudi Arabia.” Furthermore, DOJ alleged that in certain foreign countries, “Fresenius knowingly and willfully failed to implement reasonable internal accounting controls over financial transactions and failed to maintain books and records that accurately and fairly reflected the transactions.”[87]

The NPA notes that Fresenius received voluntary disclosure credit “because it voluntarily and timely disclosed to the Department the conduct described in the Statement of Facts [attached to the NPA].”[88] The company also received partial credit for its cooperation with DOJ, including, among other things: “conducting a thorough internal investigation; making regular factual presentations to the Department; . . . [and] collecting, analyzing, and organizing voluminous evidence and information from multiple jurisdictions for the Department.”[89]

Fresenius also engaged in remedial measures, according to the NPA, including: (1) terminating the employment of at least ten employees who were involved in or failed to detect the admitted misconduct; “(2) enhancing its compliance program, controls, and anti-corruption training; (3) terminating business relationships with the third party agents and distributors who participated in the misconduct described in the Statement of Facts; (4) adopting heightened controls over the selection and use of third parties, to include third party due diligence; and (5) withdrawing from consideration of pending public contracts potentially related to the misconduct described in the Statement of Facts.”[90]

Under the NPA, which has a term of three years, Fresenius “agree[d] to pay a monetary penalty in the amount of $84,715,273” and to pay “disgorgement and prejudgment interest in the amount of $147 million,” toward which DOJ credited Fresenius’s disgorgement to the SEC.[91] The monetary penalty reflected a discount of 40% off of the bottom of the U.S. Sentencing Guidelines fine range.[92]

Fresenius agreed “to an independent compliance monitor for a term of two years, followed by self-monitoring for the remainder of the Agreement.”[93] It also agreed to cooperate with DOJ and “any other domestic or foreign law enforcement and regulatory authorities and agencies, as well as with Multilateral Development Banks, in any investigation of the Company, its parent company or its affiliates, or any of its present or former officers, directors, employees, agents, and consultants, or any other party.”[94] The NPA also acknowledges that Fresenius must comply with relevant data privacy laws, among other applicable laws and regulations, and it requires the company to provide DOJ with “a log of any information or cooperation that is not provided based on the assertion of law, regulation, or privilege.”[95] This is in keeping with DOJ’s public statements that, under the FCPA Corporate Enforcement Policy, the “company bears the burden of establishing the prohibition” on disclosing information.[96] DOJ has expressed an expectation that “a cooperating company will work to identify all available legal means to provide” requested data.[97]

On October 21, 2019, German prosecutors confirmed they are conducting an investigation based on findings in the NPA.[98]

Heritage Pharmaceuticals (DPA)

On May 30, 2019, Heritage Pharmaceuticals Inc. (“Heritage”), and the Antitrust Division of DOJ entered into a DPA.[99] The Heritage DPA secured by Gibson Dunn is the Antitrust Division’s first DPA with a company other than a financial institution and the only DPA to provide protection from criminal prosecution for all of the company’s current officers, directors and employees.

The Heritage DPA resolved allegations that from about April 2014 until at least December 2015, Heritage participated in a criminal antitrust conspiracy with other companies and individuals engaged in the production and sale of generic pharmaceuticals, a purpose of which was to fix prices, rig bids, and allocate customers for glyburide, a medicine used to treat diabetes.[100] The agreement requires Heritage to cooperate fully with the ongoing investigation and pay a $225,000 criminal penalty.[101] In return, the prosecution of Heritage is deferred for a period of three years.[102] Heritage’s resolution with the DOJ does not require the imposition of a corporate monitor.

DOJ noted the agreement was based on a variety of facts and circumstances, including the fact that a criminal conviction would have potentially exposed Heritage to mandatory exclusion from federal health care programs.[103]

Heritage has agreed to resolve all civil claims relating to federal health care programs arising from its conduct.[104] In a separate civil resolution, Heritage agreed to pay $7.1 million to resolve allegations under the FCA related to the alleged price-fixing conspiracy.[105]

For additional information regarding the Antitrust Division’s latest guidance on DPAs, and particularly the role that corporate compliance programs will play in securing a DPA, please see our recent client alert, “DOJ Antitrust Division Will Now Consider DPAs for Companies Demonstrating ‘Good Corporate Citizenship.’”

HSBC Private Bank (Suisse) SA (DPA)

On December 10, 2019, HSBC Private Bank (Suisse) SA (“HSBC Switzerland”), a private bank headquartered in Geneva, entered into a DPA with DOJ’s Tax Division and the U.S. Attorney’s Office for the Southern District of Florida.[106] The agreement resolved allegations that HSBC Switzerland conspired with U.S. taxpayers to evade taxes.[107] As part of the DPA, which has a term of three years, HSBC Switzerland consented to the filing of a one-count Information charging the bank with conspiracy to (1) defraud the United States for the purpose of impeding the lawful collection of federal income taxes, (2) file false federal income tax returns, and (3) evade federal income taxes, all in violation of 18 U.S.C. § 371.[108]

