An overview of key FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from 2023.

2023 was another dynamic year of international anti-corruption enforcement. Although U.S. Foreign Corrupt Practice Act (“FCPA”) enforcement actions have remained moderate at each of the U.S. Department of Justice (“DOJ”) and Securities and Exchange Commission (“SEC”), we are seeing more enforcement activity and legal reform with a broader group of international enforcers in the global fight against cross-border corruption. This past year also saw the passage of the first U.S. federal law to address international corruption in decades, as well as the implementation of numerous DOJ policies designed to drive change in companies and within C-Suites. As the heft of this update will evidence, there are many FCPA and FCPA-related developments to discuss.

Gibson Dunn’s expertise in this area is a reflection of the complex, cutting-edge anti-corruption challenges we have the privilege of advising clients on every day, and we are honored to once again be ranked Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices for the sixth consecutive year and eighth of the last nine years.

For further analysis on anti-corruption enforcement and related developments in 2023, we invite you to register and join us for our upcoming complimentary webcast presentation on February 29, 2024: “2023 Year-End FCPA Update.”

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with corrupt intent, for the purpose of obtaining or retaining business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d) (typically referring to companies whose shares are listed on a national exchange). In this context, foreign issuers whose American Depositary Receipts (“ADRs”) or American Depositary Shares (“ADSs”) are also listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf, and that are comprised of two core components. First, the books-and-records provision requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal accounting controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a transaction that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal accounting controls deficiency.

International corruption also may implicate other U.S. criminal laws. Frequently, prosecutors from the FCPA Unit of DOJ charge non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Without question, the most prevalent amongst these “FCPA-related” charges is money laundering—a generic term used as shorthand for statutory provisions, including 18 U.S.C. § 1956, that generally criminalize conducting or attempting to conduct a transaction involving proceeds of “specified unlawful activity” or transferring funds to or from the United States, in either case to promote the carrying on of specified unlawful activity; to conceal or disguise the nature, location, source, ownership or control of the proceeds; or to avoid a transaction reporting requirement. “Specified unlawful activity” includes over 200 enumerated U.S. crimes and certain foreign crimes, including the FCPA, fraud, and corruption offenses under the laws of foreign nations. Although this has not always been the case, in recent history DOJ has frequently deployed the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is not unusual for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations, particularly if the recipient is employed by a state-owned enterprise. Finally, as covered in greater detail below, 2023 saw the passage of the Foreign Extortion Prevention Act, which directly criminalizes the solicitation or receipt of bribes by foreign officials under the federal domestic bribery statute (18 U.S.C. § 201).

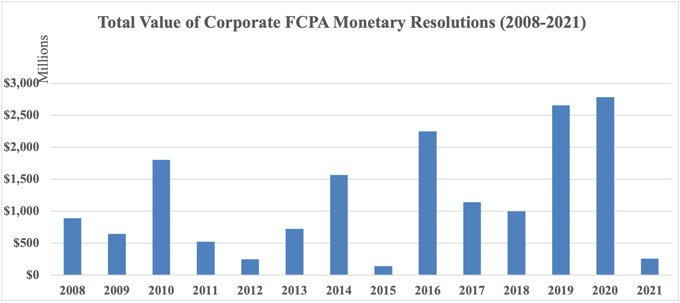

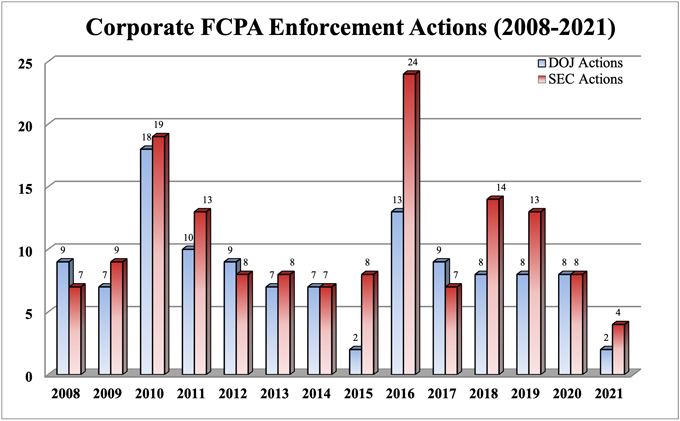

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

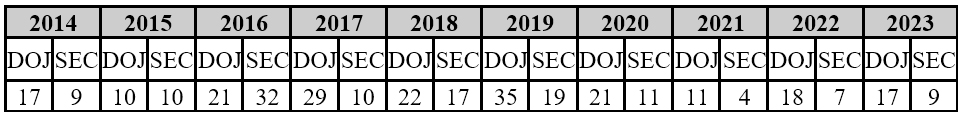

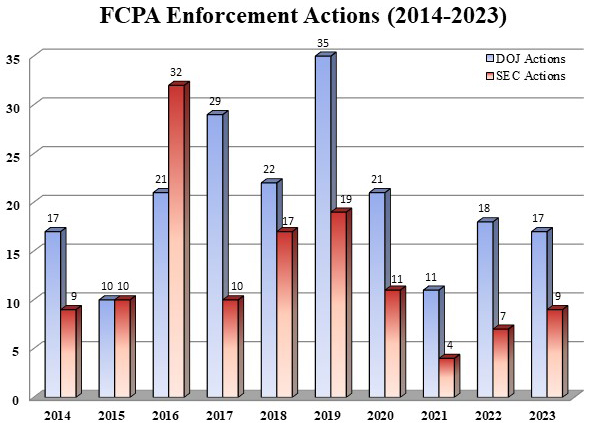

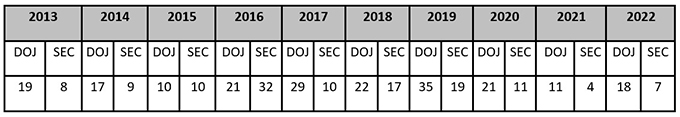

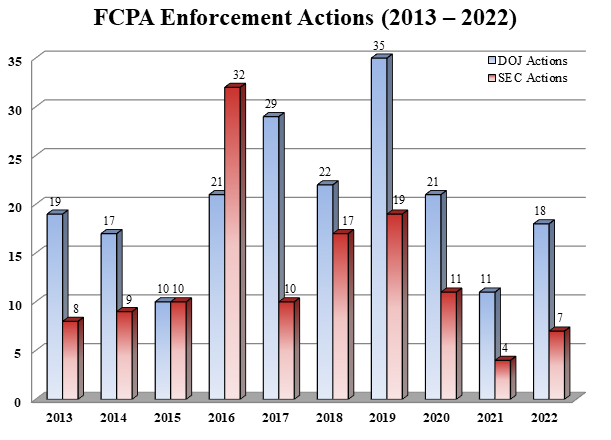

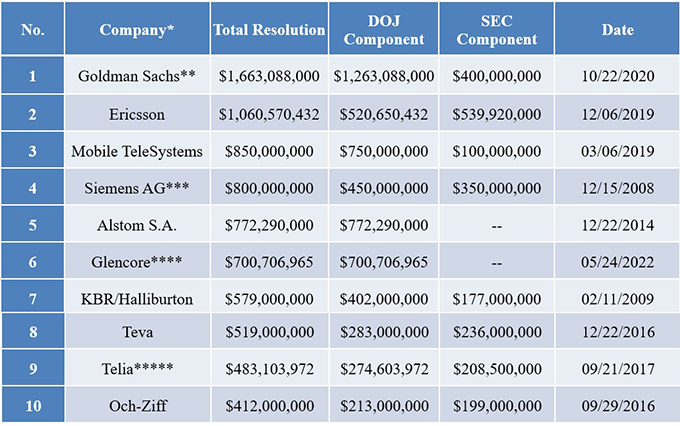

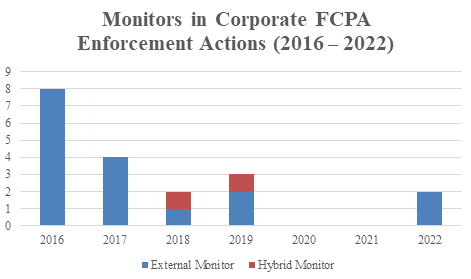

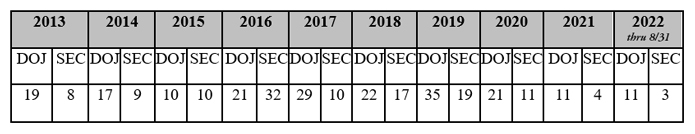

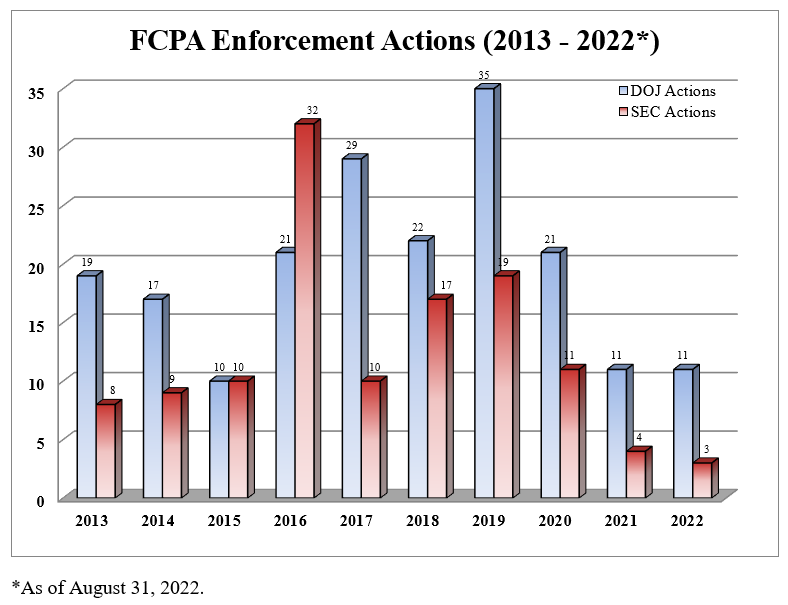

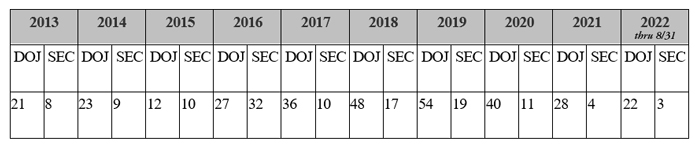

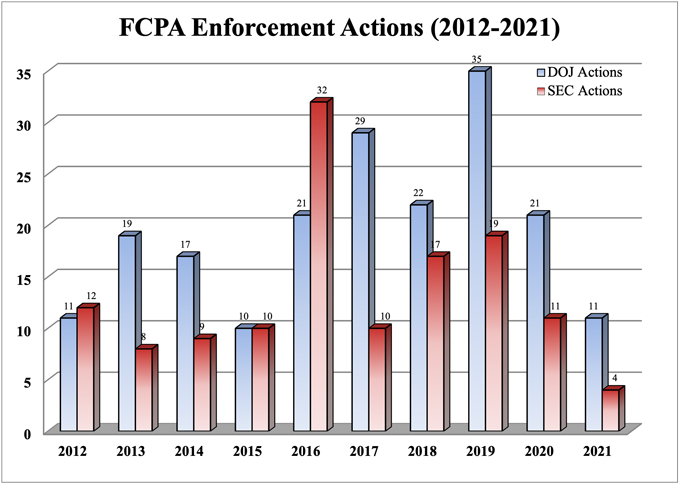

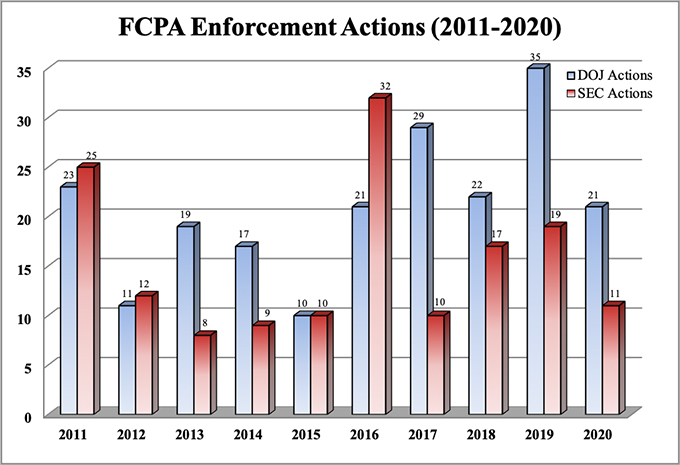

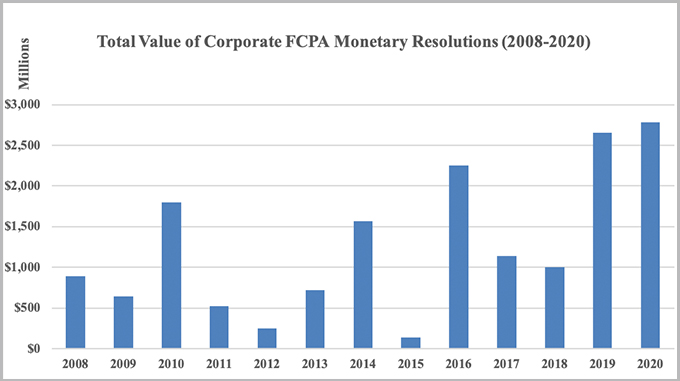

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, during the past 10 years.

