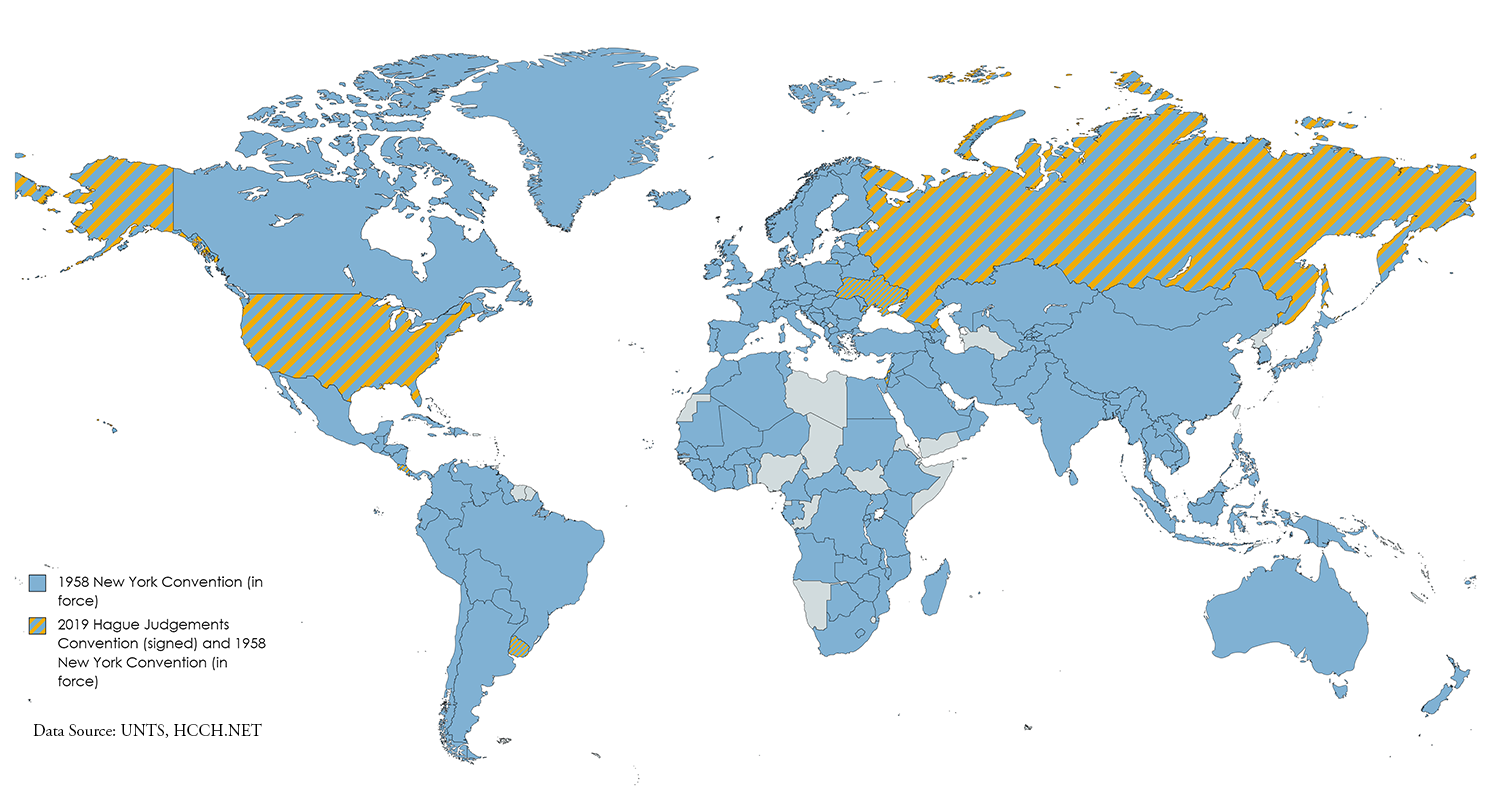

On 2 March 2022, the United States signed the Convention of 2 July 2019 on the Recognition and Enforcement of Foreign Judgments in Civil or Commercial Matters (the “Hague Judgments Convention” or the “Convention”).[1] The Hague Judgments Convention seeks to enhance access to justice and facilitate international trade and investment by encouraging the free flow of judgments across national borders.[2] It does so by providing a set of clear, predictable rules under which civil and commercial judgments rendered by the courts of one Contracting State are recognized and enforced in other Contracting States. While not yet in force, the Hague Judgments Convention could provide an important complement to the widely adopted 1958 New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards[3] (the “New York Convention”) (which provides for the recognition and enforcement of arbitral awards), as well as its sister treaty, the 2005 Hague Choice of Court Convention.[4]

I. Recognition of Foreign Judgments in the United States

At present, there is no federal law that governs the recognition of foreign judgments in the United States, nor is there an international treaty in force. Rather, recognition and enforcement are a question of state law, although the rules are relatively consistent across all 50 U.S. states and the District of Columbia.[5] Most U.S. states have modeled their approaches to foreign judgment recognition on the model laws promulgated by the National Conference of Commissioners on Uniform State Laws—the Uniform Foreign Money Judgments Recognition Act of 1962 (the “1962 Uniform Act”), or increasingly, the Uniform Foreign-Country Money Judgments Recognition Act of 2005 (the “2005 Uniform Act”).[6]

Generally, the United States favors recognition and enforcement of foreign judgments: in U.S. state and federal courts, foreign judgments are presumptively entitled to recognition and enforcement unless specific mandatory or discretionary grounds for non-recognition apply.[7]

II. The Hague Judgments Convention

The 2019 Hague Judgments Convention is the culmination of over 25 years of negotiations at the Hague Conference on Private International Law (the “Hague Conference”).[8] The process began in 1992 at the request of the United States, which sought to develop a global approach to jurisdiction and recognition of judgments.[9] The final text of the Hague Judgments Convention was eventually signed and opened for signature on 2 July 2019. Signatory States in addition to the United States include Uruguay, Ukraine, Israel, Costa Rica, and the Russian Federation (in order of signature).[10] The European Commission is also contemplating accession on behalf of the EU Member States.[11]

Recognition of Arbitral Awards under the New York Conventions and Foreign Judgments under the Hague Judgments Convention

The Convention will enter into force as soon as the second State deposits its instrument of ratification, acceptance, approval, or accession.[12] However, under Article 29 (the “bilateralization” clause), a Contracting State can prevent the application of the Convention to judgments rendered by the courts of a particular State by making a targeted declaration.[13]

The Convention applies to “the recognition and enforcement of judgments relating to civil or commercial matters.”[14] It specifically excludes subjects that are fundamental to State sovereignty or public policy (such as criminal, revenue, customs, or administrative matters),[15] as well as other specialized areas, some of which are subject to other treaty regimes or where the rules vary more significantly across jurisdictions (such as matters involving family disputes, intellectual property, antitrust, defamation, privacy, or armed forces matters).[16]

The Convention, like most domestic laws, favors recognition. It requires each Contracting State to recognize and enforce judgments from other Contracting States in accordance with its terms and permits refusal only on those grounds expressly set out in the Convention.[17]

Article 5(1) of the Convention sets out 13 “bases” of recognition and enforcement, including, inter alia, that:

- The judgment debtor is habitually resident in the foreign forum;

- The judgment debtor has their principal place of business in the foreign forum (and the claim on which the judgment is based arose out of the activities of that business);

- The judgment debtor expressly consented to the foreign court’s jurisdiction;

- The judgment debtor waived his jurisdictional objections by arguing on the merits in the forum state;

- The judgment ruled on a lease of immovable property (tenancy) and it was given by a court of the State in which the property is situated; or,

- The judgment ruled on a non-contractual obligation arising from death, physical injury, damage to or loss of tangible property, and the act or omission directly causing such harm occurred in the forum State, irrespective of where that harm occurred.

These bases for jurisdiction and enforcement echo the basic concepts found in domestic U.S. recognition and enforcement law,[18] including the constitutional due process requirements reflected in the notion of “minimum contacts” that U.S. courts require for the exercise of long-arm jurisdiction and the comity-based rules adopted by the U.S. Supreme Court in the seminal decision, Hilton v. Guyot, 159 U.S. 113 (1895).