Specifically, DOJ alleged that from at least 2000 through 2010, HSBC Switzerland “used Swiss bank secrecy to conceal the accounts of U.S. clients from the U.S. tax authorities.”[109] This included the provision of a number of traditional Swiss banking services, such as numerical and coded names for accounts, prepaid debit and credit cards to allow U.S. clients to withdraw funds remotely “without a clear paper trail back to their undeclared accounts in Switzerland,” and hold-mail services in which the bank would not send any account documents to U.S. account holders.[110] HSBC Switzerland bankers also assisted U.S. clients with creating entities that were incorporated in offshore tax havens and opening accounts in the names of nominee entities and trusts.[111]

Pursuant to the DPA, HSBC Switzerland agreed to pay a total of $192,350,000 to the United States, consisting of restitution of the approximate unpaid pecuniary loss to the United States that allegedly resulted from the conduct, forfeiture of the approximate gross fees paid to HSBC Switzerland by U.S. taxpayers with undeclared accounts at the bank, and a monetary penalty.[112] Notably, the monetary penalty portion of the resolution reflected a discount of 50% off of the bottom of the U.S. Sentencing Guidelines fine range.[113] DOJ considered that HSBC self-reported its conduct, performed a thorough internal investigation, and extensively cooperated with the government as mitigating factors in support of the lower penalty.[114] The DPA did not impose a monitor or regular self-reporting requirement.[115]

Hydro Extrusion USA LLC (DPA)

On April 23, 2019, Hydro Extrusion USA, LLC, formerly known as Sapa Extrusions Inc. (“SEI”), entered into a three-year DPA for mail fraud after an extensive investigation by the National Aeronautics and Space Administration (“NASA”) Office of Inspector General, FBI’s Portland Field Office, and the Defense Criminal Investigative Service (“DCIS”).[116] At the same time, SEI’s direct subsidiary, Hydro Extrusion Portland, Inc., formerly known as SAPA Profiles Inc. (“SPI”), agreed to plead guilty to one count of mail fraud in connection with the same criminal activity and to pay restitution in the amount of $34.1 million and a forfeiture money judgment in the amount of $1.8 million.[117] The resolutions were entered after the two companies admitted to providing customers, including U.S. government contractors, with falsified certifications from altered tensile test results for nearly two decades.[118] The tests were designed to ensure the consistency and reliability of aluminum extruded at the companies’ facilities in Oregon, and the falsified results therefore allegedly resulted in the sale of aluminum that did not meet contract specifications for use on rockets for NASA and missiles provided to the Department of Defense’s Missile Defense Agency.[119]

A number of factors contributed to DOJ’s criminal resolution with the companies. The DPA noted that Hydro Extrusion USA LLC and SPI “received full credit for their cooperation with the United States’ investigation and the Civil Division’s parallel civil investigation.”[120] That cooperation included “conducting an independent internal investigation and making regular factual presentations to the United States; facilitating witness interviews of current and former SPI employees; collecting, analyzing, and organizing voluminous evidence and information for the United States; providing counsel for certain witnesses; and responding to the United States’ requests for evidence and information.”[121] Moreover, the companies received significant credit for “their engagement in extensive remedial measures to address the misconduct, including the termination and severance of employees who were involved, the implementation of state-of-the-art equipment to automate the tensile testing process, company-wide audits at all U.S. tensile labs, increased resources devoted to compliance, and revamping internal quality controls and quality audit processes.”[122] In entering the DPA, the government also considered SPI’s ongoing negotiations with DOJ’s Civil Division, Commercial Litigation Branch, Fraud Section, “to resolve its civil liability for related civil claims, including under the federal False Claims Act.”[123]

Hydro Extrusion USA’s extensive remediation efforts, the state of its compliance program, and its agreement to periodic self-reporting, led DOJ to determine that an independent compliance monitor was unnecessary.[124] However, the companies did not receive more significant mitigation credit, either in the penalty or the form of resolution, because the companies did not voluntarily self-disclose the full extent of their misconduct to the Department.[125]

Insys Therapeutics, Inc. (DPA)

Insys Therapeutics, Inc. (“Insys”) entered into a five-year DPA with the U.S. Attorney’s Office for the District of Massachusetts on June 5, 2019, to resolve federal criminal charges arising from Insys’s payment of kickbacks and other unlawful marketing practices related to its promotion of Subsys, a sublingual fentanyl spray DOJ described as a “powerful, but highly addictive opioid painkiller.”[126] DOJ alleged that between August 2012 and June 2015, Insys used sham “speaker programs” as a vehicle for paying bribes and kickbacks to physicians and other medical practitioners in exchange for prescribing Subsys to their patients, in many instances where the drug was not medically necessary.[127] As part of the resolution, Insys’s wholly owned operating subsidiary, Insys Pharma, Inc. (“Insys Pharma”), pled guilty to five counts of mail fraud.[128]

As part of the DPA, Insys agreed to pay a $2 million criminal fine and to forfeit $28 million, representing its unlawful proceeds from the mail fraud scheme.[129] Additionally, Insys agreed to pay $195 million as part of a related FCA settlement, bringing its total penalty amount to $225 million.[130] Insys also agreed to “cooperate fully with the United States . . . in any federal investigation, trial, or other proceeding of its current and former officers, agents, and employees” arising from this investigation or otherwise related the company’s sales, promotion, and marketing practices related to Subsys.[131] This cooperation obligation may prove significant given that eight Insys executives have been convicted for crimes related to the illegal marketing of Subsys, five of whom, including company founder John Kapoor, were convicted at trial for racketeering conspiracy in May.[132] Insys also agreed to fully comply with federal law related to the marketing, sale, and distribution of pharmaceutical products, to continue implementing its associated compliance policies, procedures, and controls, and to abide by all of the terms of its Corporate Integrity Agreement and associated civil Settlement Agreement with HHS OIG.[133]