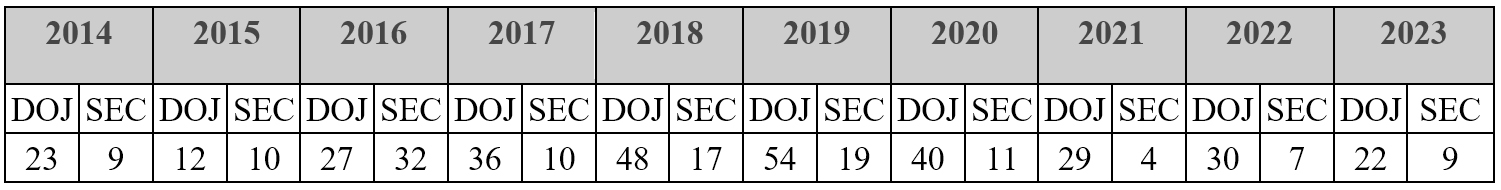

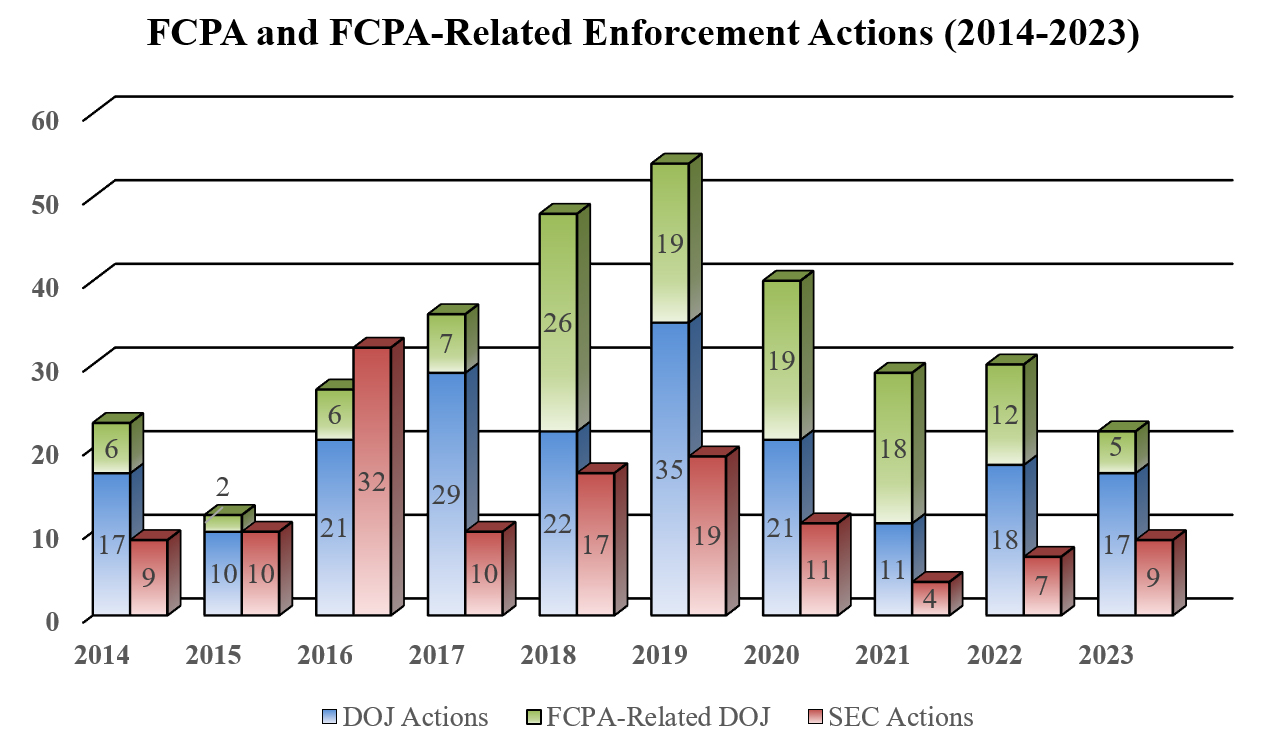

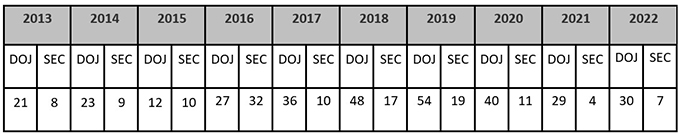

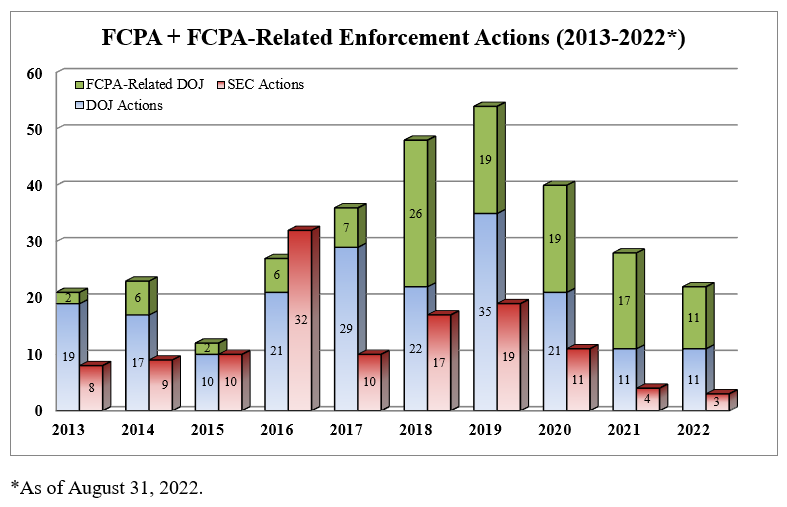

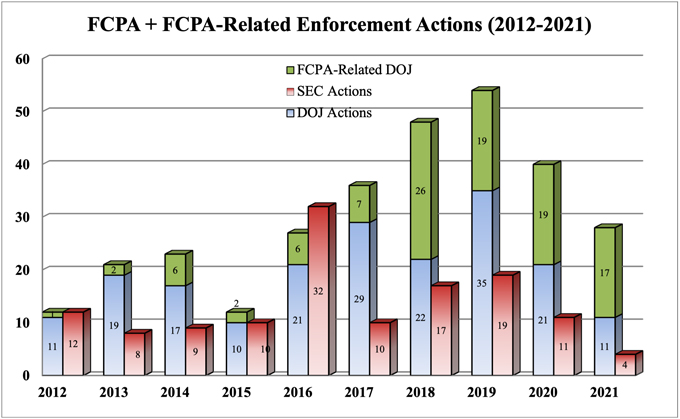

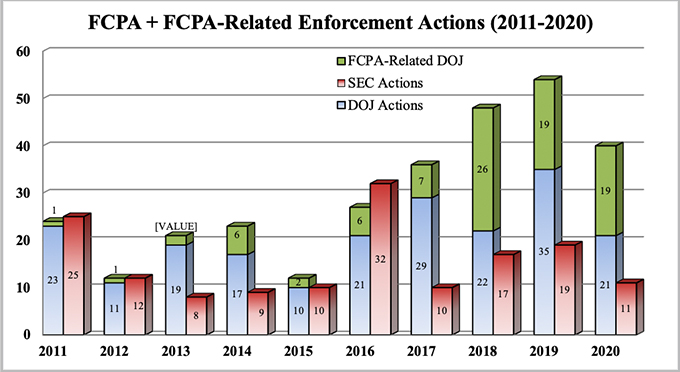

But as our readers know, the number of enforcement actions predicated on substantive FCPA charges represents only a portion of the full scope of international anti-corruption enforcement efforts by DOJ. This publication has remarked on the increasing proportion of “FCPA-related” charges for years, which can sometimes equal or even exceed criminal FCPA charges, although the relative percentage of such cases brought in 2023 was less pronounced than in recent years. The past 10 years of FCPA plus FCPA-related enforcement activity is illustrated in the following table and graph.

2023 FCPA-RELATED ENFORCEMENT TRENDS

As our readers know, our year-end FCPA updates endeavor not only to describe the year’s FCPA enforcement actions, but also to explain the patterns and trends underlying this enforcement activity. For 2023, we have identified five notable patterns from the year in FCPA enforcement, though whether they represent longer-term trends or only single-year aberrations varies by the pattern in question and may require additional time to determine:

- Tracking early returns in DOJ Corporate Enforcement Policy discounts;

- DOJ’s new forfeiture practice continues;

- A year of DOJ deferred and non-prosecution agreements;

- The FCPA’s dual enforcers largely go it alone; and

- LATAM continues to dominate FCPA-plus individual prosecutions.

1. Tracking Early Returns in DOJ Corporate Enforcement Policy Discounts

In a “bonus” supplement to our 2022 Year-End FCPA Update, accelerated for coverage there even though DOJ announced the policy on January 17, 2023, we covered the issuance of an updated Criminal Division Corporate Enforcement & Voluntary Self-Disclosure Policy (“Corporate Enforcement Policy”). We refer our readers to that prior update for a more fulsome analysis of this important development. But one key aspect that we have followed closely throughout the year 2023 for discussion here is DOJ’s ability to grant enhanced cooperation and remediation credit pursuant to the updated Corporate Enforcement Policy.

As covered in our 2022 Year-End FCPA Update, perhaps the most significant update to the Corporate Enforcement Policy was to substantially increase the discount from criminal penalties that companies can receive as credit for cooperating in DOJ investigations and remediating from prior compliance lapses. Under the Corporate Enforcement Policy, DOJ can now grant up to a 75% discount in voluntary disclosure cases, and 50% in non-voluntary disclosure cases, up from 50% and 25%, respectively. In most instances, this discount is applied from the bottom of the U.S. Sentencing Guidelines (“USSG” or “Guidelines”) range, although the Corporate Enforcement Policy includes enhanced guidance for increasing the point-of-departure for so-called “recidivists.”