If any of the jurisdictional tests (or “jurisdictional filters”[19]) in Article 5(1) is met, then the judgment is presumptively “eligible” for recognition and enforcement.[20] Under Article 15, national law provides a further independent basis for recognition.[21] In this sense, “the convention is a floor, not a ceiling.”[22]

Article 7 of the Convention, in turn, sets out discretionary bases for non-recognition, including, inter alia, the following:

- The defendant was not notified, or the manner of notification was incompatible with fundamental principles of service of documents in the forum State;

- The decision was obtained by fraud;

- Recognition or enforcement would be “manifestly incompatible” with the public policy of the recognizing State;

- The specific proceedings were incompatible with fundamental principles of procedural fairness of the recognizing State; or,

- The judgment is inconsistent with a judgment given by a court of the recognizing State in a dispute between the same parties.[23]

This too reflects the traditional non-recognition grounds found in most national legal systems, including that of the United States, such as inconsistency with the forum State’s public policy, due process violations, fraud, lack of notice or proper service, and conflict with other judgments.[24]

The Hague Judgments Convention is therefore in line with many precepts of existing U.S. recognition and enforcement law reflected in the 2005 Uniform Act.[25] However, the Convention covers not only foreign money judgments, but civil and commercial decisions generally.

III. Implications for the Recognition of Foreign Judgments in the United States

The Convention could be “a gamechanger for cross-border dispute settlement”[26] by providing a set of consistent rules for the recognition and enforcement of foreign judgments, much like the New York Convention has been for the widespread adoption of arbitral awards. Ultimately, a judgment in an international dispute is only as valuable as the judgment creditor’s ability to have it recognized and enforced abroad (where the judgment debtor or its assets may be found). However, making the enforcement of foreign judgments easier can be a double-edged sword. While a more robust and predictable enforcement regime can certainly be beneficial, that is only the case where the foreign court provides due process and a just outcome.

Ultimately, the force of the Hague Judgments Convention will depend on how widely it is signed and ratified. Following the U.S. signature, the Hague Judgments Convention will not automatically come into force in the United States. It must first undergo a ratification process in U.S. Congress, a procedure that can in some cases take several years. Ratification may be slower here due to the prevalence of state law (and absence of federal law) in this particular area.[27]

For U.S. litigants, if ultimately ratified by the United States, the Hague Judgments Convention could aid the recognition and enforcement of U.S. judgments in a wider range of countries, in particular in jurisdictions that may currently refuse recognition on reciprocity grounds (i.e., where a foreign court would not recognize a U.S. judgment unless convinced that its judgment would receive the same treatment by a U.S. court). Similarly, the Convention could facilitate the recognition and enforcement of foreign judgments issued by courts of other Contracting States in U.S. courts (of course subject to the above-mentioned non-recognition defenses). This would greatly increase the ability of both U.S. and non-U.S. litigants to obtain meaningful cross-border relief in transnational litigation.

Until the Hague Judgments Convention comes into force, global trade and investment will continue to be facilitated by alternative dispute resolution mechanisms, such as the New York Convention for arbitral awards, as discussed above, and the new Singapore Convention for international settlement agreements resulting from mediation.[28] Thus, for now, international arbitration awards remain more portable than foreign judgments (in addition to other advantages of international arbitration, like the selection of a neutral forum to avoid any “home court” advantage).[29]

___________________________

[1] Convention on the Recognition and Enforcement of Foreign Judgments in Civil or Commercial Matters, July 2, 2019, https://www.hcch.net/en/instruments/conventions/full-text/?cid=137 (hereinafter “Convention”) (last visited Mar. 18, 2022).

[2] See Hague Conference on Private International Law, Explanatory Note Providing Background on the Proposed Draft Text and Identifying Outstanding Issues, Prel. Doc. No 2, 3 (2016) (“[T]he future Convention is intended to pursue two goals: to enhance access to justice; [and] to facilitate cross-border trade and investment, by reducing costs and risks associated with cross-border dealings.”)

[3] Convention on the Recognition and Enforcement of Foreign Arbitral Awards (hereinafter “New York Convention”), June 10, 1958, 21.3 U.S.T. 2517, 3 U.N.T.S. 330.

[4] Convention on Choice of Court Agreements, June 30, 2005, 44 I.L.M. 1294 (hereinafter “2005 Choice of Court Convention”).

[5] See Gibson Dunn, New York Updates Law on Recognition of Foreign Country Money Judgments to Bring in Line with Other U.S. Jurisdictions, June 22, 2021, https://www.gibsondunn.com/new-york-updates-law-on-recognition-of-foreign-country-money-judgments-bring-in-line-with-other-us-jurisdictions/.

[8] See generally Louise Ellen Teitz, Another Hague Judgments Convention? Bucking the Past to Provide for the Future, 29 Duke J. Comp. & Int’l L. 491 (2019) (reviewing the Convention’s negotiations history).

[9] See generally Ronald A. Brand, The Hague Judgments Convention in the United States: A “Game Changer” or a New Path to the Old Game?, 82 U. Pitt. L. Rev. 847 (2021).

[10] See Hague Conference on Private International Law, Status Table – Convention of 2 July 2019 on the Recognition and Enforcement of Foreign Judgments in Civil or Commercial Matters, https://www.hcch.net/en/instruments/conventions/status-table/?cid=137 (last visited Mar. 18, 2022).

[11] European Commission, Proposal for a Council Decision on the Accession by the European Union to the Convention on the Recognition and Enforcement of Foreign Judgments in Civil or Commercial Matters, COM (2021) 388 (July 16, 2021), here (last visited Mar. 18, 2022) (recommending accession to the Convention so as to ensure the circulation of foreign judgments beyond the EU area and to increase “growth in international trade and foreign investment and the mobility of citizens around the world”).

[17] See id. at art. 4(1) (“A judgment given by a court of a Contracting State (State of origin) shall be recognised and enforced in another Contracting State (requested State) in accordance with the provisions of this Chapter. Recognition or enforcement may be refused only on the grounds specified in this Convention.”).

[18] See Gibson Dunn, New York Updates Law on Recognition of Foreign Country Money Judgments to Bring in Line with Other U.S. Jurisdictions, June 22, 2021, https://www.gibsondunn.com/new-york-updates-law-on-recognition-of-foreign-country-money-judgments-bring-in-line-with-other-us-jurisdictions/.

[19] See Brand, supra note 9, at 851.

[20] On the other hand, a judgment that ruled on rights in rem in immovable property “shall be recognised and enforced if and only if the property is situated in the State of origin.” Convention, art. 6.

[21] Convention, art. 15 (“Subject to Article 6, this Convention does not prevent the recognition or enforcement of judgments under national law.”)

[22] Teitz, supra note 8, at 503.

[24] See also 2005 Choice of Court Convention, art. 9 (setting forth grounds for non-recognition).

[25] See Gibson Dunn, New York Updates Law on Recognition of Foreign Country Money Judgments to Bring in Line with Other U.S. Jurisdictions, June 22, 2021, https://www.gibsondunn.com/new-york-updates-law-on-recognition-of-foreign-country-money-judgments-bring-in-line-with-other-us-jurisdictions/.

[26] Hague Conference on Private International Law, Gamechanger for Cross-Border Litigation in Civil and Commercial Matters to be Finalized in the Hague (June 18, 2019) (quoting the Secretary General of the Hague Conference), https://www.hcch.net/en/news-archive/details/?varevent=683 (last visited Mar. 18, 2022).

[27] The United States has been a member of the Hague Conference since 1964 and is currently a Contracting Party to seven Hague Conventions (Convention Abolishing the Requirement of Legalisation for Foreign Public Documents (“Apostille Convention”), Oct. 5, 1961, 527 U.N.T.S.; Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters (“Service Convention”), Nov. 15, 1965, 658 U.N.T.S. 163; Convention on the Taking of Evidence Abroad in Civil or Commercial Matters (“Evidence Convention”), Mar. 18, 1970, 847 U.N.T.S. 231; Convention on the Civil Aspects of International Child Abduction (“Child Abduction Convention”), Oct. 25, 1980, 1343 U.N.T.S. 89; Convention on Protection of Children and Co-operation in respect of Intercountry Adoption (“Adoption Convention”), May 29, 1993, 1870 U.N.T.S. 167; Convention on the Law Applicable to Certain Rights in respect of Securities Held with an Intermediary (“Securities Convention”), July 5, 2006, 46 I.L.M. 649; Convention on the International Recovery of Child Support and Other Forms of Family Maintenance (“Child Support Convention”), Nov. 23, 2007, 47 I.L.M. 257. The U.S. has not yet ratified the 2005 Choice of Court Convention, often seen as the sister treaty to the Hague Judgments Convention.