The Corporate Integrity Agreement sets forth detailed undertakings regarding the structure, content, and oversight of Insys’s corporate compliance program and the commissioning of an annual independent review process,[134] as well as: (1) a requirement that Insys establish a program allowing for clawback of up to three years of executive incentive-based compensation;[135] (2) restrictions on research grants and charitable donations;[136] and (3) a requirement that Insys divest Subsys and an associated product and cease all business activities related to opioids within 12 months.[137] The Settlement Agreement required payment of a $195 million civil penalty over a five-year period.[138] The OIG reserved the right to exclude Insys from participating in federal health care programs in the event of a material breach of the Corporate Integrity Agreement or a default in its payment obligations under the Settlement Agreement.[139]

Less than a week after entering this resolution, on June 10, 2019 Insys filed for Chapter 11 bankruptcy protection, claiming it could not keep up with its obligations due to the combination of significantly declined sales amid enhanced scrutiny of opioid prescriptions and its costs associated with the DOJ investigation and numerous associated civil lawsuits brought by municipalities seeking damages from Insys’s alleged contributions to the opioid epidemic.[140] Since then, Insys has filed a recovery plan providing for tiered treatment of claims, including DOJ’s claim based on the $225 million settlement.[141] The plan has not yet been confirmed, and it is not yet clear how much of the settlement amount DOJ would actually receive under the plan.

LLB-Verwaltung (Switzerland) AG (NPA)

In July 2019, DOJ’s Tax Division entered into an NPA with LLB-Verwaltung (Switzerland) AG (“LLB-Switzerland”), a private Swiss bank, to resolve allegations that LLB-Switzerland and certain of its employees, including members of management, conspired with an independent Swiss asset manager and with U.S. clients to conceal the clients’ assets and incomes from the IRS through various means, including using Swiss bank secrecy and nominee companies set up in tax-haven jurisdictions.[142] The NPA’s Statement of Facts noted that during 2009, “the Bank held nearly $200 million” in assets for 93 U.S. clients despite allegedly knowing that many of these clients had brought undeclared funds to LLB-Switzerland, and despite knowing of an investigation then being conducted by the U.S. government into similar conduct at another Swiss bank.[143] LLB-Switzerland’s parent, Liechtensteinische Landesbank, AG (“LLB-Vaduz”), reached a separate agreement with DOJ in 2013 through the DOJ Tax Swiss Bank Program (covered extensively in our 2015 Mid-Year and Year-End Updates), that excluded LLB-Switzerland from the resolution.[144]

The NPA, which has a term of four years, imposed a penalty of $10,680,554.[145] The DOJ Tax Division entered into the Agreement, in part, based on factors including: “(a) [LLB-Switzerland’s] disclosure of the Conduct, including how LLB-Switzerland structured, operated, and supervised its cross-border business for accounts owned and/or controlled by U.S. persons; (b) [LLB-Vaduz’s] termination of the banking activities by LLB-Switzerland and the return of LLB-Switzerland’s banking license to [the Swiss Financial Market Supervisory Authority (“FINMA”)] in December 2013; and (c) [LLB-Switzerland’s] cooperation with the Tax Division as well as the cooperation of LLB-Vaduz” in the investigation.[146] Additionally, DOJ noted LLB-Switzerland’s “comprehensive” remediation efforts since 2012, which included the bank’s termination of all cross-border business with U.S. clients and of its relationship with the Swiss asset manager.[147] LLB-Switzerland also closed and surrendered its banking license, as noted above, and dismissed the managers and employees implicated in the investigation.[148]

Lumber Liquidators (DPA)

In March 2019, the DOJ Fraud Section, U.S. Attorney’s Office for the Eastern District of Virginia (E.D. Va.), and Lumber Liquidators entered into a DPA in connection with a criminal information charging the company with securities fraud.[149] The agreement capped a multiyear investigation initiated following a March 1, 2015, 60 Minutes segment that claimed laminate floors Lumber Liquidators sold did not comply with California Air Resource Board (“CARB”) regulations because they contained an unacceptably high amount of formaldehyde.[150]

According to the DPA, Lumber Liquidators filed a false and misleading Form 8-K with the SEC, affirming that it complied with CARB regulations while failing to disclose material facts, the day after the 60 Minutes segment aired.[151] The DPA alleged that Lumber Liquidators had failed to include in its 8-K that the company’s products had failed its own tests for CARB compliance and that the company had discontinued its relationship with a supplier due to compliance concerns.[152]

Lumber Liquidators paid DOJ a total penalty of $33 million, including a criminal fine of approximately $19 million, and approximately $14 million in forfeiture. The DPA is for a three-year period.[153] The agreement reflects the company’s cooperation and remedial efforts, which included offering consumers in-home testing for installed flooring, implementing new policies and procedures regarding CARB compliance, and terminating all employees involved in the wrongdoing who did not resign.[154]

The company entered into a separate resolution with the SEC through which it agreed to pay more than $6 million in disgorgement of profits and prejudgment interest.[155]