An interesting thought exercise that becomes more and more relevant in an age of enhanced DOJ assertions of jurisdiction over even foreign-sited companies is how DOJ would treat a voluntary disclosure to a non-U.S. regulator with primary cognizance over the entity. The Corporate Enforcement Policy states that although voluntary disclosures “must ordinarily be to the Criminal Division . . . , the Criminal Division will also apply the provisions of this Policy where a company made a good faith disclosure to another office or component of the Department of Justice.” This leaves silent how DOJ would treat voluntary disclosure to a foreign regulator that only later comes to the attention of DOJ.

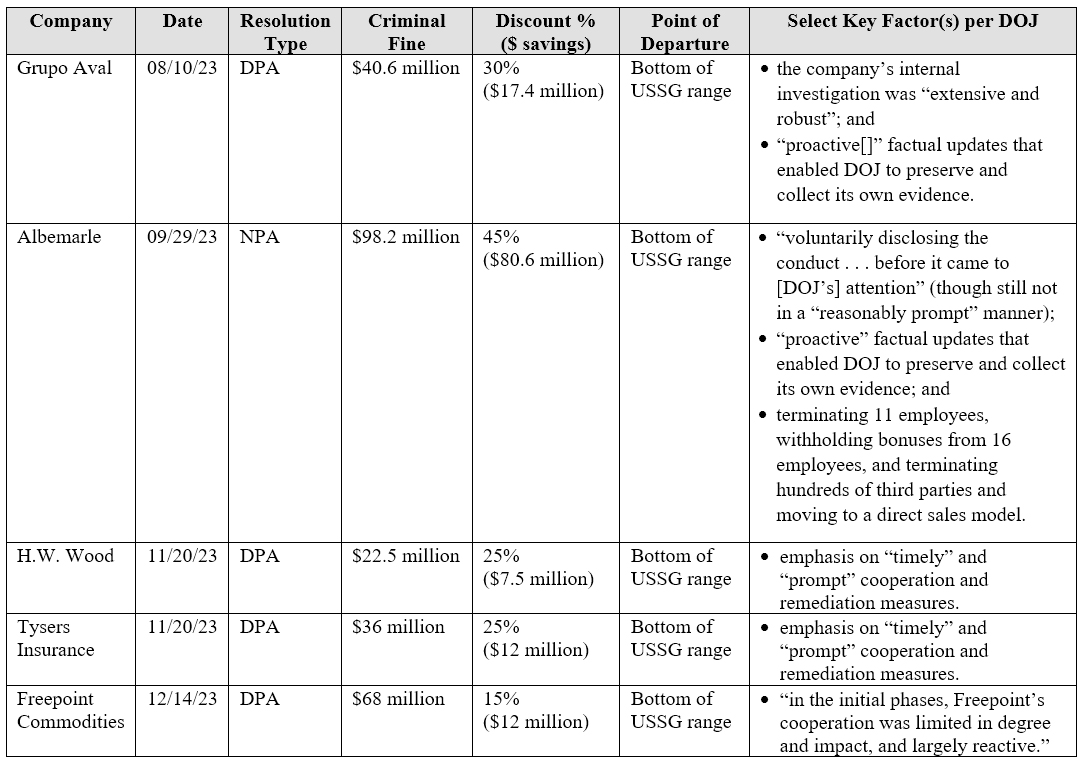

In 2023, there were five corporate FCPA enforcement actions resolved with criminal fines pursuant to DOJ’s Corporate Enforcement Policy. None of the five cases involved “voluntary disclosures” eligible for the enhanced 75% discount (but see the Albemarle discussion below), and indeed typically such cases are resolved as “declinations with disgorgement” where there is no criminal fine as in the Corsa Coal and Lifecore Biomedical cases discussed separately herein. In all five cases, the discount was applied from the bottom of the Guidelines range. But consistent with DOJ’s prognostication in announcing the enhanced discounts, the maximum 50% credit available in non-disclosure cases has not become “the new norm”—indeed, there is yet to be a 50% credit granted under the Corporate Enforcement Policy. The discounts awarded to date have ranged from a low of 15% to a high of 45% in corporate FCPA enforcement actions. The average discount across the five FCPA cases is 28%, which translates to an average $25.9 million in savings to the five companies.

To explain the basis for its varied discounts, DOJ has taken in each case to including a detailed list of “Relevant Considerations.” In all cases, this includes statements regarding the seriousness of the underlying offense, a recitation of the various ways in which the company cooperated, in which the company remediated, and the company’s criminal and regulatory history. Standard cooperation comments common to the five corporate FCPA prosecutions of 2023 include, among others, that the defendant:

- responded to DOJ requests;

- made factual presentations to DOJ on the company’s internal investigation findings;

- produced relevant documents (typically noting that the documents were produced from foreign jurisdictions in manner that complied with local data privacy laws, and frequently further noting that courtesy translations were provided); and

- facilitated DOJ interviews of relevant employees (frequently noting the retention of separate counsel to represent these employees).

Standard remediation comments common to the resolutions include, among others, that the defendant:

- conducted a root cause analysis of the illegal conduct identified during the investigation;

- invested in improving its compliance program governance and resources;

- took appropriate disciplinary action against employees found to have been involved in misconduct; and

- committed to continue enhancing its compliance program and internal controls, consistent with the minimum elements set forth in the standard Attachment C (Corporate Compliance Program) to the resolution agreement.

Where companies appear to have distinguished themselves in this early set of cases is on the cooperation side by providing “proactive” updates to DOJ, especially where it enabled DOJ to preserve and collect further evidence on its own, and on the remediation side by terminating and/or withholding bonuses from numerous culpable employees, and also by restructuring the company’s go-to-market strategy to reduce reliance on third parties. Below is a chart summarizing the Corporate Enforcement Policy discount details across the five DOJ corporate FCPA resolutions of 2023, followed by descriptions of the first two cases (with the remaining three covered in the following section):

Grupo Aval S.A.

In the first corporate criminal FCPA prosecution announced under the new Corporate Enforcement Policy, Colombian financial holding company and U.S. issuer Grupo Aval reached a joint FCPA resolution with DOJ and the SEC on August 10, 2023. According to the charging documents, a senior executive of a minority-owned joint venture established by Grupo Aval to bid on the largest highway construction project in Colombia’s history (Ruta del Sol II) became aware of bribes that the majority joint venture partner agreed to pay government officials to obtain additional work in connection with the project. In total, the executive caused the joint venture to pay more than $20 million in corrupt payments to Colombian officials between 2014 and 2016, funded through sham invoices.

To resolve the matter, Grupo Aval subsidiary Corficolombiana entered into a deferred prosecution agreement with DOJ charging a conspiracy to violate the FCPA’s anti-bribery provisions and agreed to pay a $40.6 million criminal penalty, which as noted above reflected a 30% Corporate Enforcement Policy discount from the bottom of the Guidelines range. But DOJ agreed to credit up to half of that amount to a penalty imposed by Colombia’s Superintendencia de Industria y Comercio, so long as the subsidiary dropped its appeal of this penalty in Colombia, leading DOJ to proclaim this as the first coordinated anti-corruption resolution of its kind with Colombian authorities. As part of the three-year agreement, Corficolombiana agreed to provide periodic reports to DOJ regarding its remedial efforts, but there was no compliance monitor imposed. Simultaneously, Grupo Aval consented to an SEC order finding FCPA bribery and accounting violations and imposing more than $40.2 million in disgorgement plus prejudgment interest, bringing the combined financial resolution to greater than $80 million. DOJ alleged that the majority joint venture partner who coordinated much of the alleged bribery was Brazilian construction company Odebrecht S.A., whose multi-country anti-corruption resolution covered in our 2016 Year-End FCPA Update continues to reverberate the better part of a decade later.

Albemarle Corporation

In the only other joint FCPA enforcement action of the year, on September 29, 2023 DOJ and the SEC announced FCPA resolutions with North Carolina-based specialty chemicals manufacturing company Albemarle. The charging documents collectively allege that Albemarle engaged in a conspiracy to make millions of dollars in corrupt payments to government officials in India, Indonesia, and Vietnam between 2009 and 2017 to obtain business from state-owned entities in these countries, including by structuring tender requirements to favor Albemarle, providing confidential information about competitors, and to keep the company from being blacklisted. The SEC then alone extended its allegations to contend that the company additionally engaged in private-sector bribery in India and failed to maintain adequate controls and accurate and complete records regarding third-party payments in China and the United Arab Emirates.

To resolve DOJ’s allegations of conspiracy to violate the FCPA’s anti-bribery provision, Albemarle entered into a three-year non-prosecution agreement and agreed to pay a criminal fine of $98.2 million plus forfeiture of $98.5 million, the former of which reflected a 45% Corporate Enforcement Policy discount from the bottom of the Guidelines range and the latter of which was substantially offset by the SEC disgorgement resolution. To resolve the SEC’s charges of FCPA bribery and accounting violations, Albemarle consented to the filing of an administrative cease-and-desist proceeding and to pay $103.6 million in disgorgement plus prejudgment interest, with no penalty assessed in light of the DOJ criminal fine. After offsets between the two resolutions, the total resolution amount was approximately $218 million.

Far and away the most controversial aspect of the Albemarle resolution was DOJ’s refusal to credit the company’s voluntary disclosure as such. There was no dispute that Albemarle voluntarily disclosed the conduct to DOJ and the SEC prior to either agency being aware of it. But DOJ took the position that the voluntary disclosure was not “reasonably prompt,” a prerequisite for getting voluntary disclosure treatment under the Corporate Enforcement Policy. Specifically, DOJ alleged that Albemarle learned of the initial allegations in Vietnam 16 months prior to disclosure, and was able to confirm the conduct at least nine months prior to the disclosure. The company then took remedial action and expanded the investigation to cover other geographies, but did not disclose the initial conduct in Vietnam until it disclosed four geographies all at once 16 months after the initial allegations. Reminiscent of the ABB resolution covered in our 2022 Year-End FCPA Update—where DOJ refused to credit a disclosure as voluntary where counsel had contacted DOJ to schedule a disclosure meeting without naming the subject matter, and then after the initial contact but before the meeting the underlying allegations were reported in the press—DOJ refused to treat Albemarle’s disclosure as voluntary for purposes of the Corporate Enforcement Policy, which would have entitled the company to a presumption of a declination. Nonetheless, DOJ did purport to give “significant weight” to the disclosure, including in determining the appropriate disposition (non-prosecution agreement) and Corporate Enforcement Policy discount (45% below the bottom of the Guidelines range), the latter of which is the highest figure granted to date under the Corporate Enforcement Policy and its predecessors.

Of final note from the Albemarle resolution is that it represented the first credit pursuant to Part II of the Criminal Division’s Compensation Incentives and Clawbacks Pilot Program from March 2023, discussed below. Specifically, DOJ reduced Albemarle’s criminal fine by $763,453 as dollar-for-dollar credit in bonuses the company withheld from employees deemed by the company to be culpable for the misconduct. These credits can under the right circumstances have a double impact, in that companies may both save the bonus (assuming litigation does not ensue and overtake the benefit) and get the reduction from their penalty. But the fact that the credit amounts to a fraction of one percent of the overall resolution, or even just the criminal penalty, underscores the commentary that this program has received as not being meaningful in most cases.

2. DOJ’s New Forfeiture Practice Continues.

In our 2022 Mid-Year FCPA Update, we noted an unusual and even unprecedented aspect of the May 2022 Glencore FCPA enforcement action. Specifically, Glencore was the first corporate defendant in the history of the FCPA (to our knowledge) to agree to pay a gain-based criminal forfeiture judgment on top of a criminal fine that was itself premised on gain. To be sure, there have been many other examples of modest forfeiture components of FCPA corporate criminal enforcement actions, as well as certain DOJ components (e.g., the U.S. Attorney’s Office for the Southern District of New York) that have a history of imposing forfeiture on top of gain-based criminal fines in non-FCPA cases. Further, our readers will be familiar with the fact that issuers have long been required to disgorge profits to the SEC on top of gain-based criminal fines imposed by DOJ in joint FCPA enforcement actions. But our research shows that in the first 45 years of the FCPA—and across nearly 50 different cases against non-issuer companies pre-Glencore—DOJ did not impose gain-based forfeiture on top of a gain-based criminal fine.