[28] See generally United Nations Convention on International Settlement Agreements Resulting from Mediation, opened for signature Aug. 7, 2019 (adopted Dec. 20, 2018) (“Singapore Convention”), https://treaties.un.org/pages/ViewDetails.aspx?src=TREATY&mtdsg_no=XXII-4&chapter=22&clang=_en (last visited Mar. 18, 2022).

[29] For international commercial arbitration awards, the above map shows the broad reach of the New York Convention.

The following Gibson Dunn lawyers prepared this client alert: Rahim Moloo, Lindsey D. Schmidt, Maria L. Banda, and Nika Madyoon.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s International Arbitration, Judgment and Arbitral Award Enforcement or Transnational Litigation practice groups, or the following:

Rahim Moloo – New York (+1 212-351-2413, rmoloo@gibsondunn.com)

Lindsey D. Schmidt – New York (+1 212-351-5395, lschmidt@gibsondunn.com)

Anne M. Champion – New York (+1 212-351-5361, achampion@gibsondunn.com)

Maria L. Banda – Washington, D.C. (+1 202-887-3678, mbanda@gibsondunn.com)

Please also feel free to contact the following practice group leaders:

International Arbitration Group:

Cyrus Benson – London (+44 (0) 20 7071 4239, cbenson@gibsondunn.com)

Penny Madden QC – London (+44 (0) 20 7071 4226, pmadden@gibsondunn.com)

Judgment and Arbitral Award Enforcement Group:

Matthew D. McGill – Washington, D.C. (+1 202-887-3680, mmcgill@gibsondunn.com)

Robert L. Weigel – New York (+1 212-351-3845, rweigel@gibsondunn.com)

Transnational Litigation Group:

Susy Bullock – London (+44 (0) 20 7071 4283, sbullock@gibsondunn.com)

Perlette Michèle Jura – Los Angeles (+1 213-229-7121, pjura@gibsondunn.com)

Andrea E. Neuman – New York (+1 212-351-3883, aneuman@gibsondunn.com)

William E. Thomson – Los Angeles (+1 213-229-7891, wthomson@gibsondunn.com)

© 2022 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

With the energy transition gaining pace and the use of LNG as a bridge fuel to phase out the use of coal for power generation, the environmental credentials of LNG are in the spotlight. Although LNG has lower carbon emissions than other fossil fuels, participants in the LNG industry have been exploring ways to further decarbonise the LNG value chain. So called ‘carbon-neutral’ LNG transactions, where carbon credits are used to offset the emissions from LNG, are gaining popularity and there is a nascent market developing, with over 30 carbon-neutral LNG cargoes having been traded to date.

To encourage the growth of such transactions, certain organisations have published methodologies which seek to standardise the measurement and reporting of emissions from LNG, as well as ensuring that the carbon credits used to offset these emissions have been properly issued and retired, and price assessments are now being published to help market participants track the incremental cost of carbon-neutrality in LNG transactions. As the world works towards net zero, an increased focus on emissions is driving stricter requirements for LNG projects and LNG transactions which could signal a growing role for carbon-neutral LNG.

In this alert, we analyse carbon-neutral LNG transactions and consider the measurement of emissions and transaction reporting, with a view to establishing whether carbon-neutral LNG trades are the beginning of a new paradigm that the LNG industry will need to adopt in order to address the requirements of governments, customers and stakeholders.

The following Gibson Dunn lawyers assisted in the preparation of this article: Brad Roach, Nick Kendrick, and Zan Wong. The authors wish to thank Jeffrey Moore and Kenneth Foo from S&P Global Platts for their contributions to this article.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding the article. Please contact Brad Roach or the Gibson Dunn lawyer with whom you usually work, or the following leaders of the firm’s Oil and Gas practice group:

Brad Roach – Singapore (+65 6507 3685, broach@gibsondunn.com)

Michael P. Darden – Houston (+1 346 718 6789, mpdarden@gibsondunn.com)

Anna P. Howell – London (+44 (0) 20 7071 4241, ahowell@gibsondunn.com)

© 2022 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

On 23 February 2022, the European Commission (“EC”) published its long-awaited draft directive on “Corporate Sustainability Due Diligence” (the “Directive“),[1] which sets out mandatory human rights and environmental due diligence obligations for corporates, together with a civil liability regime to enforce compliance with the obligations to prevent, mitigate and bring adverse impacts to an end.[2]

The draft Directive will now undergo further review and debate, with its likely adoption by the European Parliament and subsequent implementation into domestic legal systems anticipated by 2027.

This was hailed as an opportunity to introduce uniform standards for corporates operating in Europe, in circumstances where numerous individual jurisdictions have been developing their own, differing human rights and environmental due diligence and/or reporting obligations (see our previous client alert).

|

Key features of the Directive

|

Introduction of four key corporate due diligence obligations

The Directive lays down four key due diligence obligations regarding actual and potential “adverse human rights impacts” and “adverse environmental impacts” (both of which the Directive defines by reference to international conventions). The due diligence is to be conducted not only in relation to companies’ own operations and those of their subsidiaries, but also the operations of their “established business relationships” (whether direct or indirect), where those operations are related to the company’s “value chains”.[8]

“Value chain” is broadly defined as “activities related to the production of goods or the provision of services by a company, including the development of the product or the service and the use and disposal of the product as well as the related activities of upstream and downstream established business relationships of the company”. For regulated financial services companies, the Directive gives further guidance, noting that the value chain “shall only include the activities of the clients receiving such loan, credit, and other financial services and of other companies belonging to the same group whose activities are linked to the contract in question”.

Integrate human rights and environmental due diligence

First, companies are required to integrate human rights and environmental due diligence into all of their corporate policies and have in place “a specific due diligence policy” which contains: (i) a description of the company’s due diligence approach; (ii) a code of conduct to be followed by company employees and subsidiaries; and (iii) a description of processes put in place to implement due diligence—including measures taken to extend its application to “established business relationships”.

Identify actual or potential adverse impacts

Second, as noted above, companies are required to take appropriate measures to identify actual and potential adverse human rights and environmental impacts arising not only from their own operations, but their subsidiaries’ and the operations of established business relationships in their value chains. (Certain companies are, however, confined to identifying only “severe” adverse impacts.)[9] This is an ongoing, continuous obligation for companies within the scope of the Directive, except for financial institutions which need only identify adverse impacts before providing a service (such as credit or a loan).

In terms of how to identify the adverse impacts, the Directive contemplates the use of both qualitative and quantitative information, including use of independent reports, information gathering through the complaints procedure (see below) and consultations with potentially affected groups.

Prevent or mitigate potential adverse impacts

Third, companies have an obligation to prevent potential adverse impacts – and, where this is not possible, to adequately mitigate adverse impacts that have been or should have been identified pursuant to the prior identification obligation. This is contemplated through a number of strategies:

- Companies should, where complex prevention measures are required, develop and implement a “prevention action plan” (in consultation with affected stakeholders), including timelines and indicators for improvement. Related measures include the requirement to make necessary investment into management or production processes and infrastructures.

- In the case of direct business relationships, companies should seek contractual assurances from their direct business partners that the latter will ensure compliance with the company’s code of conduct and prevention action plan, including by seeking contractual assurances from their own partners, to the extent that their activities are part of the company’s value chain. This is known as “contractual cascading”.

- In the case of indirect business relationships, where potential adverse impacts cannot be prevented or mitigated through the prevention action plan and related measures, the company may seek to conclude a contract with that indirect partner, aimed at achieving compliance with the company’s code of conduct or a prevention action plan.

- Where the potential adverse impacts cannot be prevented or adequately mitigated by the prevention action plan and use of contractual assurances and contracts, the company is required to refrain from entering into new or extending existing relations with the partner in question. To the extent permitted by the relevant local laws, the company must also: (i) temporarily suspend commercial relations with the partner in question, while pursuing prevention and minimisation efforts (provided there is reasonable expectation that the efforts will succeed in the short-term), or (ii) where the potential adverse impact is severe, terminate the business relationship with respect to activities concerned.