Merrill Lynch Commodities, Inc. (NPA)

On June 25, 2019, Merrill Lynch Commodities, Inc. (“Merrill Lynch”) entered into a three-year NPA with DOJ’s Fraud Section.[156] The agreement binds Merrill Lynch, which operates a global commodities trading business, as well as its parent company, Bank of America Corporation.[157]

The agreement resolved allegations that Merrill Lynch’s precious metals traders deceived other market participants by manipulating U.S. commodities markets with false and misleading information.[158] Specifically, from about 2008 to 2014, its traders allegedly created the false impression of increased supply or demand by placing orders for precious metals future contracts on the market that they intended to cancel before execution (a practice known as “spoofing”).[159] That spoofing purportedly induced other market participants “to buy or to sell precious metals futures contracts at prices, quantities, and times that they likely would not have otherwise.”[160]

The NPA states that Merrill Lynch agreed to pay “combined appropriate criminal fine, forfeiture, and restitution amounts” of $25 million. Merrill Lynch also committed to report evidence or allegations of similar misconduct to DOJ.[161] The NPA noted that Merrill Lynch received credit for its cooperation with DOJ’s investigation and engaged in remedial measures before the investigation began, “including enhancing their compliance program and internal controls designed to detect and deter spoofing and other manipulative conduct.”[162] Based on these factors, DOJ determined that an independent compliance monitor was unnecessary.[163]

On the same day the parties entered into the NPA, the CFTC announced a separate settlement with Merrill Lynch to end parallel civil proceedings.[164] Merrill Lynch agreed to pay $25 million to the CFTC, including a civil penalty of $11.5 million, as well as restitution and disgorgement for which it received a credit for restitution and disgorgement paid to DOJ.[165]

Edward Bases and John Pacilio, two former precious metals traders employed by Merrill Lynch, were also indicted last year in connection with the alleged spoofing.[166] The litigation is pending in the U.S. District Court for the Northern District of Illinois.[167]

Microsoft Magyarország Számítástechnikai Szolgáltató és Kereskedelmi Kft. (Microsoft Hungary) (NPA)

On July 22, 2019, DOJ announced an FCPA resolution with the Hungarian subsidiary of leading technology company Microsoft, relating to alleged violations of the FCPA’s books-and-records and internal controls provisions.[168] These allegations involved Microsoft’s subsidiary allegedly making improper payments to government officials through third parties.[169] To resolve the DOJ matter, Microsoft’s Hungarian subsidiary entered into a three-year non-prosecution agreement and paid a criminal fine of $8,751,795.[170] The DOJ awarded a 25% cooperation credit to Microsoft Hungary for its substantial cooperation and extensive remedial measures.[171] Microsoft’s Hungarian subsidiary was not required to retain a monitor, but will report on its compliance program efforts and enhanced internal control policies and procedures for the three-year non-prosecution period.[172]

In a parallel resolution with the SEC, parent company Microsoft consented to the entry of a cease-and-desist order and agreed to pay $16,565,151 in disgorgement plus prejudgment interest, in connection with alleged conduct in Hungary, Turkey, Saudi Arabia, and Thailand. For additional details, please see our 2019 Year-End FCPA Client Alert.

Mizrahi Tefahot Bank Ltd., United Mizrahi Bank Switzerland Ltd., and Mizrahi Tefahot Trust Co. Ltd. (DPA)

On March 12, 2019, the DOJ’s Tax Division and U.S. Attorney’s Office for the Central District of California entered into a DPA with Mizrahi-Tefahot Bank Ltd., (“Mizrahi-Tefahot”) and its subsidiaries, United Mizrahi Bank (Switzerland) Ltd. (“UMBS”) and Mizrahi Tefahot Trust Company Ltd. (“Mizrahi Trust Company”).[173] In the Gibson Dunn negotiated DPA, Mizrahi-Tefahot admitted responsibility, “under United States respondeat superior law,” for the actions of “[c]ertain private bankers, relationship managers, and other employees of [MTB Entities] with similar levels of responsibility” which had, from 2002-2012, allegedly enabled U.S. customers to evade U.S. tax obligations by disguising and failing to report the customers’ ownership and control of assets held at all three entities.[174]

The DPA involved payment terms totaling $195 million, of which $53 million was restitution; $24 million was disgorgement; and $118 million was a penalty.[175] The agreement notes that a potentially “higher penalty” was “mitigat[ed]” by the fact that Mizrahi-Tefahot “conducted an internal investigation and engaged in concomitant efforts to provide information and materials . . . derived from that investigation to U.S. authorities.”[176]

The agreement describes a comprehensive internal investigation, which involved, among other things, reviewing “millions of e-mails from three countries,” producing over 560,000 pages of documents to the government, providing translations for various documents, conducting internal interviews and proffering the substance of those interviews to the government, and presenting the results of the internal investigation to the government.[177]

The DPA will remain in place for a two-year period.[178]

Mobile TeleSystems PJSC (DPA)