At the time, Glencore was just a single example, and DOJ made no announcement to suggest it had changed its approach in FCPA cases. Indeed, quite to the contrary as covered in these updates, DOJ’s corporate FCPA enforcement policy announcements of recent years had been heavily seasoned with the flavor of all the benefits companies may receive from disclosure, cooperation, and remediation. But DOJ’s final three corporate FCPA prosecutions of 2023 (all against non-issuers) continued the “Glencore trend,” imposing sizeable gain-based forfeiture on top of sizeable criminal penalties. And then finally, at the ACI FCPA Conference in November 2023, Acting Assistant Attorney General Nicole M. Argentieri confirmed the practice by stating that in non-issuer cases DOJ is now “requiring . . . that, in addition to paying any required criminal penalty, companies must pay appropriate forfeiture” such that “issuers and non-issuers [will be treated] alike” in “both pay[ing] applicable fines and forego[ing] the proceeds of their criminal activity.” DOJ has yet to issue an official policy to this effect, which stands in stark contrast to the proliferation of more “corporate-friendly” policies issued in 2023 as discussed herein, but clearly this appears to be DOJ’s position until it is challenged.

H.W. Wood Ltd. & Tysers Insurance Brokers Ltd.

On November 20, 2023, DOJ announced separate but related FCPA conspiracy charges against UK reinsurance brokers H.W. Wood and Tysers Insurance. DOJ alleged that each company paid millions of dollars to an intermediary between 2013 and 2017 while knowing the intermediary would bribe various Ecuadorian government officials to secure insurance and reinsurance business with state-owned insurance companies Seguros Sucre S.A. and Seguros Rocafuerte S.A.

To resolve the charges, each company entered into a three-year deferred prosecution agreement. H.W. Wood agreed to a criminal fine of $22.5 million and $2.3 million in forfeiture, but established an inability to pay under DOJ policy that reduced the financial penalty to only a $508,000 fine. Tysers Insurance agreed to pay a criminal fine of $36 million plus approximately $10.5 million in forfeiture. Both companies’ criminal fines reflected a 25% Corporate Enforcement Policy discount for cooperation and remediation, and neither company received a compliance monitor.

Both of these resolutions arise out of the same matter in which Gibson Dunn negotiated a “declination with disgorgement” resolution for Jardine Lloyd Thompson Group Holdings Ltd., as reported in our 2022 Year-End FCPA Update. There and in prior updates we also covered separate criminal FCPA and money laundering charges brought against eight individual defendants, including the former chairman of Seguros Sucre and Seguros Rocafuerte who allegedly received the H.W. Wood and Tysers insurance bribes, as well as intermediary Esteban Merlo Hidalgo who allegedly paid them.

Freepoint Commodities LLC

In the final corporate FCPA enforcement action of the year, on December 14, 2023 DOJ and the Commodity Futures Trading Commission (“CFTC”) announced a joint resolution with Connecticut-based commodities trading company Freepoint Commodities arising out of allegations that it paid bribes to secure business with Brazilian state-owned oil company, Petróleo Brasileiro S.A. – Petrobras (“Petrobras”). The government alleged that between 2012 and 2018, Freepoint made nearly $4 million in corrupt payments to Petrobras officials in exchange for confidential information about pricing and bids submitted to Petrobras by Freepoint’s competitors.

To resolve the corruption allegations, Freepoint entered into a deferred prosecution agreement with DOJ and agreed to pay a $68 million criminal fine, reflecting a 15% Corporate Enforcement Policy discount from the bottom of the Guidelines range, and additionally pay $30.5 million in criminal forfeiture. In parallel, Freepoint also entered into a civil resolution with the CFTC agreeing to pay a $61 million civil penalty and $30.5 million in disgorgement, but the civil penalty was completely offset by the DOJ criminal fine and DOJ and the CFTC agreed to offsetting credits between the forfeiture and disgorgement such that 75% went to DOJ and 25% to the CFTC. In total, Freepoint paid $98.5 million between the two U.S. settlements, and DOJ has provisioned for a credit of up to $22.4 million off of the criminal fine for a resolution with Brazilian authorities, although no such resolution has yet been announced. The joint DOJ / CFTC corruption-related resolution in Freepoint—in which the corruption is charged by the latter as “manipulative and deceptive conduct” under the Commodity Exchange Act—is the third of its kind following Glencore (discussed in our 2022 Year-End FCPA Update) and Vitol (discussed in our 2020 Year-End FCPA Update).

Related to the Freepoint Commodities case, in 2023 DOJ announced criminal charges against three individual defendants: Gary Oztemel, Glenn Oztemel, and Eduardo Innecco. An indictment charging Freepoint trader Glenn Oztemel and third-party agent Innecco with FCPA and money laundering arising out of the alleged Petrobras corruption scheme was unsealed on February 17. Glenn’s brother Gary Oztemel, who works at another oil trading company, was subsequently indicted on similar charges on August 29. The two Oztemel brothers have been released on bail, pending a September 2024 trial date. Innecco has yet to make an appearance and appears to be outside of the United States. In a final case connection, it appears that one of the officials who allegedly received the corrupt payments was Rodrigo Berkowitz, who worked at Petrobras’ U.S. arm in Houston, Texas, and previously pleaded guilty to conspiracy to commit money laundering as covered in our 2020 Year-End FCPA Update.

3. A Year of DOJ Deferred and Non-Prosecution Agreements.

The careful reader of our Corporate Enforcement Policy chart in Section 1 above will note that all of the new corporate FCPA prosecutions of 2023 were resolved (at least at the top level) as deferred and non-prosecution agreements. In a vacuum, this may seem in tension with pronouncements by DOJ officials purporting to scrutinize more carefully the grant of these so-called pretrial diversion agreements under the various memoranda issued by Deputy Attorney General Lisa O. Monaco discussed in our 2021 and 2022 year-end FCPA updates. Time will tell whether 2023 was an aberration or the start of a more permissive trend in corporate enforcement. But it is notable that the one parent-level guilty plea in an FCPA case from 2023 was a breach declaration from a 2019 deferred prosecution agreement.

We discuss this, and the two “declination with disgorgement” letters issued in 2023, below.

Telefonaktiebolaget LM Ericsson DPA Breach

On March 2, 2023, DOJ announced that Swedish multinational telecommunications company Ericsson had agreed to plead guilty in connection with its 2019 FCPA resolution following DOJ’s determination that the Company had breached its prior deferred prosecution agreement. As covered in our 2019 Year-End FCPA Update, Ericsson entered into the earlier deferred prosecution agreement to resolve FCPA charges with DOJ arising out of alleged corruption in China, Djibouti, Indonesia, Kuwait, Saudi Arabia, and Vietnam. In 2023, DOJ revoked the 2019 deferred prosecution agreement and Ericsson agreed to plead guilty to the original criminal charges, pay a fine of $206,728,848, and agreed to extend its pre-existing monitorship and associated term of probation by one year, through June 2024.

The Ericsson breach declaration demonstrates DOJ’s focus on corporate compliance with post-resolution terms imposed by deferred prosecution and other “pretrial diversion” agreements. Notably, DOJ does not charge or even allege new criminal conduct (which is why this case is not reflected in the 2023 statistics above). Rather, DOJ asserts that Ericsson violated the cooperation and disclosure provisions of the 2019 agreement by failing to disclose promptly all evidence related to the previously charged conduct in Djibouti and China, as well as failing to disclose adequately certain other activities in Iraq. Of further note, DOJ alleged that company leadership instructed its counsel to disclose to DOJ the conduct in Iraq, but that “prior outside counsel omitted material facts and information” in their reporting. DOJ credited Ericsson for “significantly enhanc[ing] its cooperation and information sharing efforts” after this matter came to light. Gibson Dunn represented the company in the 2023 resolution (but was not “prior outside counsel”).

The Ericsson case is only one of two cases in which DOJ has revoked a deferred prosecution agreement and demanded a guilty plea in a corporate FCPA case. As reported in our 2008 Year-End FCPA Update, in November 2008 DOJ alleged a breach of Aibel Group’s 2007 deferred prosecution agreement arising out of alleged corruption in Nigeria, after which Aibel Group pleaded guilty to the underlying charges. Further, as discussed in our 2017 Mid-Year FCPA Update, DOJ once entered into a second deferred prosecution agreement based in part on allegations of breaches arising during the term of the first agreement in the January 2017 Zimmer Biomet case.

Corsa Coal Corp. Declination with Disgorgement

On March 8, 2023, DOJ issued its first “declination with disgorgement” letter of the year to Pennsylvania coal company Corsa Coal. The letter alleges that between 2016 and 2020, Corsa Coal employees paid $4.8 million to a consultant while knowing that portions of those fees would be used to make corrupt payments to officials of an Egyptian state-owned coke and chemical production company, including its chairman. Corsa Coal allegedly secured $143 million in contracts as a result of these payments, and earned $32.7 million in illicit profits.

In conjunction with DOJ’s declination, Corsa Coal agreed to pay $1.2 million in disgorgement, an amount substantially reduced from realized gains based on DOJ’s Inability-to-Pay Guidance and a determination that further payment would “substantially threaten” the company’s ongoing viability. In declining to prosecute Corsa Coal, DOJ noted the company’s voluntary disclosure, cooperation, and remediation efforts.

We covered the guilty plea of former Corsa Coal International Sales Head Frederick Cushmore, Jr. and indictment of former Vice President Charles Hunter Hobson, respectively, in our 2021 Year-End and 2022 Mid-Year FCPA updates. As of this writing, there is yet to be a trial date set in the Hobson case.

Lifecore Biomedical, Inc. Declination with Disgorgement

In the year’s second of two “declinations with disgorgement,” on November 16, 2023 DOJ announced that it was declining to prosecute Lifecore for allegedly corrupt payments made in 2018 and 2019 by a former subsidiary to Mexican government officials to secure a wastewater discharge permit and avoid various wastewater discharge expenses. Notably, the alleged payments began prior to Lifecore’s acquisition of the subsidiary, were affirmatively hidden from Lifecore during due diligence, and then were discovered during post-acquisition integration as the payments continued under the ownership of Lifecore. Relevant to the Albemarle disclosure discussion above, DOJ made a point of noting that Lifecore reported the matter to DOJ within three months of discovering the possible misconduct, and within hours of the internal investigation confirming the alleged corruption. This was deemed to be a “reasonably prompt” report qualifying as a “voluntary disclosure” for purposes of the Corporate Enforcement Policy.

To resolve the matter, Lifecore agreed to DOJ’s statement of facts and consented to disgorge just over $400,000. The disgorgement amount was set based on the costs Lifecore allegedly avoided having to pay to Mexican regulatory authorities through the purported corrupt payments, with credits for remediation costs Lifecore already had paid after discovering the misconduct.