Bring to an end or minimise actual adverse impacts

Finally, companies must bring to an end actual adverse impacts that have been or should have been identified. Where this is not possible, companies should ensure that they minimise the extent of such an impact. Companies are required to take the following actions, as necessary: (i) neutralise the adverse impact or minimise its extent, including through the payment of damages to the affected persons; (ii) implement a corrective action plan with timelines and indicators; (iii) seek contractual assurances; and (iv) make necessary investments. As with the obligation to prevent and mitigate potential adverse impacts, there are provisions governing circumstances where the actual adverse impact cannot be brought to an end or minimised.[10]

Standalone climate change obligation

Group 1 companies are required to adopt a plan to ensure that the business model and strategy of the company are compatible with limiting global warming to 1.5°C in line with the Paris Agreement. The plan should identify the extent to which climate change is a risk for, or an impact of, the company’s operations. Fulfilment of the obligations in the plan should then be taken into account in the context of directors’ variable remuneration, where such remuneration is linked to the director’s contribution to business strategy and long-terms interests and sustainability.

Expansion of directors’ duties

The Directive introduces a “directors’ duty of care” provision requiring directors to take into account the human rights, climate change and environmental consequences of their decisions in the short, medium and long term. Directors[11] should put into place and oversee due diligence actions and policies, and adapt the company’s strategy where necessary. Member States must ensure that their laws applicable to breach of directors’ duties are extended to the provisions in the Directive. As currently drafted, the Directive itself does not impose personal liability on directors for non-compliance.

In practical terms, this will likely carry with it obligations of transparency, and boards should document how they are engaging with sustainability requirements and considering risks in all relevant decision-making, including on matters of strategy. Directors should also ensure that they are sufficiently informed on how due diligence processes and reporting lines are resourced and managed within the company, and conduct training on ESG matters.

What will be required of the board will ultimately be industry-specific, but it will be important to demonstrate that the board is actively engaging with these issues.

Sanctions and enforcement

Non-compliance with the substantive requirements of the Directive carries the threat of civil liability and specific sanctions. A civil liability provision requires Member States to ensure companies are liable for damages if: (a) they have failed to prevent or mitigate potential adverse impacts; and (b) as a result of this failure, an adverse impact that could have been avoided in fact occurred and caused damage. Importantly, a company cannot escape liability by relying on local law (for example, where the jurisdiction of the alleged adverse impact does not provide for damages). Where, however, a company has taken the “appropriate” due diligence measures identified in the Directive, there should be no such liability unless it was “unreasonable” in the circumstances to expect that the action taken (including as regards verifying business partners’ compliance) would be adequate to prevent, mitigate, bring to an end or minimise the extent of the adverse impact. This begs the question as to what may be considered “unreasonable” and what measures are to be considered “appropriate” for the relevant company, to which there are no clear answers in the Directive. Further guidance on the scoping of expectations and nature of “appropriate” due diligence will be essential.

Meanwhile, the Directive requires Member States to set up supervisory authorities to monitor compliance, but gives discretion as regards sanctions for non-compliance. These authorities will be empowered to conduct investigations, issue orders to stop violations, and publish their decisions.

In-scope companies which are incorporated outside the EU must also appoint an “authorised representative”, i.e. a natural or legal person domiciled or established in the EU Member State in which that company generated most of its annual net turnover in the EU in the previous year. The authorised representative must have a mandate to act on the company’s behalf in relation to complying with the Directive, and will communicate and cooperate with supervisory authorities.

Next steps

The draft Directive will now be presented to the Council of the European Union and the European Parliament, upon whom it is incumbent to reach agreement on a final text. It is expected that the Directive will be subject to further debates by a range of industry, government and NGO stakeholders, and it remains to be seen whether any material changes will be made. The political tailwinds behind EU-wide action in this area are strong,[12] particularly as national governments across the EU continue to implement their own legislative measures and the European Parliament has already advocated for similar legislation. Current best estimates envisage adoption in or around 2023, with subsequent transposition into national law two to four years thereafter. Hence, it is likely that the earliest that companies will be required to report pursuant to the proposed Directive will be in relation to the financial years ending 2025 or 2026.

The draft Directive is an ambitious proposal and there remain a number of open questions regarding the scope and nature of the duties envisaged. Further guidance on issues such as the nature of due diligence has been promised by the Commission, and will be critical as corporates seek to understand their obligations and address them in practical terms.

__________________________

[1] On the same date, the European Commission also published a Q&A publication and a factsheet which provide further colour and background to the draft Directive. These are available on the European Commission’s Corporate Sustainability Due Diligence website.

[2] This follows a public consultation period held between 26 October 2020 and 8 February 2021, and an EU Parliament draft directive on “Corporate Due Diligence and Corporate Accountability” published on 10 March 2021 (the “EU Parliament draft Directive“). See our previous client alert, addressing the 27 January 2021 report containing the proposed EU Parliament draft Directive.

[3] The definition of “companies” extends beyond corporate entities to other forms of enterprises with separate legal personality by reference to the Accounting Directive 2013/34 and to certain regulated financial undertakings regardless of their legal form. See Article 2(iv) of the draft Directive (defining “Company”).

[4] See Article 2(2) of the draft Directive. Whilst the parameters of application of the Directive draw upon thresholds and definitions that have been utilised in other EU sustainability and ESG-related regulations (such as the Non-Financial Reporting Directive and the proposed new Corporate Sustainability Reporting Directive (CSRD)), this threshold relating to turnover attributable to high impact sectors is a new development.

[5] Namely, the reporting requirements under Articles 19a and 29a of Directive 2014/95/EU (the Non-Financial Reporting Directive), which will soon be replaced by the Corporate Sustainability Reporting Directive).

[6] This compares to the broader scope of the CSRD which is expected to capture around 50,000 entities.

[7] See Article 2(iv) of the draft Directive (defining “Company”).

[8] The italicized terms are defined under the Directive (Article 3).

[9] Namely, Group 2 companies, and non-EU companies generating a net turnover of more than EUR 40 million but not more than EUR 150 million in the EU in the preceding financial year, provided at least 50% of its net worldwide turnover was generated in a high-impact sector.

[10] Namely, as in Article 7, the company may seek to conclude a contract with an entity with whom it has an indirect relationship with a view to achieving compliance with the company’s code of conduct or corrective plan (Article 7(4)), and refrain from entering into new or extending existing relations with the partner in connection with or in the value chain where the impact has arisen, and shall temporarily suspend commercial relationships or terminate the business relationship where the adverse impact is severe (Article 7(6)).

[11] “Directors” is defined broadly in the draft Directive as those who are part of the “administrative, management or supervisory bodies of a company”, the CEO and any Deputy CEO, in addition to other persons who perform similar functions. “Board of directors” is broadly defined as “the administrative or supervisory body responsible for supervising the executive management of the company”, or those performing equivalent functions. See draft Directive, Articles 3((o), (p).

[12] This proposal also comes off the back of a flurry of other developments in the EU in relation to ESG-related regulation. These developments include the European Commission’s presentation of the same date of a Communication on Decent Work Worldwide, and very recent feedback and developments on proposed changes to the CSRD from various European Parliament committees, including the Permanent Representatives Committee’s (Coreper) general approach regarding the European Commission’s proposed CSRD, published on 18 February 2022 and European Parliament’s Economic and Monetary Affairs Committee’s (ECON) opinion and proposed changes to the CSRD, published on 28 February 2022.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Environmental, Social and Governance (ESG) practice, or the following authors:

Susy Bullock – London (+44 (0) 20 7071 4283, sbullock@gibsondunn.com)

Selina S. Sagayam – London (+44 (0) 20 7071 4263, ssagayam@gibsondunn.com)

Sophy Helgesen – London (+44 (0) 20 7071 4261, shelgesen@gibsondunn.com)

Stephanie Collins – London (+44 (0) 20 7071 4216, SCollins@gibsondunn.com)

Ashley Kate Hammett – London (+44 (0) 20 7071 4240, ahammett@gibsondunn.com)

Please also feel free to contact the following ESG practice leaders:

Susy Bullock – London (+44 (0) 20 7071 4283, sbullock@gibsondunn.com)

Elizabeth Ising – Washington, D.C. (+1 202-955-8287, eising@gibsondunn.com)

Perlette M. Jura – Los Angeles (+1 213-229-7121, pjura@gibsondunn.com)

Ronald Kirk – Dallas (+1 214-698-3295, rkirk@gibsondunn.com)

Michael K. Murphy – Washington, D.C. (+1 202-955-8238, mmurphy@gibsondunn.com)

Selina S. Sagayam – London (+44 (0) 20 7071 4263, ssagayam@gibsondunn.com)

© 2022 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

Utah is poised to join California, Virginia, and Colorado in enacting comprehensive data privacy legislation. Although Utah’s law largely follows the Virginia and Colorado models—with a few provisions that may ease the burden on businesses—it adds to an increasingly active state legislative landscape. Meanwhile, California is proposing changes to its landmark privacy law as other states plow ahead with debating or updating their own data privacy laws. Companies should account for these changes as they develop programs to comply with the laws.