On March 7, 2019, DOJ announced the Mobile TeleSystems (“Mobile TeleSystems”) DPA, which involved allegations that Mobile TeleSystems conspired to violate the anti-bribery, books and records, and internal controls provisions of the FCPA.[179] Mobile TeleSystems’ Uzbek subsidiary, Kolorit Dizayn Ink LLC (“Kolorit”), pled guilty to anti-bribery and books and records violations.[180] According to DOJ, the companies allegedly paid bribes to Gulnara Karimova, the daughter of former president of Uzbekistan Islam Karimov, in exchange for the ability to conduct business in Uzbekistan.[181] Between the DPA and an SEC settlement announced the day before, Mobile TeleSystems and Kolorit agreed to pay a total of $950 million in civil and criminal penalties.[182] In indictments announced the same day as the DPA, Karimova and Bekhzod Akhmedov, the former CEO of another Mobile TeleSystems subsidiary, were charged with money laundering violations, and money laundering and FCPA violations, respectively.[183] According to the press release announcing the indictments, the amount that Karimova allegedly received in bribes is the largest ever paid to any individual FCPA defendant.[184] The Mobile TeleSystems DPA highlights DOJ’s continued emphasis on prosecuting individuals, even in the wake of the recent curtailment of the Yates Memorandum’s requirement of blanket disclosure of relevant individuals by companies hoping for cooperation credit.[185]

While only the fifth-largest NPA or DPA by dollar value in 2019, the Mobile TeleSystems DPA is the second-largest agreement in 2019 to impose an independent compliance monitor.[186] Consistent with its prior practice of imposing monitorships where it believes companies’ compliance programs are immature, DOJ’s agreement with Mobile TeleSystems explains it is imposing a monitor “because the Company [i.e., Mobile TeleSystems] has not yet fully implemented or tested its compliance program.”[187] The Mobile TeleSystems DPA also marks the second monitorship to be imposed in recent years against a foreign telecommunications company over bribery allegations concerning Uzbekistan. DOJ’s 2016 DPA with VimpelCom Limited imposed a three-year monitorship on that company in a case that involved overlapping factual allegations and nearly as much in criminal and civil penalties as the Mobile TeleSystems case did.[188] The largest agreement in 2019 under which a monitor was imposed was the Ericsson DPA, which is discussed further above.

Two additional notable features of the Mobile TeleSystems DPA relate to the nature and size of the company’s total monetary penalty under the U.S. Sentencing Guidelines (“USSG”). First, the penalty was nearly 25% higher than the bottom end of the guideline range dictated by the USSG.[189] In setting forth the facts and circumstances that DOJ believed warranted this upward deviation and the nature and size of the resolution more broadly, the DPA noted (among other things) that Mobile TeleSystems “did not receive voluntary disclosure credit . . . because it did not voluntarily and timely self-disclose . . . the conduct described in the Statement of Facts,” and that while Mobile TeleSystems “ultimately provided” DOJ with “all relevant facts known to it,” the company “did not receive additional credit for cooperation and remediation . . . because it significantly delayed production of certain relevant materials, refused to support interviews with current employees during certain periods of the investigation, and did not appropriately remediate.”[190]

The second notable feature of Mobile TeleSystems’ total penalty is the fact that DOJ’s USSG analysis relied primarily on the value of the alleged bribes, and not on any alleged profit Mobile TeleSystems made as a result of the payments.[191] Unlike other FCPA cases that have involved some amount of profit realized from the alleged improper payments, Mobile TeleSystems’ conduct “result[ed] in no realized pecuniary gain to the Company” because “the Uzbek government expropriated the Company’s telecommunications assets in Uzbekistan.”[192] Only if profits surpassed the value of the alleged bribes would the USSG calculation have required that the profit figure, rather than the value of the bribe, dictate the penalty level.[193] Because the value of the alleged bribe here was larger than the base fine that the USSG would have otherwise provided for were profit used as a starting point, the result was a significant increase over the penalty DOJ could have otherwise sought from Mobile TeleSystems.[194]

For additional analysis regarding the Mobile TeleSystems DPA and other FCPA-related agreements, see Gibson Dunn’s 2019 Year-End FCPA Update.

Monsanto Company (DPA)

On November 21, 2019, the U.S. Attorney’s Office for the Central District of California (C.D. Cal.), acting as Special Attorney in the District of Hawaii,[195] announced a two-year DPA with the agrochemical and biotechnology company Monsanto, in connection with a criminal information charging the company with storing a banned pesticide.[196] Monsanto also agreed to plead guilty to spraying the pesticide.[197] The case is the result of an investigation by the U.S. Environmental Protection Agency (EPA), Criminal Investigation Division.[198]

According to the DPA, Monsanto continued spraying and storing the pesticide Penncap-M in Hawaii after the EPA issued a cancellation order in 2013 prohibiting all sale or use of the pesticide.[199] After the cancellation order, the pesticide had to be managed as “acute hazardous waste” in compliance with the Resource Conversation and Recovery Act (RCRA), which required a permit for storage or transportation of the pesticide.[200] According to the DPA, from 2013 through 2014 Monsanto stored and transported the pesticide without the required permit.[201]

The resolution required Monsanto to pay $10.2 million, including a fine of $6.2 million and $4 million in community service payments to Hawaiian government entities.[202] The DPA provides that the community services payments will be used for various purposes, including the creation of a pesticide disposal program by the Hawaii Department of Agriculture.[203] The agreement also requires that Monsanto develop and implement an environmental compliance program for all of its Hawaii sites and retain a third-party environmental compliance auditor.[204] The auditor will conduct “audits every six months of all of [Monsanto’s] locations in Hawaii in order to determine whether or not [Monsanto] is in full compliance with RCRA and FIFRA [the Federal Insecticide, Fungicide, and Rodenticide Act].”[205]