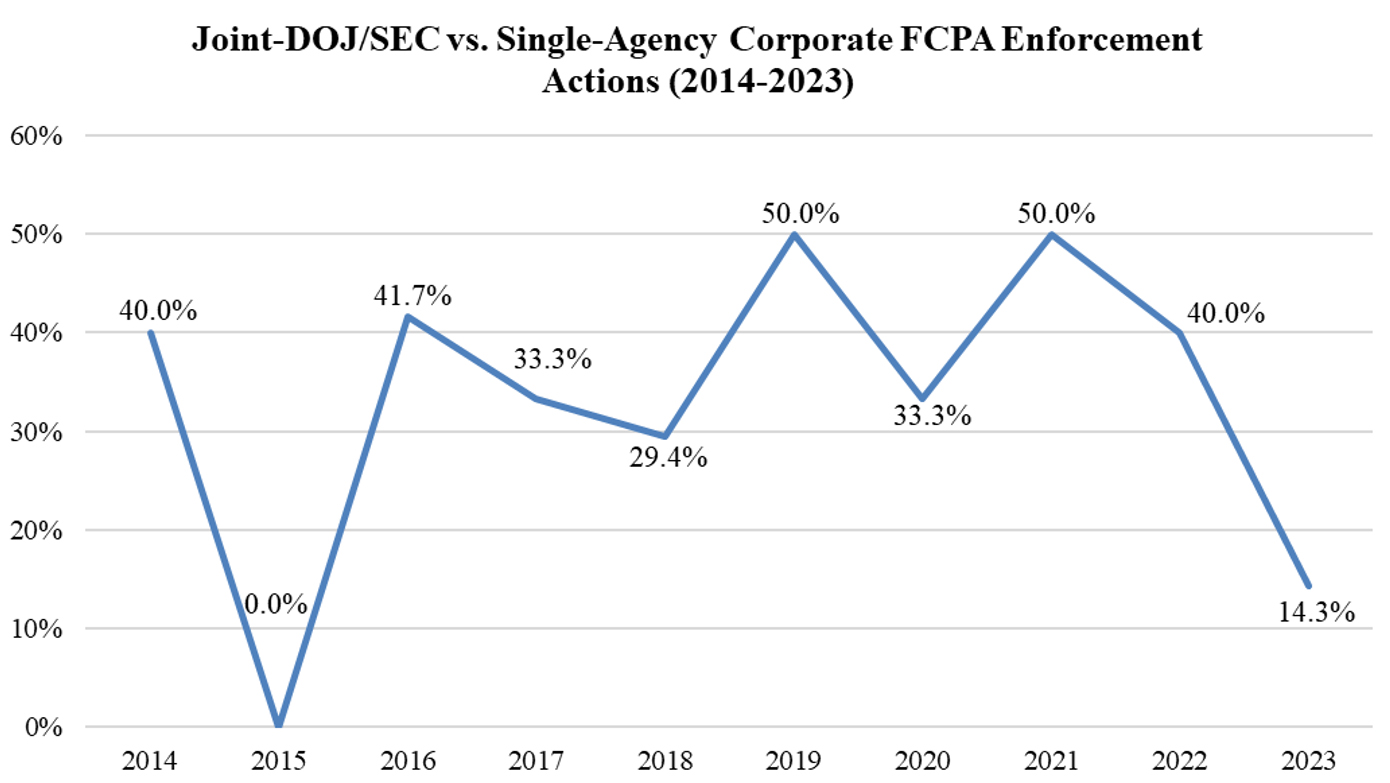

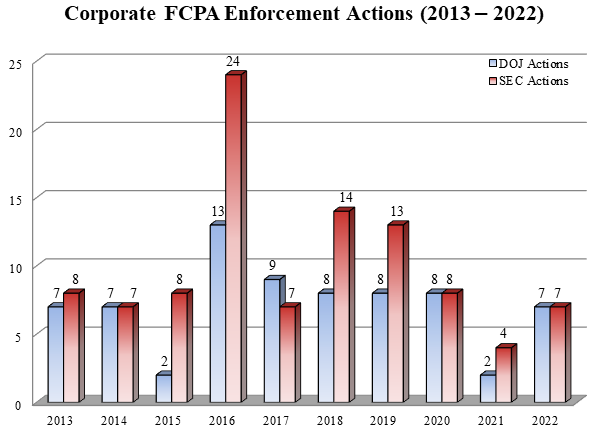

4. The FCPA’s Dual Enforcers Largely Go it Alone in 2023.

Several of the principal authors of this update have been known to say on more than one occasion that DOJ and the SEC—the FCPA’s dual enforcers—”work hand in glove.” The closeness of the working relationship between the specialized FCPA Units of each agency has historically been borne out in a heavy overlap in enforcement actions—especially corporate enforcement actions. But that was not the case in 2023.

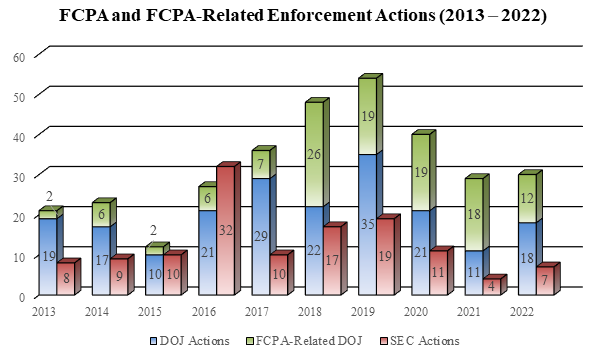

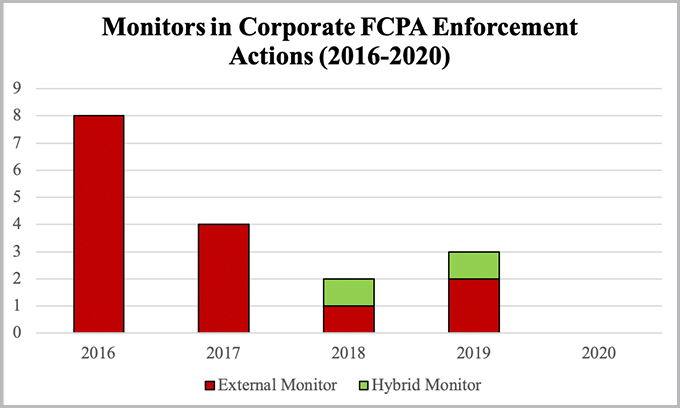

In 2023, only 2 of 14 corporate FCPA enforcement actions were dually brought by DOJ and the SEC. That is substantially lower than historical averages, and indeed is the lowest percentage of overlap in corporate enforcement actions since 2015, where we also noted the lack of duality in our 2015 Year-End FCPA Update. There will always be corporate cases that cannot, or should not, be brought jointly by both agencies, such as prosecutions against non-issuers or where the evidence of non-compliant conduct does not meet the higher standard required for criminal prosecution. Nonetheless, those dynamics have been static over the years studied and the departure in 2023 enforcement numbers is noteworthy, though we expect more a blip than a trend.

A line graph summarizing the percentage of overlap in DOJ / SEC corporate FCPA enforcement actions over the past 10 years follows. The two examples of joint actions in 2023 (Albemarle and Grupo Aval) are covered above, and the seven SEC-only actions are covered below the graph. We will continue to study the degree of overlap in corporate FCPA enforcement in the year ahead to see if this is a blip or a trend.

Flutter Entertainment plc

The first SEC-only FCPA enforcement action of the year came on March 6, 2023, when Irish sports betting and gaming company Flutter resolved a corruption case arising out of Russia. According to the SEC’s order, Flutter (then operating as The Stars Group, Inc.) paid nearly $9 million to Russian consultants between 2015 and 2020 in an apparently unsuccessful effort to legalize online poker in the country. The SEC alleged that Flutter failed to perform risk-based diligence prior to hiring the consultants, entered into contracts that did not contain anti-corruption provisions, and failed to review expense reimbursements submitted by the consultants, which caused the company to reimburse expenses that did not comply with its own policies.

To resolve the FCPA books-and-records and internal controls charges, and without admitting or denying the findings, Flutter agreed to pay a $4 million civil penalty. The SEC noted the company’s cooperation and remediation efforts, which included exiting the Russian market following Russia’s invasion of Ukraine, and did not require any further, forward-looking compliance undertakings. The status of any DOJ investigation, if there is one, is not known.

Rio Tinto plc

Also on March 6, 2023, the SEC announced FCPA books-and-records and internal controls charges against global mining and metals company and ADS issuer Rio Tinto arising out of its iron ore operations in Guinea. According to the SEC’s order, Rio Tinto hired a consultant who had no experience in the industry or country because he was a former classmate with close connections to a senior Guinean official who had influence over a disputed mining concession belonging to Rio Tinto. Without substantial evidence of services performed, the company allegedly paid the consultant $10.5 million, several days after which the consultant attempted to transfer over $800,000 to a Hong Kong company purportedly owned by someone with ties to the senior government official and other Guinean officials. The processing bank blocked that payment, but thereafter the same Hong Kong company allegedly commissioned $200,000 worth of t-shirts to support the senior Guinean official’s reelection campaign.

To resolve the charges, Rio Tinto agreed to pay a $15 million civil penalty. There was no disgorgement because the company did not ultimately develop the mining concession. The SEC credited Rio Tinto’s cooperation and remedial efforts, and did not require any further, forward-looking compliance undertakings. There is no indication that DOJ will take separate action. For its part, the UK Serious Fraud Office has announced the closure of its investigation, in part due to the company’s resolution with the SEC and a separate enforcement action described below against the consultant who allegedly made the payment to the senior Guinean official by the French National Financial Prosecutor’s Office.

Frank’s International N.V.

On April 26, 2023, the SEC announced a resolved FCPA enforcement action against Dutch oilfield services provider Frank’s International. The SEC alleged that Frank’s International retained and paid substantial commissions to an agent while allegedly knowing the agent had close relationships with officials of Angola’s state-owned oil company Sonangol, and further that the agent did not have any relevant technical expertise. Notably, the company retained the agent prior to listing on the New York Stock Exchange, but allegedly continued the commission payments after becoming an issuer. The SEC also asserted that Frank’s International did not perform any due diligence on the agent, and only created a backdated agreement long after engaging the agent.

Without admitting or denying the SEC’s allegations, Frank’s International agreed to pay a $3 million civil penalty plus nearly $5 million in disgorgement and prejudgment interest. The SEC acknowledged the company’s self-reporting and cooperation, which appear to have occurred after Frank’s was acquired by another company, and did not require any further, forward-looking compliance undertakings. Frank’s International’s successor has reported that DOJ has closed its parallel investigation without charges against the company.

Koninklijke Philips N.V.

In another SEC-only FCPA enforcement action, on May 11, 2023, Dutch medical supplier Koninklijke Philips agreed to resolve books-and-records and internal controls charges arising from the company’s use of distributors in China. According to the SEC’s order, between 2014 and 2019, Koninklijke Phillips subsidiaries in China provided special price discounts to distributors, which allegedly “created a corruption risk that the increased margins could be used to fund improper payments to employees of government-owned hospitals.” The SEC further alleged that these subsidiaries engaged in improper bidding practices, such as influencing hospital officials to tailor specifications to favor the companies’ products and preparing false “complementary bids” to provide an inaccurate sense of competition.

To resolve the allegations, and without admitting or denying the SEC’s findings, Koninklijke Philips agreed to pay approximately $62.2 million, consisting of a $15 million civil penalty and the balance to disgorgement and prejudgment interest. The company also agreed to self-report to the SEC on the status of its FCPA compliance program for a two-year period. The SEC noted that it had previously charged Koninklijke Philips in 2013 for alleged FCPA misconduct in Poland, as covered in our 2013 Mid-Year FCPA Update. The company announced that DOJ has closed its parallel investigation into the more recent matter without filing any charges.

Gartner, Inc.

On May 26, 2023, Connecticut-headquartered technological research and consulting company Gartner resolved FCPA bribery and accounting charges with the SEC. The SEC’s order alleged that, from roughly December 2014 through August 2015, Gartner entered into subcontracts with a South African IT consulting company and subagents that allegedly had close ties to officials in the South Africa Revenue Service. The SEC claimed that Gartner knew or consciously disregarded the risk that all or part of the money it paid to the consulting company would be used to bribe revenue officials to influence the award of sole-source contracts to Gartner, and that the justification for using this consultant was false because neither it nor its subagents qualified for the Broad-Based Black Economic Empowerment legislation that was the purported basis for the consultant’s retention. The SEC further alleged that the company maintained false records and deficient controls relating to the retention of consultants.