Utah Consumer Privacy Act

In Utah, the legislature unanimously passed the Utah Consumer Privacy Act.[1] After the bill reaches the governor’s desk, he will have 20 days to sign or veto it or it will become law automatically signature if the governor vetoes the bill, the legislature has sufficient votes to override the veto, given that it was passed unanimously. Once enacted, the new law will become effective by its terms on December 31, 2023,[2]—approximately one year after the similar laws in Colorado and Virginia go into force. Comparable to the other laws, the new law applies to companies that (1) conduct business in Utah or target consumers in the state, (2) have $25 million or more in annual revenue, and (3) either (a) process or control personal data of 100,000 or more Utah consumers or (b) process or control personal data of 25,000 or more Utah consumers and derive 50 percent or more of their gross revenue from selling personal data.[3]

While Utah’s law is similar to Virginia’s and Colorado’s laws, it has a few differences that may make the law easier for businesses to follow. For example, like Virginia and Colorado, Utah does not include a private right of action in its law, although the attorney general can seek statutory damages, as described more fully below. However, unlike the laws in Virginia and Colorado, Utah’s law does not require businesses to conduct and document data protection assessments about their data-processing practices.[4] Utah also does not require businesses to set up a mechanism for consumers to appeal a business’s decision regarding the consumer’s request to exercise any of their personal data rights.[5] And finally, Utah’s law makes it easier to charge a fee when responding to consumer requests. Specifically, businesses may charge a fee when responding to consumer requests to exercise their personal data rights in Virginia only if those requests are “manifestly unfounded, excessive, or repetitive,”[6] or in Colorado only if a second request is made in a 12-month period.[7] But Utah allows businesses to charge a fee in both those situations as well as when the business “reasonably believes the primary purpose in submitting the request was something other than exercising a right” or is harassing, disruptive, or poses an undue burden on the controller.[8]

Relating to enforcement, while Utah’s Division of Consumer Protection can investigate potential violations, Utah’s law, like Colorado’s and Virginia’s, limits enforcement to the state attorney general.[9] The attorney general must give companies at least 30 days to cure before initiating an action.[10] If the attorney general does bring such an action, they may collect statutory damages of up to $7,500 per violation or actual damages.[11]

Developments in Other States

As Utah moves ahead with its new privacy law, California legislators have floated proposals to extend the business-to-business and employment-related exemptions in the California Consumer Privacy Act (“CCPA”). Under those exemptions, the CCPA does not generally apply to employment-related data or data involved in transactions between businesses for due diligence or to provide a good or service. The California Privacy Rights Act (“CPRA”) is presently set to sunset those exemptions on January 1, 2023. But the bills introduced in California would extend those exemptions either through January 1, 2026, or pursuant to the alternative bill, indefinitely.[12]

California is not the only state with updates to its comprehensive data privacy law in the works. Colorado’s attorney general announced recently that a formal notice of proposed rulemaking under the Colorado Privacy Act will be issued by this fall to prepare regulations that will be implemented by January 2023. In the meantime, town halls and meetings are planned to gather comments on that rulemaking.

Other states are moving rapidly to join California, Colorado, Virginia, and Utah. Data privacy laws have passed committee or chamber votes this year in Indiana, Iowa, Florida, Massachusetts, Ohio, Washington, and Wisconsin, and numerous other states also are considering legislation. Although the precise contours of these laws—and how many, if any more this year, will be enacted, and when—remain in flux, the enactment of state privacy laws already has ushered in notable regulatory changes affecting how companies collect and manage data while imposing a host of new obligations and potential liability, across the country. Companies would be well-served to focus their compliance programs accordingly.

We will continue to monitor developments in this area, and are available to discuss these issues as applied to your particular business.

___________________________

[1] Utah Consumer Privacy Act (“UCPA”), S.B. 227, 2022 Leg. Sess. (Utah 2022).

[4] See Colorado Privacy Act (“CPA”), S.B. 21-190, § 6-1-1309, 73d Leg., 2021 Regular Sess. (Colo. 2021); Virginia Consumer Data Protection Act (“VCDPA”), S.B. 1392, § 59.1-576, 2021 Spec. Sess. (Va. 2021).

[5] See CPA, 6-1-1306(3)(a); VCDPA, § 59.1-573(C).

[8] UCPA, § 7, 13-61-203(4)(b)(i)(B)-(C).

[9] UCPA, § 13, 13-61-305; § 13, 13-61-401; § 14, 13-61-402(1)-(2).

[10] UCPA, § 14, 13-61-402(3)(b)-(c).

[11] UCPA, § 14, 13-61-402(3)(d).

[12] See A.B. 2871, 2021–2022 Reg. Sess. (Calif. 2022); A.B. 2891, 2021–2022 Reg. Sess. (Calif. 2022).

This alert was prepared by Ryan T. Bergsieker, Cassandra Gaedt-Sheckter, Eric M. Hornbeck and Alexander H. Southwell.

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any member of the firm’s Privacy, Cybersecurity and Data Innovation practice group:

United States

Alexander H. Southwell – Co-Chair, PCDI Practice, New York (+1 212-351-3981, asouthwell@gibsondunn.com)

S. Ashlie Beringer – Co-Chair, PCDI Practice, Palo Alto (+1 650-849-5327, aberinger@gibsondunn.com)

Debra Wong Yang – Los Angeles (+1 213-229-7472, dwongyang@gibsondunn.com)

Matthew Benjamin – New York (+1 212-351-4079, mbenjamin@gibsondunn.com)

Ryan T. Bergsieker – Denver (+1 303-298-5774, rbergsieker@gibsondunn.com)

David P. Burns – Washington, D.C. (+1 202-887-3786, dburns@gibsondunn.com)

Cassandra L. Gaedt-Sheckter – Palo Alto (+1 650-849-5203, cgaedt-sheckter@gibsondunn.com)

Nicola T. Hanna – Los Angeles (+1 213-229-7269, nhanna@gibsondunn.com)

Howard S. Hogan – Washington, D.C. (+1 202-887-3640, hhogan@gibsondunn.com)

Robert K. Hur – Washington, D.C. (+1 202-887-3674, rhur@gibsondunn.com)

Kristin A. Linsley – San Francisco (+1 415-393-8395, klinsley@gibsondunn.com)

H. Mark Lyon – Palo Alto (+1 650-849-5307, mlyon@gibsondunn.com)

Karl G. Nelson – Dallas (+1 214-698-3203, knelson@gibsondunn.com)

Ashley Rogers – Dallas (+1 214-698-3316, arogers@gibsondunn.com)

Deborah L. Stein – Los Angeles (+1 213-229-7164, dstein@gibsondunn.com)

Eric D. Vandevelde – Los Angeles (+1 213-229-7186, evandevelde@gibsondunn.com)

Benjamin B. Wagner – Palo Alto (+1 650-849-5395, bwagner@gibsondunn.com)

Michael Li-Ming Wong – San Francisco/Palo Alto (+1 415-393-8333/+1 650-849-5393, mwong@gibsondunn.com)

Europe

Ahmed Baladi – Co-Chair, PCDI Practice, Paris (+33 (0) 1 56 43 13 00, abaladi@gibsondunn.com)

James A. Cox – London (+44 (0) 20 7071 4250, jacox@gibsondunn.com)

Patrick Doris – London (+44 (0) 20 7071 4276, pdoris@gibsondunn.com)

Kai Gesing – Munich (+49 89 189 33-180, kgesing@gibsondunn.com)

Bernard Grinspan – Paris (+33 (0) 1 56 43 13 00, bgrinspan@gibsondunn.com)

Penny Madden – London (+44 (0) 20 7071 4226, pmadden@gibsondunn.com)

Michael Walther – Munich (+49 89 189 33-180, mwalther@gibsondunn.com)

Alejandro Guerrero – Brussels (+32 2 554 7218, aguerrero@gibsondunn.com)

Vera Lukic – Paris (+33 (0) 1 56 43 13 00, vlukic@gibsondunn.com)

Sarah Wazen – London (+44 (0) 20 7071 4203, swazen@gibsondunn.com)

Asia

Kelly Austin – Hong Kong (+852 2214 3788, kaustin@gibsondunn.com)

Connell O’Neill – Hong Kong (+852 2214 3812, coneill@gibsondunn.com)

Jai S. Pathak – Singapore (+65 6507 3683, jpathak@gibsondunn.com)

© 2022 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

On March 9, 2022, the Securities and Exchange Commission (“SEC” or “Commission”) held a virtual open meeting where it considered a rule proposal for new cybersecurity disclosure requirements for public companies, primarily consisting of: (i) current reporting of material cybersecurity incidents and (ii) periodic reporting of material updates to cybersecurity incidents, the company’s cybersecurity risk management, strategy, and governance practices, and the board of directors’ cybersecurity expertise, if any.