Reckitt Benckiser Group (NPA)

On July 11, 2019, Reckitt Benckiser Group plc (“RB Group”), a global consumer goods conglomerate headquartered in Slough, England, entered into an NPA with DOJ’s Consumer Protection Branch and the U.S. Attorney’s Office for the Western District of Virginia. The NPA resolved the investigation of RB Group related to the marketing, sale, and distribution of Suboxone in the United States by its former subsidiary Reckitt Benckiser Pharmaceuticals Inc., which spun off from RB Group in 2014 and is now a separate company known as Indivior.[206] Indivior was indicted on April 9, 2019 for alleged fraud in connection with the promotion and sale of Suboxone Film, an opioid used to treat opioid addiction.[207] The NPA with RB Group resolved potential liability “based on the subject matter” of that indictment.[208] The NPA imposed monetary obligations on RB Group of $1.4 billion – by total dollar value, the RB Group NPA is the largest resolution reached in 2019.

According to the Indivior indictment, Indivior promoted Suboxone Film as less-divertible and less-abusable and safer around children, families, and communities than other buprenorphine drugs, even though such claims have never been established.[209] The Indivior indictment further alleged that Indivior used its “Here to Help” internet and telephone program to connect patients to doctors it knew were prescribing Suboxone to more patients than allowed by federal law, at high doses, and in a careless and clinically unwarranted manner.[210] The Indivior indictment alleged substantial costs to the government as a result of the company’s conduct.[211]

As part of the NPA, which has a term of three years, RB Group agreed that neither RB Group nor any affiliated entity will manufacture, distribute, or sell in the United States any Schedule I, II, or III controlled substance, as defined in the Controlled Substances Act, during the term of the NPA.[212] Moreover, RB Group agreed to fully cooperate with all investigations and prosecutions by DOJ related, in any way, to Suboxone.[213] The agreement did not impose an independent compliance monitor or a self-reporting obligation on RB Group.

The $1.4 billion in monetary obligations imposed by the NPA consisted of a $700,000,000 payment pursuant to a Civil Settlement Agreement; a $647,000,000 payment for forfeiture of alleged proceeds; a $50,000,000 payment to resolve claims by the Federal Trade Commission;[214] and a $3,000,000 payment to the Virginia Medicaid Fraud Control Unit’s Program Income Fund.[215] Notably, the government did not impose a criminal penalty on RB Group.

The Civil Settlement Agreement resolved six qui tam actions filed in the Western District of Virginia and the District of New Jersey alleging that RB Group engaged in fraudulent marketing of Suboxone and promoted the drug to physicians it knew were prescribing the drug illegitimately.[216] As a result, the government alleged, RB Group caused false claims for Suboxone to be submitted to government health care programs.[217]

Republic Metals Corporation (NPA)

In an NPA announced on April 17, 2019, the United States Attorney’s Office for the Southern District of Florida and Republic Metals Corporation (“RMC”), a gold refinery based in Miami, Florida, resolved allegations regarding RMC’s role in an ongoing investigation concerning alleged money laundering and Bank Secrecy Act violations in the gold importation and refining industry.[218] Little information is available on the nature of DOJ’s concerns regarding RMC, and on the precise allegations in the broader investigation, as the parties expressly agreed in the NPA—at RMC’s request—to keep the agreement’s statement of facts confidential “absent a court order.”[219] While such a provision is not unheard of in negotiated resolutions, it is rare absent special circumstances, and here may reflect the fact that RMC is currently subject to a Chapter 11 bankruptcy proceeding filed in November 2018.[220] The NPA provided that RMC and the government “may disclose” the agreement publicly without its attachments,[221] but RMC’s motion for bankruptcy court approval of the NPA, which attached the NPA itself, was originally filed completely under seal.[222] However, the bankruptcy court determined “that certain information pertaining to the Motion should be made public consistent with the importance of transparency in public proceedings,”[223] and accordingly ordered disclosure of the NPA without attachments.[224] The NPA did not impose a penalty on RMC.[225]

Notably, DOJ granted RMC “full credit for its voluntary cooperation” with the government’s investigation, and explicitly noted that the information RMC produced to the government “tended to show that the Company has made significant efforts to create a culture of proper compliance” and “has been corroborated by other evidence.”[226] The NPA also cited RMC’s remediation efforts and “the state of its compliance program” as factors informing the government’s decision not to impose a monitor.[227] Among RMC’s remediation efforts was its termination, prior to being aware of the government’s investigation, of “several suppliers who ultimately proved suspicious” and which RMC had hired not because it intended to violate the anti-money laundering (“AML”) laws, but because of an alleged failure in the company’s compliance controls.[228]

Rick Weaver Buick GMC, Inc. (Pretrial Diversion Agreement)

On January 15, 2019, Rick Weaver Buick GMC, Inc. (the “Dealership”) entered into an agreement with the U.S. Attorney’s Office of the Western District of Pennsylvania to resolve allegations of wire fraud and conspiracy to commit wire fraud.[229] According to the indictment incorporated into the agreement and originally handed down in August 2017, the Dealership and three individual defendants defrauded auto loan providers by using straw purchasers to buy vehicles from the Dealership at inflated prices.[230]