Without admitting or denying the SEC’s findings, Gartner agreed to pay a $1.6 million civil penalty and pay $856,764 in disgorgement plus prejudgment interest. The SEC recognized Gartner’s self-disclosure, following press reports in South Africa, as well as the company’s cooperation, and did not require any additional, forward-looking compliance undertakings.

U.S.-Based Multinational Company

On August 25, 2023, the SEC announced a settled FCPA resolution with a U.S.-based multinational conglomerate. According to the SEC’s order, between approximately 2014 and 2018, employees of the company’s Chinese subsidiary allegedly arranged for influential Chinese healthcare officials from various state-owned entities to attend overseas conferences, healthcare facility visits, and other educational events, including to the United States. The SEC suggested that the true purpose of the trips was to encourage the officials to purchase the company’s products, though it seemed unable to establish a quid pro quo connection between the trips and any business awarded to the entity. Still, the SEC’s theory was that employees allegedly submitted one set of travel itineraries emphasizing the educational purposes of the trips for compliance review, while at the same time maintaining secret, alternate itineraries for the government officials that included tourism and entertainment activities unrelated to the company’s business operations, thus falsifying corporate books and records. Finally, the SEC alleged that the employees submitted vaguely described payments to travel agencies to obtain reimbursement of otherwise non-reimbursable expenses associated with the trips.

To resolve the matter, and without admitting or denying the SEC’s allegations concerning FCPA books-and-records and internal controls charges, the company agreed to pay nearly $4.6 million in disgorgement and prejudgment interest, plus a $2 million civil penalty. The SEC credited the company for its prompt and voluntary self-reporting and cooperation, as well as undertaking substantial remedial measures. It appears that DOJ’s investigation into the matter has been closed.

Clear Channel Outdoor Holdings Inc.

In the year’s final SEC-only FCPA enforcement action, on September 28, 2023 Texas-based out-of-home advertising company Clear Channel agreed to resolve charges arising out of alleged corruption in China. According to the SEC’s order, from 2012 to 2017, Clear Channel’s Chinese subsidiary made improper payments and gifts to Chinese government officials in an effort to obtain advertising display contracts with local Chinese government transport authorities. These payments and other items of value were allegedly provided directly and by inflating third-party vendor contracts to maintain the outdoor advertising displays. The subsidiary also allegedly created a so-called “off-book fund” by creating false invoices used to justify employee cash withdrawals that were then provided to un-diligenced third parties with whom the subsidiary had no contracts in order to facilitate business development activities. Finally, the SEC alleged that these activities occurred at the subsidiary despite multiple internal audits flagging various bribery risks in China, and that the control deficiencies continued throughout 2019.

To resolve the matter, and without admitting or denying the allegations, Clear Channel consented to the filing of FCPA bribery and accounting charges and to pay a total of $26.2 million in penalties, disgorgement, and prejudgment interest. Reportedly in part due to its inability to remediate the issues raised in the SEC order, Clear Channel divested its interest in the Chinese subsidiary in 2020. The SEC credited Clear Channel’s cooperation with the SEC and remediation, and did not require any post-resolution reporting. According to the company, DOJ has closed its investigation without filing any charges.

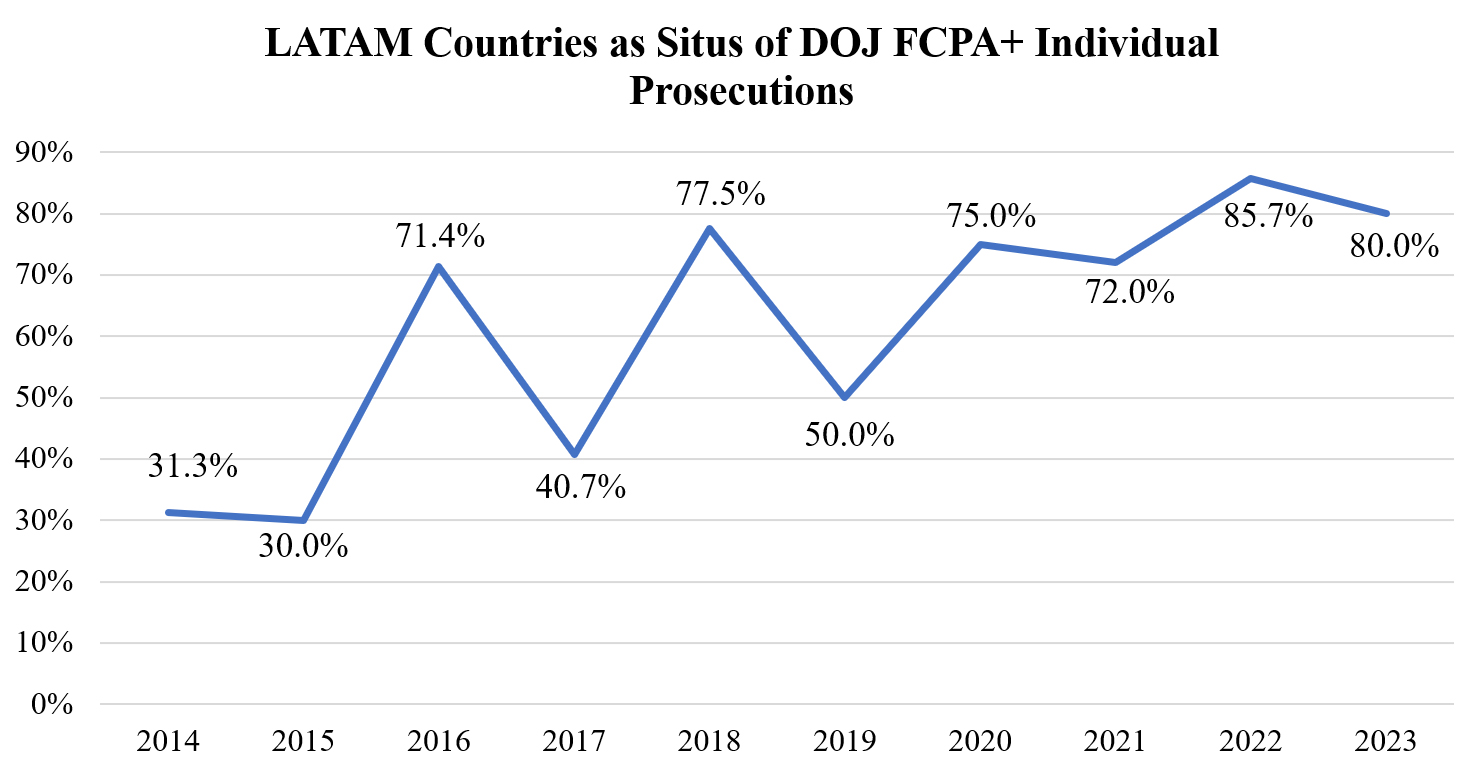

5. LATAM Continues to Dominate FCPA-Plus Individual Prosecutions.

Latin America collectively makes up about 5% of global gross domestic product, but many multiples of that as a percentage of criminal FCPA and related anti-corruption enforcement by DOJ. This is particularly the case in individual prosecutions for which, in 2023, 80% of criminal FCPA and FCPA-related prosecutions arose out of fact patterns involving Latin American countries. And this figure is not aberrant as compared to recent years in anti-corruption enforcement. Over the past 10 years, nearly 65% of criminal FCPA and FCPA-related charges brought by DOJ had a nexus to conduct occurring in Latin American countries.

There are many reasons for this, and we do not count among them that Latin America is particularly corrupt as compared to other parts of the developing world—it is not. One principal reason has to do with the degree of integration between the U.S. economy and those of its neighbors across the Americas. This is true both because of the diaspora of immigrants who have set up businesses in the United States focused on their home countries, as well as a reflection of flight to the stability of the U.S. Dollar from markets with less stable currencies, of which there are several across Latin America. Another principal reason has to do with the relationships that DOJ has established over the past decade with prosecutors across the region, starting in Brazil with the “Operation Car Wash” investigation, but also prominently with Colombian and several Central American enforcers. Finally, there can be no escaping the unique significance of the collapse of the Venezuelan economy and the looting of state-owned oil company Petróleos de Venezuela, S.A. (“PDVSA”), among other corruption-related fact patterns that have found their way into U.S. court filings.

These factors influence corporate anti-corruption enforcement as well, particularly the second relating to DOJ’s cross-border partnerships with Latin American enforcement agencies. But our experience shows that as a whole the above dynamics influence individual prosecutions to a much greater degree. This is because individuals are far more likely than companies to press their cases to indictment and beyond, and when assessing the prospect of trial, a case that involves meetings in Miami and bank accounts in Houston is far more compelling than an Africa or Asian-based fact pattern where the only U.S. touchpoints are correspondent banking account transfers. The greater degree of travel—both directly to the United States and indirectly to extradition-friendly countries—within the Americas also makes it far more likely that individuals within the region will be picked up on a warrant and have their indictment unsealed.

As noted above, 80% (12 of 15) individual FCPA enforcement actions in 2023 arose from Latin America-based fact patterns. The Brazilian (Petrobras) case involving the Oztemel brothers and Innecco is covered above together with the corporate case of Freepoint , and the remainder follow. Consistent with our standard practice, we discuss both actual FCPA charges and FCPA-related charges brought by DOJ’s FCPA Unit, most frequently under the money laundering statute as illustrated below.

Maikel Jose Moreno Perez (Venezuela)

The first FCPA-related case of 2023 was made public on January 26, when DOJ announced an indictment on money laundering charges returned against Maikel Jose Moreno Perez, a sitting justice on Venezuela’s Supreme Tribunal of Justice and former President of the Court. The indictment, which tracks a criminal complaint filed in 2020, alleges that between 2014 and 2019 Moreno accepted more than $10 million in bribes for taking various actions in his role on the Court, including dismissing criminal charges or arrest warrants, sentencing defendants leniently, and even approving the judicial seizure of an auto plant owned by a U.S. car manufacturer.

Moreno, who also has been designated as a Specially Designated National by the Treasury Department’s Office of Foreign Asset Controls, has been declared a fugitive by the U.S. District Court for the Southern District of Florida.

George Walther-Meade & Juan Gonzalez Ruiz (Mexico)

In another FCPA-related case, on February 9, 2023, a grand jury sitting in the Southern District of California returned an indictment charging a former division manager of a U.S. defense contractor, George Walther-Meade, and third-party consultant Juan Gonzalez Ruiz, with wire fraud and money laundering arising out of an embezzlement scheme tied up in an FCPA investigation. According to the indictment, Walther-Meade arranged for his employer to retain Gonzalez’s company as a subcontractor in Mexico and caused the defense contractor to pay the subcontractor more than $3 million between 2012 and 2021 for work that was never performed. In return, Gonzalez allegedly kicked back portions of the defense contractor’s payments to Walther-Meade by, among other avenues, issuing credit cards to Walther-Meade and his family members that they used to pay for personal expenses. Separate civil litigation between the defense contractor and Walther-Meade (which has since been stayed pending the criminal cases) makes clear that the matter is part of a broader FCPA investigation disclosed by the defense contractor, which also is consistent with the presence of DOJ FCPA Unit prosecutors on the docket sheet.

On June 15, 2023, Ruiz reached a plea agreement and entered a guilty plea to one count each of money laundering and wire fraud. He was sentenced on December 22 to 314 days (time served) and ordered to make $3.2 million in restitution to the defense contractor. Sadly, under the weight of the charges and prospect of a cooperating co-defendant, Walther-Meade reportedly took his own life on November 6, 2023. This was tragically the second FCPA defendant to take their life in 2023, as in a heartbreaking scene Juan Manuel Gonzalez Testino (whose 2019 FCPA-related guilty plea was covered in our 2020 Year-End FCPA Update) was found shot to death together with his three-year-old son in their South Florida apartment in March, weeks before the father’s sentencing hearing, in what was reported as a murder-suicide.