The proposal passed on party lines and the comment period ends on the later of 30 days after publication in the Federal Register or May 9, 2022 (which is 60 days from the date that the rules were proposed). Below please find a summary description of the rule proposal, as well as certain Commissioner’s concerns related to the proposal.

Summary of Proposed Amendments

New Current Reporting Requirements

The proposed amendments would require current reporting of material cybersecurity incidents by adding new Item 1.05 to Form 8-K. As is the case with almost all other Form 8-K items, Item 1.05 would require companies to disclose material cybersecurity incidents[1] within four business days. The trigger date for the disclosure is the date of the materiality determination, rather than the date of discovery of the incident, although companies are required to make a materiality determination as soon as reasonably practicable after discovery. Required disclosure would include:

- When the incident was discovered and whether it is ongoing;

- A brief description of the nature and scope of the incident;

- Whether any data was stolen, altered, accessed, or used for any other unauthorized purpose;

- The effect of the incident on the company’s operations; and

- Whether the company has remediated or is currently remediating the incident.

According to the release, “[w]hat constitutes “materiality” for purposes of the proposed cybersecurity incidents disclosure would be consistent with that set out in the numerous cases addressing materiality in the securities laws, including: TSC Industries, Inc. v. Northway, Inc.,[2] Basic, Inc. v. Levinson,[3] and Matrixx Initiatives, Inc. v. Siracusano[4].”[5] The SEC noted in the proposed rule that it would not expect companies to disclose technical information about its planned response, cybersecurity systems, related networks and devices, or vulnerabilities “in such detail as would impede the company’s response or remediation of the incident.”[6] However, Item 1.05 would not allow for a reporting delay when there is an ongoing internal or external investigation related to the cybersecurity incident. Notably, however, an untimely filing of Item 1.05 disclosure on Form 8-K would not result in a loss of Form S-3 and Form SF-3 eligibility and would be covered by the safe harbor for Section 10(b) and Rule 10b-5 liability. With respect to foreign private issuers, the amendments would similarly create a disclosure trigger for cybersecurity incidents on Form 6-K.

New Periodic Reporting Requirements

Material Updates to Cybersecurity Incidents. The proposed amendments would add additional disclosure requirements to public companies’ quarterly and annual reports by introducing new Item 106(d) of Regulation S-K, which would require companies to disclose any material changes, additions, or updates to information required to be disclosed pursuant to proposed Item 1.05 of Form 8-K in the company’s Form 10-Q or Form 10-K for the covered period (the company’s fourth fiscal quarter in the case of a Form 10-K) in which the material change, addition, or update occurred. Item 106(d) would also require companies to disclose when a series of previously undisclosed individually immaterial cybersecurity incidents becomes material in the aggregate.

Risk Management and Strategy. In addition, public companies would be required to disclose their policies and procedures, if any, to identify and manage cybersecurity risks and threats. The company would also be required to describe whether it engages assessors or other third parties in connection with its risk assessment and any policies or procedures for risks in connection with the use of third party service providers. The other topics included in proposed Item 106(b) would require disclosure regarding whether the company undertakes to prevent, detect and minimize the threat of cybersecurity incidents; whether the company has business continuity, contingency or recovery plans in the event of cybersecurity incident; whether previous cybersecurity incidents have informed changes in the company’s governance, policies and procedures, or technologies; whether and how cybersecurity-related risk and incidents have affected or are reasonably likely to affect the company’s results of operations or financial condition; and whether and how cybersecurity risks are considered as part of the company’s business strategy, financial planning, and capital allocation.

Governance. Proposed Item 106(c) of Regulation S-K would require disclosure regarding the role of the board of directors and management in cybersecurity governance. With respect to the board of directors, companies would need to disclose whether the entire board, specific board members or a board committee is responsible for the oversight of cybersecurity risks. Disclosure would also need to include a discussion of the processes by which the board is informed about cybersecurity risks, the frequency of discussions on cybersecurity, and whether and how the board or responsible board committee considers cybersecurity risks as part of its business strategy, risk management, and financial oversight. With respect to management, companies would need to disclose whether certain management positions or committees are responsible for measuring and managing cybersecurity risk and the relevant expertise of such persons. The company would also need to disclose whether it has designated a chief information security officer, or someone in a comparable position, and if so, to whom that individual reports within the company’s organizational chart, the relevant expertise of any such persons, the processes by which such persons or committees are informed about and monitor the prevention, mitigation, detection, and remediation of cybersecurity incidents, and whether and how frequently such persons or committees report to the board or a committee of the board on cybersecurity risk.

Director Cybersecurity Expertise. Proposed Item 407(j) of Regulation S-K would require companies to annually disclose (in proxy statements for their annual meetings of shareholders or their annual reports on Form 10-K) cybersecurity expertise of directors of the company, if any. If any member of the board has cybersecurity expertise, the company would be required to disclose the name of any such director, and provide such detail as necessary to fully describe the nature of the director’s expertise. Cybersecurity expertise would remain undefined, but the proposed rule would introduce criteria relevant for the determination, such as whether the director has work experience in cybersecurity, whether the director obtained a certification or degree in cybersecurity, and whether the director has knowledge, skills or other background in cybersecurity. Similar to the existing safe harbor with respect to “audit committee financial experts,” proposed Item 407(j)(2) would state that a person who is determined to have expertise in cybersecurity will not be deemed an expert for any purpose, including, without limitation, for purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as a director with expertise in cybersecurity pursuant to proposed Item 407(j).

Foreign Private Issuers. Comparable changes would be made to require similar disclosures on an annual basis on Form 20-F.

Structured Data Requirements

Disclosures required under the proposed rules would need to be tagged in Inline XBRL, which would include block text tagging of narrative disclosures, as well as detail tagging of quantitative amounts disclosed within the narrative disclosures. According to the release, “[t]his Inline XBRL tagging would enable automated extraction and analysis of the granular data required by the proposed rules, allowing investors and other market participants to more efficiently perform large-scale analysis and comparison of this information across registrants and time periods.”[7]

For additional information on the proposed amendments, please see the following links:

Commissioner Concerns

The Commission voted three to one in support of the proposed amendments, with Commissioner Peirce dissenting. Chair Gensler supported the proposed rules noting that “companies and investors alike would benefit if this disclosure were required in a consistent, comparable, and decision-useful manner.”[8] Chair Gensler emphasized two ways in which the proposed rules would enhance cybersecurity disclosure and allow investors to assess cybersecurity risks more effectively, by requiring (i) ongoing disclosures regarding companies’ governance, risk management, and strategy with respect to cybersecurity risks and (ii) mandatory, material cybersecurity incident reporting. Commissioner Peirce expressed some reservations about the proposal. Specifically, Commissioner Peirce voiced concern that: (i) the governance disclosure requirements could be viewed as substantive guidance for the composition and functioning of both the boards of directors and management of public companies; (ii) the policy disclosure requirements may pressure companies to consider adapting their existing policies and procedures to conform to the Commission’s preferred approach; and (iii) the Commission is not best suited to design cybersecurity programs to be effective for all companies. Although Commissioner Peirce was more supportive of the cybersecurity incident reporting requirements, stating that they provided guideposts for companies to follow in reporting material cybersecurity incidents, she was critical of the proposed rule’s inflexibility with regard to whether temporary relief from the disclosure requirements would best protect investors in cases of ongoing investigations.

For the published statements of the Commissioners, please see the following links:

As mentioned above, the comment period ends on the later of 30 days after publication in the Federal Register or May 9, 2022 (which is 60 days from the date that the rules were proposed). Comments may be submitted: (1) using the SEC’s comment form at https://www.sec.gov/rules/submitcomments.htm; (2) via e-mail to rule-comments@sec.gov (with “File Number S7-09-22″ on the subject line); or (3) via mail to Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, DC 20549-1090. All submissions should refer to File Number S7-09-22.