Pursuant to the agreement, which has a term of three years, the Dealership agreed to an annual independent audit of its business operations and books, as well as an independent monitor for the term of the agreement.[231] The Dealership also agreed to undertake remedial efforts, including conducting employee training on ethics and amending its policies and procedures relating to the integrity of its company-wide ethics and compliance program.[232]

Under the agreement, the Dealership paid full restitution in the total amount of approximately $143,794 under the agreement to five financial institutions.[233] The Dealership also paid a monetary penalty of $400,000.[234]

The agreement is notable for several reasons. First, it was styled as an Agreement for Pretrial Diversion, which has a deferring effect like that of a DPA but which is more traditionally used in prosecutions of individuals.[235] As such, the agreement does not contain other customary features of corporate DPAs, such as a discussion of the company’s cooperation with the government’s investigation. Second, the agreement was reached over two years after the Dealership was originally indicted, which stands in contrast to the vast majority of DPAs reached before the government has filed charges.

Rising Pharmaceuticals, Inc. (DPA)

On December 13, 2019, Rising Pharmaceuticals, Inc. (“Rising”) and the Antitrust Division of DOJ entered into a DPA to resolve allegations that from at least April 2014 until at least September 2015, Rising participated in a criminal antitrust conspiracy with other companies and individuals engaged in the production and sale of generic pharmaceuticals.[236] The alleged purpose of the conspiracy was “to suppress and eliminate competition by agreeing to allocate customers for and to stabilize, maintain, and fix prices of Benazepril HCTZ,” a generic drug used to treat hypertension.[237] As part of the DPA, Rising consented to the filing of a one-count Information in the Eastern District of Pennsylvania charging the company with conspiracy to suppress and eliminate competition in violation of the Sherman Act.[238]

The agreement imposed $1.5 million in criminal penalties and $438,066 in restitution.[239] The DPA has a term of three years but will end earlier if the ongoing Chapter 11 bankruptcy cases of Rising and several related entities are closed before three years have elapsed.[240] The DPA does not impose a formal monitoring or reporting requirement on Rising, but the agreement does require prompt reporting of any “credible evidence or allegations of criminal violations” of which Rising learns.[241]

In a separate civil resolution, Rising agreed to pay approximately $1.1 million to resolve allegations under the FCA related to the alleged price-fixing conspiracy.[242] This amount was offset in the calculation of the criminal restitution in the DPA. The payment of the monetary obligations imposed by the resolutions will be subject to certain levels of pro rata treatment under the reorganization plan in the Chapter 11 bankruptcy.[243]

In entering into the DPA, the Antitrust Division considered that “Rising provided substantial, timely cooperation with the United States’ investigation,” including disclosing information regarding additional alleged antitrust violations other than those detailed in the DPA.[244] The DPA also cited to the fact that “Rising’s cooperation has allowed the United States to advance its investigation into criminal antitrust conspiracies among other manufacturers of generic pharmaceuticals,” and to Rising’s agreement to pay restitution.[245] Lastly, the DPA also stated that a conviction or guilty plea of Rising would likely result in a substantial delay of the ongoing bankruptcy proceedings.[246]

Rochester Drug Co-Operative (DPA)

As part of the federal government’s continued efforts to combat the opioid crisis, on April 23, 2019, the U.S. Attorney’s Office for the Southern District of New York announced a DPA with Rochester Drug Co-Operative (“RDC”).[247] The DPA resolved criminal allegations that RDC conspired to distribute controlled substances in violation of the Controlled Substances Act (“CSA”), conspired to defraud the Drug Enforcement Administration (“DEA”), and knowingly failed to file suspicious order reports with DEA.[248] A separate consent judgment agreed to by the parties resolved allegations that RDC committed civil violations of the CSA’s suspicious order reporting requirements.[249] RDC agreed to pay $20 million in civil forfeiture in satisfaction of its obligations under both the criminal and civil resolutions.[250]

The DPA is notable for several reasons. First, it is one of only three agreements from 2019 to carry a term of at least five years,[251] which is longer than that typically imposed by DPAs and NPAs. The agreement also includes an option for a one-year extension at the government’s sole discretion.[252] The agreement also imposes an independent monitor, but the monitorship carries only a three-year term. Second, whereas a typical DPA or NPA gives the company the opportunity to provide a written response within 30 days of any determination by the government that the company has breached the agreement,[253] the RDC DPA affords the “opportunity to make a presentation” in response to such a determination, without explicitly imposing a timeframe for doing so.[254] Third, the DPA imposes significant compliance undertakings on RDC—for example, by requiring that the company’s board “establish and maintain a standing Controlled Substances Compliance Committee (the ‘CSCC’),” and by imposing detailed rules for the CSCC’s formation, composition, and activities.[255] For example, the DPA requires that the CSCC “report regularly to the full Board on compliance issues, and . . . regularly review the reports from, and interact with, the Independent Monitor [imposed by the agreement],”[256] and that the CSCC monitor the company’s compliance program and spearhead updates to the program.[257] The agreement also provides that “the CSCC, as well as the full Board, shall have access to timely legal advice, and shall be regularly advised by counsel regarding all aspects of RDC’s compliance with the [CSA], its implementing regulations, and this Agreement.”[258] While it is common for a DPA to commit a company to providing its employees with compliance guidance, the explicit requirement of legal advice to RDC’s board represents a rare and substantial level of involvement by the government in corporate governance in the wake of a DPA.