Samuel Bankman-Fried (China)

The FCPA and crypto worlds collided for the first time on March 28, 2023, when DOJ unsealed a fifth superseding indictment adding an FCPA bribery conspiracy count to the blockbuster prosecution of disgraced cryptocurrency mogul Samuel Bankman-Fried. The FCPA charge against the FTX.com and Alameda Research founder concerned an alleged bribe of approximately $40 million in cryptocurrency paid to a Chinese government official in November 2021 to unfreeze the trading accounts of Alameda Research, which contained over $1 billion in cryptocurrency and had been frozen in connection with an ongoing investigation by the Chinese government.

Bankman-Fried subsequently filed a motion to dismiss the FCPA charge, among others that were not filed prior to his extradition from the Bahamas in the underlying crypto fraud case, arguing that the “rule of specialty” prohibited the United States from extraditing a defendant on one set of charges only to subsequently indict the defendant on additional charges that were not approved in the extradition process. Of potentially greater interest to FCPA enthusiasts, Bankman-Fried separately moved to dismiss the FCPA count on the ground that the indictment did not sufficiently allege the “obtain or retain business” element of the FCPA in that lobbying a government to unfreeze corporate assets is not sufficiently related to obtaining or retaining business from that government. Finally, Bankman-Fried challenged venue for the FCPA charge in the Southern District of New York. The Honorable Lewis A. Kaplan of the U.S. District Court for the Southern District of New York denied the motion in an omnibus order issued on June 29, 2023, finding in a brief analysis that the minimal requirements required at the indictment stage were met.

DOJ did agree, however, to sever the five new charges, including the FCPA bribery count, to allow more time for discussions with the Bahamian government regarding extradition, resulting in the severance of the new charges and a separate trial date in March 2024. In the meantime, in November 2023 a jury found Bankman-Fried guilty of the original crypto-related market manipulation, wire fraud, and money laundering charges. On December 29, 2023, DOJ filed a letter with the Court advising that it did not intend to proceed to trial on the severed counts, including the FCPA charge. DOJ noted that The Bahamas still had not consented to the new charges, and that the delay required for a second trial would not be in the interests of justice given the interests in finality to the first verdict as well as, it contended, the ability of the Court to consider the additional charges as “relevant conduct” at sentencing for the first set of convictions. Sentencing for the crypto fraud convictions is scheduled for March 2024.

Alvaro Ledo Nass (Venezuela)

On March 29, 2023, the former general counsel of Venezuela’s PDVSA, Alvaro Ledo Nass, pleaded guilty to one count of conspiracy to launder bribes linked to various foreign currency exchange schemes involving PDVSA loan contracts that we have been covering regularly since our 2018 Year-End FCPA Update. According to Ledo’s factual proffer, between 2012 and 2017 he and a variety of previously-charged individuals exploited Venezuela’s fixed foreign currency exchange rate that artificially pegged the value of the bolivar above prevailing rates, selling the rights to exchange Venezuelan bolivars for U.S. dollars at inflated rates in exchange for bribes. Ledo admitted personally to accepting more than $11.5 million in payments associated with corrupt currency schemes valued at more than $1 billion.

On June 12, 2023, the Honorable Kathleen M. Williams of the U.S. District Court for the Southern District of Florida sentenced Ledo to three years in prison, coupled with an order of forfeiture.

Carlo Alloni (Djibouti)

We frequently make the point that FCPA enforcement is greater than what is reported, as many cases are filed and remain under seal for years for a variety of reasons, ranging from ongoing cooperation to extradition efforts. An excellent example of this phenomena is the case of former Ericsson regional manager Carlo Alloni, who pleaded guilty in 2018 to a single count of FCPA bribery conspiracy, had his case remain under seal until 2021 as he cooperated with the government, and then had the case publicized only with the appearance of an FCPA prosecutor in connection with his June 28, 2023 sentencing.

According to court documents, Alloni, an Italian citizen living in England who previously worked for Ericsson in Africa, was first approached by federal agents in 2017 when he landed at a U.S. airport. Although he initially denied having knowledge of the alleged corruption, he subsequently approached prosecutors with counsel and agreed to cooperate in what would become the Djibouti allegations resolved by the company in 2019. Because of “the substantial nature and significance of [his] cooperation,” at the June 28, 2023 sentencing the Honorable George B. Daniels of the U.S. District Court for the Southern District of New York sentenced Alloni to time served on probation pending sentencing, with no further sanction following the hearing.

Amadou Kane Diallo (Senegal)

On September 20, 2023, a grand jury in the Central District of California returned a superseding indictment against California businessman Amadou Kane Diallo, adding an FCPA charge to wire fraud and money laundering charges filed earlier in the year arising from an alleged investment fraud scheme. According to the indictment, from 2015 to 2020 Diallo executed a scheme to defraud investors in two companies that he owned by using a false appearance of wealth to fraudulently solicit investments, then using those investments to further his appearance of wealth rather on the businesses as represented to prior investors. But where this scheme took an FCPA turn is when Diallo allegedly attempted to corruptly obtain a land grant involved in the investment scheme from Senegalese government officials by providing or promising to provide them with gifts. This included allegedly chartering a helicopter to take one Senegalese official to an NBA basketball game while the official was visiting the United States, and then offering to purchase five motor vehicles for a second official during a trip to Senegal to discuss the land grant.

Diallo, who has been detained pretrial, has pleaded not guilty to all charges and is currently facing a March 2024 trial date.

Christian Julian Cazarin Meza (Mexico)

On October 27, 2023, Mexican construction company owner Christian Julian Cazarin Meza pleaded guilty in the U.S. District Court for the Eastern District of New York to one count of conspiracy to violate the FCPA. Cazarin admitted that between 2017 and 2020 he participated in a bribery scheme with former Vitol Group trader Javier Alejandro Aguilar Morales and others to provide more than $600,000 to Gonzalo Guzman Manzanilla and Carlos Espinosa Barba, both officials of the U.S. procurement subsidiary of Mexican state-owned oil company Petróleos Mexicanos (“PEMEX”), in exchange for confidential information that Vitol used to win contracts from the PEMEX subsidiary. We last covered the charges against Cazarin’s co-defendants in the PEMEX scheme in our 2022 Mid-Year FCPA Update.

Cazarin is currently awaiting sentencing, which has not yet been scheduled.

Orlando Alfonso Contreras Saab (Venezuela)

On November 2, 2023, Venezuelan businessman Orlando Alfonso Contreras Saab pleaded guilty to a one-count information charging him with conspiracy to violate the FCPA. According to the information, Contreras participated in a scheme to bribe the then-governor of the Venezuelan state of Táchira, Jose Gregorio Vielma Mora, in connection with Comité Local de Abastecimiento y Producción (“CLAP”), a Venezuelan food and medicine distribution program. Between 2016 and 2019, Contreras allegedly took bribe payments from co-conspirator Alvaro Pulido Vargas associated with inflated food contracts received by Pulido’s company under CLAP and passed them on to Vielma, after keeping a cut for himself. We previously reported on DOJ’s charges against Vielma, Pulido, and others, in our 2021 Year-End FCPA Update.

Contreras is scheduled to be sentenced in February 2024. His co-conspirators have been designated fugitives by the U.S. District Court for the Southern District of Florida and are not before the Court.

Carl A. Zaglin, Francisco Roberto Cosenza Centeno, Aldo N. Marchena (Honduras)

The final FCPA case of 2023 was made public on December 22, when DOJ announced the unsealing of a five-count indictment charging Carl A. Zaglin, owner of a Georgia-based manufacturer of law enforcement uniforms and equipment, with bribing co-defendant Francisco Roberto Cosenza Centeno, the former director of a Honduran governmental entity known as “TASA” that procured goods for the Honduran National Police, through companies owned by Florida resident Aldo N. Marchena. According to the indictment, Zaglin and Marchena conspired to pay more than $166,000 in bribes to Cosenza and other TASA officials to corruptly influence the award of more than $10 million in law enforcement equipment contracts to the Honduran National Police.

Zaglin and Marchena are charged with substantive FCPA and/or FCPA conspiracy offenses and all three defendants are charged with money laundering offenses. According to recent court filings, only Zaglin is currently before the Court, but both Cosenza and Marchena are in custody and undergoing extradition proceedings, from Honduras and Colombia, respectively. In the meantime, trial has been scheduled for November 2024.

2023 FCPA-RELATED ENFORCEMENT LITIGATION

As our readership knows, following the filing of FCPA or FCPA-related charges, criminal and civil enforcement proceedings can take years to wind their way through the courts. The substantial number of enforcement cases from prior years, especially involving contested criminal indictments of individual defendants, has led to an active year in enforcement litigation beyond the cases initiated in 2023 as covered above. A selection of key 2023 FCPA-related enforcement litigation developments follows.

DOJ Drops 2018 Money Laundering Charges Against Acosta y Lara

Although most indicted FCPA cases result in conviction, that is not always the case. Occasionally criminal defendants prevail in convincing a jury to acquit at trial, a judge to dismiss the charges before, during, or after trial, and sometimes DOJ even seeks to dismiss the case itself. That happened on November 22, 2023 to Uruguayan banker Marcello Federico Gutierrez Acosta y Lara, whose 2018 indictment on PDVSA-related money laundering charges was dismissed with prejudice by the Honorable Kathleen M. Williams of the U.S. District Court for the Southern District of Florida, on DOJ motion, on November 16, 2023. DOJ gave no explanation on the reason for the requested dismissal in its one-sentence motion, but Acosta y Lara’s counsel told reporters at Global Investigations Review that the “case never should have been brought and the government had a moral responsibility to dismiss it” due to exculpatory evidence.

Fifth Circuit Affirms Dismissal of Casqueiro Murta PDVSA Bribery Charges

In our 2022 Year-End FCPA Update, we covered the Fifth Circuit’s February 2023 decision reversing the dismissal of PDVSA-related FCPA and money laundering charges against wealth management advisors Daisy Teresa Rafoi Bleuler and Paulo Jorge Da Costa Casqueiro Murta. As is the typical practice, on remand the case was sent back to the judge who dismissed the indictments in the first place, which in this case was the Honorable Kenneth M. Hoyt of the U.S. District Court for the Southern District of Texas.

Post-remand proceedings as to Rafoi have been quiet, as she has yet to be extradited and make an appearance before the District Court. But as to Casqueiro Murta, Judge Hoyt once again dismissed the case with prejudice on May 17, 2023, this time finding a violation of the defendant’s right to a speedy trial under both the Sixth Amendment and Speedy Trial Act. In a subsequent memorandum and order issued on June 6, 2023, the Court found, among other things, that DOJ engaged in “intentional and protracted delay” in first bringing to the Court’s attention, and then failing to disclose details regarding, certain classified national security information that DOJ knew to be irrelevant to Casqueiro Murta in the first place. Judge Hoyt concluded “that the government intentionally used non-discoverable, irrelevant material as a faux pas basis for delaying trial because it was unprepared.” DOJ appealed and the Fifth Circuit expedited briefing.

On November 28, 2023, the Fifth Circuit affirmed the dismissal of charges against Casqueiro Murta on Speedy Trial Act grounds, but reversed the Sixth Amendment basis for dismissal as well as Judge Hoyt’s determination that the Speedy Trial Act dismissal should be with prejudice. Then, on January 5, 2024, the Fifth Circuit retracted the original opinion and substituted a new opinion for the same holding. In the substituted opinion, the Honorable Jacques L. Wiener, Jr. writing for the Fifth Circuit panel held that the District Court erred in its balancing of factors leading to the determination that the Speedy Trial Act violation weighed in favor of dismissal with prejudice. Chief among the errors found was that the District Court in weighing the dismissal factors improperly elevated the interests of Portuguese citizens in potential charges against Casqueiro Murta in Portugal (which the District Court errantly referred to as actual charges, when in fact there was only an investigation) above the interests of the United States in charges here. The Fifth Circuit likewise found in error the District Court’s Sixth Amendment basis for dismissal.