Takeaways

The proposed rule contemplates extensive changes to current reporting requirements, and many of the disclosure topics act as guidance with respect to the SEC’s expectations for public companies’ cybersecurity risk management, strategy, and governance. In light of these changes, public companies should consider the following:

- Incident Disclosure Obligations Take Priority Over All Other Considerations. As noted by Commissioner Peirce, proposed Item 1.05 of Form 8-K does not provide companies with flexibility with respect to the timing of disclosing material cybersecurity incidents, even when it may be beneficial to delay disclosure. Under the proposed rule, companies would be required to report material cybersecurity incidents within four business days of the materiality determination, even when doing so may hinder the efforts of law enforcement to investigate the extent of the incident or apprehend wrongdoers. The disclosure mandate would also effectively override any deferral provided under state and local law, as companies will still need to timely file the required Form 8-K even where a state or local law would permit a delay in notifying the public about the incident. In addition, the proposed rule does not distinguish ongoing incidents from past or remediated incidents in the reporting requirements, which could result in required disclosure of cybersecurity incidents that still have active vulnerabilities. In these instances, disclosure could exacerbate the severity of the incident, as wrongdoers could become aware of and seek to exploit current vulnerabilities in the company’s systems. In essence, the proposed rule does not allow companies to take into account any other considerations on whether to disclose material cybersecurity incidents. The proposing release justifies the rule by stating that it is “critical to investor protection and well-functioning orderly and efficient markets that investors promptly receive information regarding material cybersecurity incidents.”[9] However, the SEC does not demonstrate that the inflexibility of the rule is necessary for the functioning of the markets or that such other considerations are less critical to investor protection than strict adherence to the proposed reporting regime. Moreover, the mere fact that the trigger date for the disclosure requirement is the date of the materiality determination does not provide companies with flexibility given the rule’s expectation that companies will make such determination as soon as reasonably practicable after discovery of the incident.

- Companies May Need to Revisit their Cybersecurity Policies and Procedures. The proposed rule would require companies to disclose many facets of their cybersecurity policies and procedures, such as whether there are procedures for overseeing cybersecurity risk arising from the use of third party service providers. These disclosure topics are likely to incentivize companies to revisit their policies and procedures in order to ensure that they address such topics, as companies will want to avoid disclosure of policies that lack features that the SEC focuses on or that appear less robust than those of their peers. In addition, it will be important for companies revisiting their cybersecurity policies to ensure that they provide for effective disclosure controls and procedures that include communication between the cybersecurity team, or those responsible for cybersecurity, and the legal team. These channels of communication will be necessary for the prompt assessment and escalation of detected cybersecurity incidents, which serves the purposes of providing for proper oversight and complying with the proposed disclosure requirements. Communication will need to be maintained through the conclusion and remediation of cybersecurity incidents, given the requirement to provide material updates to the disclosure and to disclose any series of previously undisclosed, immaterial incidents that become material in the aggregate. Companies without a chief information security officer, or equivalent, should consider whether such a position should be created in light of the requirement to disclose whether the company has such an officer.

- Boards May Need to Revisit Their Oversight Role and Structures. While many companies already include disclosure on the board’s role in overseeing cybersecurity risk in their proxy statements, the proposed rule introduces a broad set of discussion topics that will need to be addressed. In particular, boards that have not delegated responsibility for overseeing cybersecurity disclosures to a specific board committee will need to consider whether it is appropriate to do so. Companies should also consider the channels through which cybersecurity information is communicated to the board (or designated committee) and evaluate whether such channels provide effective and timely communications. Boards will also need to assess whether the amount of time spent addressing cybersecurity during meetings is appropriate given the requirement to disclose the frequency of discussions on the topic.

- Director Cybersecurity Experience will be at a Premium. Requiring disclosure of whether any of a company’s directors have cybersecurity expertise will likely pressure companies to prioritize candidates with cybersecurity experience as part of their search process in order to avoid appearing behind on cybersecurity compared to their peers. Given that companies will need to describe such expertise in their annual disclosure, directors with substantive cybersecurity experience may be highly sought after. In addition, many companies include cybersecurity in director skill matrices in their proxy statements. Should the rules be adopted as proposed, those companies will need to consider whether their assessments of experience align with the criteria proposed by the SEC, or risk potentially confusing investors with two different standards for cybersecurity expertise.

__________________________

[1] Cybersecurity incident is defined to mean an unauthorized occurrence on or conducted through a company’s information systems that jeopardizes the confidentiality, integrity, or availability of a company’s information systems or any information residing therein.

[2] TSC Indus. v. Northway, 426 U.S. 438, 449 (1976).

[3] Basic Inc. v. Levinson, 485 U.S. 224, 232 (1988).

[4] 563 U.S. 27 (2011).

[6] Id.

[7] Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure, Exchange Act Release, No. 34-94382 (Mar. 9, 2022) at Part II.G, available at https://www.sec.gov/rules/proposed/2022/33-11038.pdf.

[8] Chairman Gary Gensler, “Statement on Proposal for Mandatory Cybersecurity Disclosures” (Mar. 9, 2022), available https://www.sec.gov/news/statement/gensler-cybersecurity-20220309.

[9] Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure, Exchange Act Release, No. 34-94382 (Mar. 9, 2022) at Part II.B.3, available at https://www.sec.gov/rules/proposed/2022/33-11038.pdf.

This alert was prepared by Alexander H. Southwell, Ashlie Beringer, Lori Zyskowski, Thomas J. Kim, and Julia Lapitskaya.

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. Please contact the Gibson Dunn lawyer with whom you usually work in the firm’s Privacy, Cybersecurity and Data Innovation and Securities Regulation and Corporate Governance practice groups, or the following authors:

Alexander H. Southwell – New York (+1 212-351-3981, asouthwell@gibsondunn.com)

S. Ashlie Beringer – Palo Alto (+1 650-849-5327, aberinger@gibsondunn.com)

Lori Zyskowski – New York (+1 212-351-2309, lzyskowski@gibsondunn.com)

Thomas J. Kim – Washington, D.C. (+1 202-887-3550, tkim@gibsondunn.com)

Julia Lapitskaya – New York (+1 212-351-2354, jlapitskaya@gibsondunn.com)

We would like to thank Matthew Dolloff in our New York office for his work on this article.

© 2022 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

The United States, the European Union, the United Kingdom, Australia, Japan and other countries have issued or announced sanctions and export controls targeting Russia and the Russia-backed separatist regions of Ukraine known as the Donetsk People’s Republic and the Luhansk People’s Republic. The United States took the first step by issuing broad jurisdiction-based sanctions on the two regions, similar to the existing sanctions on the Crimea region of Ukraine, and followed up with additional sanctions targeting Russia’s financial system. NATO allies also announced sanctions—including targeted designations by the United Kingdom and a sanctions package by the European Union—and non-NATO allies promised or implemented tough sanctions in close coordination. As tensions continue to rise, we continue to see more series of tools from the NATO countries and their allies to exert economic pressure on Russia to deescalate the ongoing crisis in Ukraine and withdraw its army from Ukraine’s borders.

Hear from our experts about these developments and how companies should proactively assess their exposure to the sanctions and export controls measures being discussed.

MODERATOR:

David A. Wolber is a Registered Foreign Lawyer (New York) in Hong Kong and Of Counsel in the Hong Kong office of Gibson, Dunn & Crutcher. He is a member of the firm’s International Trade Practice Group. Mr. Wolber assists clients around the world in understanding and navigating complex legal, compliance, reputational, political and other risks arising out of the interplay of various international trade, national security and financial crime laws and regulations, with particular expertise advising clients on economic and trade sanctions, export controls, foreign direct investment controls/CFIUS, anti-money laundering (AML) and anti-bribery and anti-corruption (ABC) laws and regulations.

PANELISTS:

Patrick Doris is a partner in the London office whose practice includes transnational litigation, cross-border investigations, and compliance advisory for clients including major global investment banks, global corporations, leading U.S. operators in the financial sectors, and global manufacturing companies, among others. He advises financial sector clients and others on OFAC and EU sanctions violations, responses to major cyber-penetration incidents, and other matters relating to national supervisory and regulatory bodies.