Samsung Heavy Industries Company Limited (DPA)

On November 22, 2019, DOJ and the U.S. Attorney’s Office for the Eastern District of Virginia entered into a three-year DPA with Samsung Heavy Industries Company Ltd. (“SHI”), an engineering company based in South Korea, for conspiring to violate the anti-bribery provisions of the FCPA.[259] This was the second DPA in 2019 concerning alleged FCPA violations related to projects involving Brazil’s state-owned energy company Petróleo Brasileiro S.A. – Petrobras.

SHI agreed to pay a criminal penalty totaling $75,481,600 – half of which it will pay to the United States, and the other half of which it will pay to Brazilian authorities with which SHI entered into MOUs and leniency agreements.[260] If SHI fails to pay the Brazilian authorities within a year of the execution of the DPA, that half will also be paid to the United States.[261]

In reaching the decision to defer prosecution, DOJ considered among other factors SHI’s “significant remedial measures,” which included increasing the headcount of its compliance function, enhancing its anti-corruption policies, and imposing heightened due diligence requirements for engaging third-party vendors.[262] DOJ noted that an independent monitor was not necessary because of these measures and the company’s agreement to make yearly compliance reports to DOJ for the term of the DPA.[263] DOJ also noted that SHI did not receive full cooperation credit because it did not meet “reasonable deadlines imposed by” DOJ and caused delays in reaching a resolution.[264] The total criminal penalty reflects a 20% reduction off the bottom of the U.S. Sentencing Guidelines range,[265] rather than the 25% reduction usually associated with full cooperation credit in the absence of voluntary self-disclosure.

Standard Chartered Bank (DPA)

On April 9, 2019, DOJ’s Money Laundering and Asset Recovery Section (“MLARS”) and the U.S. Attorney’s Office for the District of Columbia announced the amendment of their 2012 DPA with Standard Chartered Bank (“SCB”) over alleged sanctions violations.[266] The amended DPA, together with an amended agreement with the New York County District Attorney’s Office, imposes approximately $1.01 billion in additional penalties on SCB.[267] In conjunction with the amended agreements, one former employee of SCB’s Dubai operation pled guilty to conspiracy allegations, and an Iranian national, who previously engaged in business with SCB, was indicted on similar charges.[268] Notably, the agreement demonstrates that DOJ may credit a company’s remediation and compliance efforts,[269] even while perceiving it as a “repeat corporate offender.”[270] An earlier amendment of the 2012 DPA imposed a three-year compliance monitorship, which ended on March 31, 2019, and which DOJ and SCB agreed was unnecessary to extend.[271] The 2019 amended DPA marks the conclusion of a DOJ investigation commenced in 2014, before the term of the 2012 DPA had elapsed, on the basis of “new information” DOJ had learned “through an unrelated investigation.”[272] The information concerned alleged violations “which took place after the time period specified in the Factual Statement incorporated into the 2012 DPA.”[273] The amended DPA further alleges that the violations were known to SCB during the government’s initial investigation.[274] The amended SCB DPA suggests that DOJ will not hesitate to pursue additional penalties where it believes that an existing resolution was reached on the basis of an incomplete record.

Tower Research Capital LLC (DPA)

On November 6, 2019, Tower Research Capital LLC (“Tower”), a New York-based financial services firm, entered into a DPA with DOJ and the U.S. Attorney’s Office for the Southern District of Texas to resolve criminal charges concerning three former traders who allegedly engaged in unlawful trading activity in U.S. commodities markets.[275] Specifically, DOJ alleged that from approximately March 2012 until December 2013, three traders who were employees of Tower engaged in spoofing by fraudulently placing orders to buy and sell futures contracts traded on the Chicago Mercantile Exchange and the Chicago Board of Trade with the intent to cancel those orders before execution.[276] According to the DPA, these orders were “intended to, and did, inject false and misleading information about the genuine supply and demand” for these futures contracts into the markets, causing other market participants to make trading decisions that they otherwise likely would not have made.[277]

Although Tower did not voluntarily disclose the conduct, the Company otherwise received full credit for its cooperation with the investigation, including by conducting an internal investigation, voluntarily making employees available for interviews, and making factual presentations to DOJ.[278] Tower also undertook “extensive remedial measures” beginning in early 2014, including terminating the traders involved, enhancing the company’s compliance program and internal controls, and making changes to senior management and the company’s corporate governance structure.[279]

As part of the DPA, Tower agreed to pay a total of approximately $67.4 million, which comprises $24.4 million in criminal penalties, $10.5 million in disgorgement, and approximately $32.6 million in victim compensation payments.[280] Simultaneously with the DPA, Tower entered into a separate settlement with the CFTC to end parallel civil proceedings.[281] Tower agreed to pay $67.4 million to the CFTC, including a civil monetary penalty, disgorgement, and restitution, with all amounts to be offset by payments made to DOJ. According to the CFTC, this is “the largest monetary relief ever ordered in a spoofing case.”[282]