The Fifth Circuit remanded the case back to the District Court, but in an unusual move—premised on “the history of this case and some findings by the district judge not discussed” in the opinion—ordered that the case be reassigned to a different judge on remand. On remand, Chief Judge Randy Crane assigned the case to himself and the matter is currently set for a March 2024 evidentiary hearing on whether the Speedy Trial Act violation merits dismissal with or without prejudice.

Saab Moran Granted Clemency in Prisoner Swap with Venezuela

As we first covered in our 2019 Year-End FCPA Update, joint Colombian and Venezuelan citizen Alex Nain Saab Moran was indicted on money laundering offenses in connection with an alleged $350 million construction-related bribery scheme in Venezuela. After he was detained in the Republic of Cape Verde on a U.S. extradition request, Saab Moran filed a motion to enter a special appearance and challenge the indictment from abroad. The motion was denied by the Honorable Robert N. Scola, Jr. of the U.S. District Court for the Southern District of Florida and Saab Moran’s appeal was dismissed as moot by the Eleventh Circuit after he was successfully extradited to the United States. On December 23, 2022, Judge Scola denied the motion to dismiss the indictment, as we reported in our 2022 Year-End FCPA Update.

Saab Moran took another interlocutory appeal to the Eleventh Circuit from Judge Scola’s denial of the motion to dismiss, which was in the process of being briefed when on December 21, 2023, White House officials announced that Saab Moran had been granted clemency by President Biden. Saab Moran was part of prisoner swap between the governments of the United States and Venezuela, in which he was sent back to Venezuela in exchange for the release of 10 U.S. citizens held in Venezuela plus infamous contractor fugitive Leonard Glenn Francis (“Fat Leonard”), the latter of whom had sought asylum in Venezuela after escaping home detention prior to reporting to prison after being convicted of non-FCPA-related bribery charges in the Southern District of California. Following the inter-governmental deal, Saab Moran’s lawyer issued a statement that the swap “allows an innocent Venezuelan diplomat to return home after serving over three and a half years in custody.”

Chang Extradited; Motion to Dismiss Denied; Trial Scheduled for July 2024

In our 2019 Year-End FCPA Update, we covered the indictment of former Mozambique Minister of Finance Manuel Chang—along with seven other defendants—on FCPA-related wire fraud, securities fraud, and money laundering charges. In what is known as the “Tuna Bonds” scandal, Chang allegedly signed guarantees on behalf of the Mozambique government falsely representing its financial solvency, which caused foreign banks to issue loans to Mozambique state-owned companies for maritime projects that ultimately failed, in exchange for receiving approximately $18 million in alleged kickbacks. Chang was arrested in South Africa on a U.S. extradition request in December 2018, but extradition proceedings lasted four-and-one-half years—due in large part to a competing extradition request filed by the Government of Mozambique—and Chang was not extradited to the United States until July 2023.

On August 8, 2023, Chang filed a motion to dismiss the indictment on speedy trial grounds. Co-defendant Najib Allam, an executive of the shipbuilding company that allegedly paid the bribes, followed with his own speedy trial motion to dismiss, even though he is still in Lebanon. On December 21, 2023, the motions were denied by the Honorable Nicholas Garaufis of the U.S. District Court for the Eastern District of New York. As to Chang, Judge Garaufis found that the defendant’s own actions in resisting extradition were responsible for the majority of the pretrial delay. As to Allam, Judge Garaufis held that a defendant who stays in a country with no extradition treaty (such as Lebanon) cannot complain of the delay caused by his refusal to leave the country and face prosecution in the United States.

Trial for Chang is currently set to begin on July 29, 2024.

Schulman Motions to Dismiss Denied; Trial Scheduled for March 2024

In our 2020 Year-End FCPA Update, we reported on the FCPA-related bank, mail, and wire fraud and money laundering indictment of Maryland attorney Jeremy Wyeth Schulman arising from his alleged role in a six-year conspiracy to misappropriate $12.5 million in Somali sovereign assets frozen in U.S. financial institutions. DOJ contends that Schulman forged paperwork purporting to show that he was acting on the authority of the Central Bank of Somalia in repatriating these assets, when in fact there reportedly was no such authorization. Schulman, for his part, contends he was acting on the valid instruction of a client associated with a key member of the transitional Somali government, and notes that roughly three-quarters of the $12.5 million recovered was repatriated to the Central Bank of Somalia. Pretrial litigation has been, to put it mildly, contentious.

On September 28, 2023, the Honorable Paula Xinis of the U.S. District Court for the District of Maryland denied four different motions to dismiss filed by Schulman in a 63-page memorandum opinion. First, Judge Xinis denied the motion to dismiss for pre-indictment delay—even though she found that Schulman established prejudice based on witnesses who became unavailable with the passage of time—because the Court did not believe it appropriate to second-guess DOJ’s decision to wait up to six years to build its case before indicting, and found that ultimately DOJ acted diligently. Second, Judge Xinis denied Schulman’s motion to dismiss pursuant to the “act of state doctrine,” finding that the true question for trial was not whether Schulman actually had authority to repatriate the assets under Somali law, but whether he believed he had authority. Third, the Court denied Schulman’s “political question” motion to dismiss for similar reasons. Finally, Judge Xinis denied Schulman’s motions to dismiss various counts of the indictment for failure to state a claim, as duplicitous, or barred by the applicable statute of limitations, finding that Schulman at most presented factual questions to be resolved by the jury.

Trial in Schulman’s case is presently scheduled to begin on March 4, 2024. In the meantime, pre-trial motion practice continues apace as in early February Schulman filed yet another motion to dismiss the indictment based on allegedly exculpatory evidence withheld by DOJ.

Cognizant’s Outside Counsel Not a Government Actor for Garrity Purposes; Trial for Coburn & Schwartz Delayed Over Foreign Witness’s Availability

When we last checked in on the upcoming trial of former Cognizant Technology Solutions President Gordon Coburn and Chief Legal Officer Steven Schwartz, in our 2022 Mid-Year FCPA Update, the Honorable Kevin McNulty of the U.S. District Court for the District of New Jersey compelled the company to turn over materials associated with various internal investigation interviews, finding a waiver of privilege from the company disclosing aspects of those interviews to DOJ. On July 20, 2023, Judge McNulty issued another important opinion on an oft-recurring issue in corporate internal investigations, this time denying a “Garrity” motion to suppress the defendants’ statements to corporate counsel based on a finding that counsel was not acting at DOJ’s behest.

In Garrity v. New Jersey, the U.S. Supreme Court held that prosecutors cannot use a compelled interview statement taken by a government employer in a subsequent criminal prosecution. As we covered in our 2019 Year-End FCPA Update in connection with the momentous Connolly decision out of the U.S. District Court for the Southern District of New York, Garrity has in limited circumstances been extended to private employers “where the actions of [the] private employer in obtaining [the] statements are ‘fairly attributable to the government.’”

In this case, Judge McNulty agreed with defendants that the interviews conducted by outside counsel as part of the internal investigation were “compelled” due to the company’s policy requiring employees to cooperate in internal investigations or face disciplinary action and the fact that the defendants were specifically directed to attend the interviews in question. But still the Court denied the defendants’ Garrity motion because of insufficient evidence that the company’s internal investigation, and interviews, were directed by DOJ. Even though Judge McNulty observed that Cognizant was motivated by DOJ’s then-operative “FCPA Pilot Program,” pursuant to which the company did receive a “declination with disgorgement” as reported in our 2019 Year-End FCPA Update, he held that “[g]overnment policies alone do not entail that a company’s action in furtherance of such policies amounts to state action.”

Based on similar reasoning, the Court also denied defendants’ motion to require Cognizant to search its files for potential exculpatory evidence under Brady v. Maryland. Because Judge McNulty found that “Cognizant did not act on behalf of or under the control of the Government,” he concluded that the company’s files were not in the “constructive possession” of DOJ.

The trial for Coburn and Schwartz was set to commence on October 2, 2023, but the week before DOJ notified the Court that an “essential witness” for the government, located in India, had been ordered to turn his passport over to Indian authorities in connection with their own investigation of the same conduct. The issue was resolved, but not in time to hold the trial date, which now has been reset to May 6, 2024. In the midst of the delay, presiding Judge McNulty announced his retirement, and the case has now been transferred for trial to the Honorable Michael E. Farbiarz.

Cherrez Miño Still a Fugitive; But $72 Million Sought in Civil Forfeiture

In our 2021 Year-End FCPA Update, we covered charges against three defendants for an alleged bribery scheme involving the Instituto de Seguridad Social de la Policia Nacional (“ISSPOL”), Ecuador’s public police pension fund, whereby investment advisor Jorge Cherrez Miño paid more than $2.6 million in bribes to ISSPOL officials, including John Luzuriaga Aguinaga, in exchange for the right to manage ISSPOL funds. Luzuriaga pleaded guilty to money laundering charges, was originally sentenced to 58 months, but was then released early after serving only 40 months in November 2023 based on DOJ’s Rule 35 motion in light of his post-conviction cooperation. (The other cooperating co-defendant, Luis Alvarez Villamar, has been sentenced to six months for his role in the money laundering scheme.) But Cherrez Miño remains a fugitive outside of the United States.

One disadvantage of fugitive status is that it can prevent one’s ability to defend against the civil forfeiture of assets while a fugitive. On September 29, 2023, DOJ filed an in rem forfeiture complaint in the U.S. District Court for the Southern District of Florida against $72 million in accounts held by or for the benefit of Cherrez Miño. ISSPOL has since filed a statement of interest and a scheduling conference is scheduled for February 20, 2024.

Fifth Circuit Affirms Sealing of Ahsani Sentencing Documents

We covered the guilty pleas of Unaoil CEO and COO Cyrus and Saman Ahsani, as well as related cases associated with the sprawling corruption scheme that spanned over 15 years, dozens of companies, and close to 10 countries, in our 2019 Year-End FCPA Update. Although the Ahsani brothers’ sentencing hearings were repeatedly delayed after their guilty pleas to account for their continued cooperation with the government, Saman’s hearing ultimately took place on January 30, 2023. The Honorable Andrew Hanen of the U.S. District Court for the Southern District of Texas handed Saman a comparably favorable sentence of 12 months and one day, one year of supervised release, and $1.5 million in forfeiture.

The significance of the case, coupled with extensive sealing of proceedings before the district court, garnered the interest of media organizations The Financial Times, Global Investigations Review, and The Guardian, who, represented by The Reporters’ Committee for Freedom of the Press, jointly moved to intervene and unseal. The court granted the press outlets intervenor status and unsealed much of record leading up to the sentencing. But the sentencing memoranda and a portion of the sentencing hearing itself (taking place in chambers the morning of the public hearing) were not only sealed, but docketed only as “Sealed Events” such that the intervenors were unable effectively to challenge the court’s closure of proceedings. Still, intervenors were able to garner enough information to challenge the sealings, which the district court denied on February 23, 2023.

On appeal, the Honorable Jerry E. Smith wrote for a unanimous panel of the U.S. Court of Appeals for the Fifth Circuit on August 4, 2023. The Court was critical of the district court’s failure to create a record capable of scrutiny through more transparent docketing of the full sentencing proceedings, but ultimately affirmed the merits of the ruling to seal. Specifically, Judge Smith agreed that the need to protect the defendants, their families, and the integrity of ongoing investigative activities by the government justified the sealing, even with the passage of time and fact that the defendants’ general cooperation was a matter of public knowledge.

Saman Ahsani’s case is now complete, but brother Cyrus’s sentencing is set for November 2024.

Aguilar Gets FCPA Count Severed; Now Faces Indictments in Two Districts