Christopher T. Timura is Of Counsel in the Washington D.C. office. He counsels clients on compliance with U.S. and international customs, export controls, and economic sanctions law and represents them before the departments of State (DDTC), Treasury (OFAC and CFIUS), Commerce (BIS), Homeland Security (CBP and ICE), and Justice in voluntary and directed disclosures, civil and criminal enforcement actions and investment reviews. Working with in-house counsel, boards, and other business personnel, he helps to identify and leverage existing business processes to integrate international trade compliance, and CSR-related data gathering, analysis, investigation, and reporting throughout client business operations.

Richard Roeder is an associate in the Munich office who was previously seconded to the Washington, D.C. office and worked with the firm’s U.S. sanctions and export control team and assisted clients in managing the challenges posed by the divergence between U.S. and EU economic and financial sanctions. He advises clients in the banking, insurance, automotive, mining, oil and gas, healthcare and information technology industries in the areas of sanctions, anti-money-laundering and anti-corruption compliance.

Claire Yi is an associate in the Washington, D.C. office. She is a member of the firm’s International Trade and White Collar Defense and Investigations Practice Groups. Ms. Yi received her Juris Doctor, magna cum laude, from Harvard Law School, where she was an Articles Editor for Harvard International Law Journal. During law school, she served as an intern for the Compliance and Business Risk Department at the World Bank-International Finance Corporation, for the Office of the Inspector General at the State Department, and for the Office of the Legal Adviser at the State Department.

On March 9, 2022, President Biden signed a long-awaited Executive Order (titled “Ensuring Responsible Development of Digital Assets” and issued with an accompanying Fact Sheet) regarding the U.S. government’s strategy for digital assets, defined to include cryptocurrencies and other forms of exchange that are recorded on the blockchain.[1] Citing the need for the federal government to address the role of digital assets in the financial system, the Executive Order represents the first whole-of-government approach to the benefits and risks of digital assets. It is a general policy statement that reflects the views of the administration, as opposed to a specific proposal for regulation.

In our view, there are three principal takeaways from the Executive Order. First, it acknowledges the exponential growth and opportunity that the digital asset ecosystem presents, and outlines a policy interest in “responsible financial innovation” and the need for evolution and coordination to ensure that the United States continues to be a leader in the space. Second, the Executive Order identifies a number of perceived general risk areas that digital assets can pose on issues ranging from consumer protection to national security to the environment. Third, to address these risks, the Executive Order tasks various federal agencies—working in coordination—to draft a host of reports, frameworks, and action plans to evaluate the various perceived challenges and opportunities presented by digital assets. We discuss each takeaway in order below.

U.S. Commitment to Digital Asset Leadership

To date, countries around the world have taken divergent stances on digital assets. Cryptocurrency transactions are banned in China, for instance, whereas other jurisdictions have gone as far as to make bitcoin legal tender.[2] It was not clear where the White House would come down on this spectrum, as individual U.S. lawmakers, regulators, and enforcers have offered differing views on how to approach digital assets.

The Executive Order offers a strong endorsement of the potential of digital assets and the need for the United States to play a leading role in shaping the design of this ecosystem. Specifically, it declares that “[w]e must reinforce United States leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets.”[3] Further, it provides that the U.S. has an interest in remaining at the “forefront” of the “responsible development and design of digital assets,” where its leadership can “sustain United States financial power and promote United States economic interests.”[4] One potential way to do so is by creating a central bank digital currency (“CBDC”), which, as discussed below, the Executive Order tasks various parts of the government to study at length.

The Executive Order also recognizes the benefits that digital assets can provide to consumers, as they may help expand equitable access to financial services by, for instance, “making investments and domestic and cross-border funds transfers and payments cheaper, faster, and safer.”[5]

At the same time, the Executive Order acknowledges that many opportunities and challenges posed by blockchain-based ecosystems fall outside the scope of existing laws and that government approaches to date have been “inconsistent,” “necessitating an necessitate an evolution and alignment of the United States Government approach to digital assets.”[6]

Potential Risks in the Digital Asset Ecosystem

The Executive Order identifies a number of broad potential risk areas involving digital assets that may implicate a wide range of participants in the ecosystem including exchanges, custody providers, investors, token issuers, and companies that accept digital assets for payment. Specific risks cited in the Executive Order include:

- Data Protection—Without “sufficient oversight and standards,” firms providing digital asset services “may provide inadequate protections for sensitive financial data, custodial and other arrangements relating to customer assets and funds.”[7]

- Privacy—Key “safeguards” identified in “responsible development” of digital assets include “maintain[ing] privacy” and “shield[ing] against arbitrary or unlawful surveillance.”[8]

- Risk Disclosures—An important facet of protecting investors is ensuring adequate “disclosures of risks associated with investment.”[9]

- Cybersecurity—Cybersecurity issues that have occurred at major digital asset exchanges and trading platforms to date have contributed to billions of dollars of losses.[10]

- Systemic Risk—In order to mitigate systemic risk, digital asset issuers, exchanges and trading platforms, and other intermediaries “should, as appropriate, be subject to and in compliance with regulatory and supervisory standards that govern traditional market infrastructures and financial firms.”[11] Moreover, new and unique uses of digital assets “may create additional economic and financial risks” that require “an evolution to a regulatory approach.”[12]

- National Security and Illicit Finance—Noting that digital assets can pose significant national security and illicit finance risks ranging from terrorism financing to cybercrime, the Executive Order aims to “ensure appropriate controls and accountability” for digital asset systems to “promote high standards for transparency, privacy, and security” in order to counter these activities.[13]

- Sanctions Evasion—Digital assets may be used to circumvent sanctions.[14]

- Climate and Pollution—The United States also has an interest in reducing “negative climate impacts and environmental pollution” from “some cryptocurrency mining.”[15]

In light of some of these risks, President Biden’s Executive Order provides that the United States “must support technological advances that promote responsible development and use of digital assets,” including by ensuring that digital asset technologies “are developed, designed, and implemented in a responsible manner” that includes privacy and security, features and controls to defend against illicit exploitation, and efforts to reduce negative environmental impacts.[16]

Researching the Path Forward

To determine the next steps for the U.S. government in the digital asset space, the Executive Order establishes an interagency process to address many of the opportunities and challenges outlined above.[17] Further, it calls for a number of reports, frameworks, action plans, and more to be developed, as outlined in the table below.

Critically, the Executive Order does not itself implement any new regulations over the digital asset space or require that agency reviews adopt particular rules or requirements. Instead, it just identifies what homework needs to be done. Accordingly, the Executive Order has not changed the jurisdiction of any U.S. regulator or enforcer with respect to digital assets, nor does it call for Congress to act to expand the jurisdiction or authority of independent agencies such as the CFTC or SEC, even as it opens by acknowledging that the novel challenges and opportunities presented by digital assets may not be within the scope of existing federal laws.[18] Various federal agencies are therefore instructed to “consider” whether some of the digital asset risks that are identified—such as privacy, consumer protection, and investor protection—are within the jurisdiction of existing regulators or “whether additional measures may be needed.”[19] The agencies’ conclusions to those questions, of course, will be of great interest to all market participants and those interested in digital assets and blockchain technology, including potentially to members of Congress.

Notably absent from the Executive Order is any reference to regulations implementing the tax information reporting provisions of HR 3684, the Infrastructure Investment and Jobs Act, signed into law on November 15, 2021. As discussed in this Gibson Dunn Client Alert, those provisions are one of the few recent legislative measures addressing digital assets and include effective dates that contemplate reporting requirements on a broad range of digital asset transactions beginning in January of 2023.

| Subject | Lead Agency | Supporting Agencies | Detailed Description | Due |

| Action Plans, Frameworks, and Reports | ||||

| Report on Strengthening International Law Enforcement[18] | DOJ | State, Treasury, DHS | How to strengthen international law enforcement cooperation for detecting, investigating, and prosecuting criminal activity related to digital assets. | Within 90 days (June 7, 2022) |

| Framework for International Engagement[19] | Treasury | State, Commerce, USAID, other relevant agencies | Establishing a framework for interagency international engagement to enhance adoption of global principles and standards for how digital assets are used and transacted. | Within 120 days (July 7, 2022) and an update one year later |

| Report on Prosecution of Crimes related to Digital Currency[20] | DOJ | Treasury, DHS | The role of law enforcement agencies in detecting, investigating, and prosecuting criminal activity related to digital assets, including any recommendations on regulatory or legislative actions. | Within 180 days (September 5, 2022) |